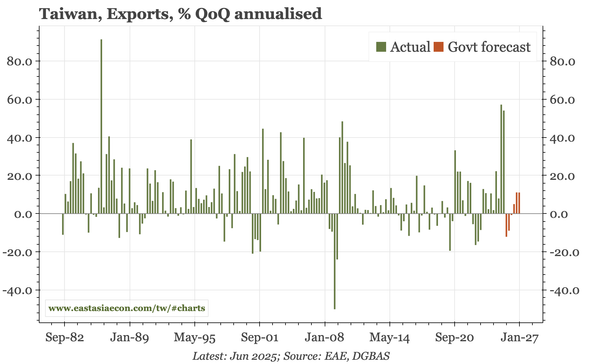

Taiwan – trade surplus back to 1980s levels

Even with data today showing a dip in exports in December, Taiwan's trade surplus last year reached the sort of sky-high levels last seen before the big TWD appreciation of the 1980s. Barring a real dislocation in AI hardware demand, underlying pressure for renewed appreciation will grow in 2026.

Taiwan – the export surge continues

There is little growth in exports outside of tech in general, and semiconductors specifically. But the surge in chip exports is big enough to offset all the weakness in other products. The overall trade surplus eased back in November, but the bilateral surplus with the US reached 25% of Taiwan GDP.

Taiwan – everything revised up, except inflation

In today's GDP release, the government raised estimated growth for Q1, Q2, and Q3. The FY forecast was raised by almost 3ppts to 7.4%. But because of AI, officials remain bullish about the outlook, and so raised the forecast for 2026 as well, And yet, none of this is expected to impact inflation.

Taiwan – trade surplus reaches 30% of GDP

I am running out of superlatives to describe Taiwan's export story in 2025. So I'll let the numbers speak for themselves: today's October data show semi exports have grown 70% this year, pushing the overall trade surplus last month to 30% of GDP, and the bilateral surplus with the US to 20% of GDP

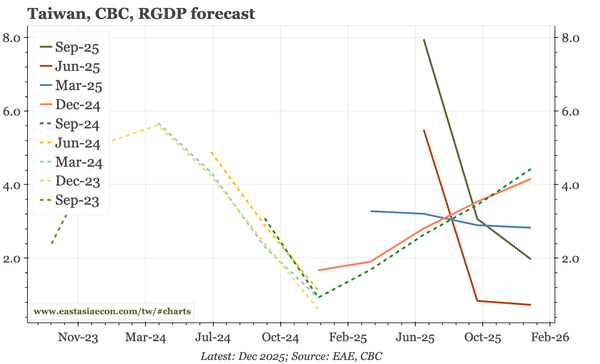

Taiwan – calmer macro, CBC on hold

Macro volatility – in inflation, growth, property prices and the TWD – eased in Q3, and it was no surprise that the CBC was on hold today. That won't change if AI demand growth slows. But the AI cycle has proven tough to forecast, and I'd expect the CBC will also be faced with more TWD strength.

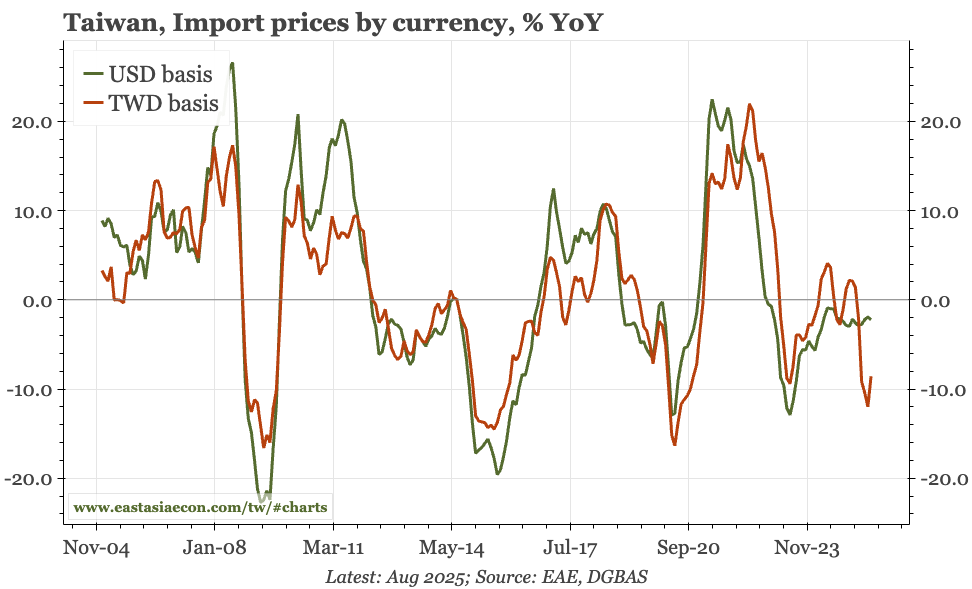

Taiwan – import prices up, core CPI up more

August data today show the impact of the weaker TWD since July: fx reserves fell, import prices ticked up MoM, and CPI inflation rose. The lesson is that without currency strength, the step-change in economic growth since 2020 is more likely to show up in domestic prices.

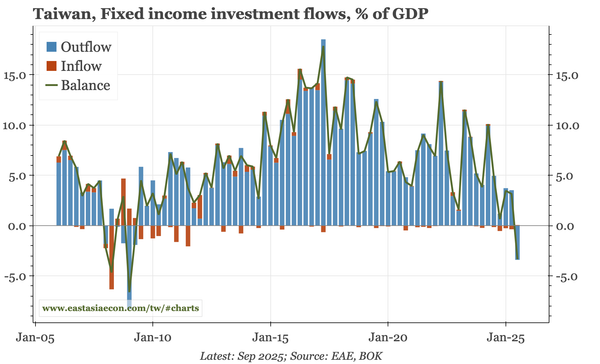

Taiwan – export orders peaking, Q2 capital flows

July export orders data show a continued reshoring, but overall export orders have clearly peaked. Today's Q2 BOP data show the rise in exports has further boosted the current account surplus. With the surplus so large, the TWD is vulnerable to the sort of shifts in capital flows seen in Q2.

Taiwan – less worried on exports

The government today confirmed the export surge of 1H – and released much less pessimistic forecasts for 2H. The underlying story is simple: AI-related demand offsetting the impact of TWD appreciation and tariffs. Exports are now expected to grow almost 25% this year, and GDP by 4.5%.

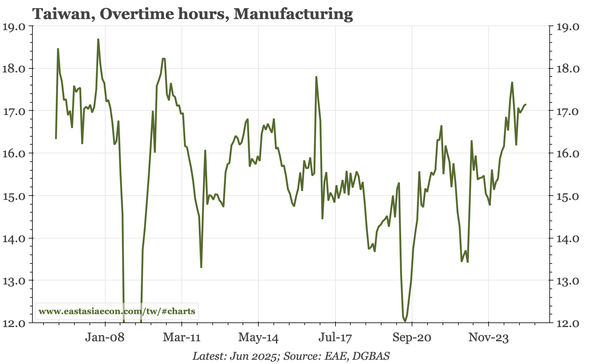

Taiwan – tight labour market, at least in manufacturing

The export surge is boosting demand for labour, with data today showing manufacturing overtime hours in June near the highest in 15 years, and wage growth of close to 4% YoY. Overall wage growth has also trended up, but less quickly, because the demand:supply balance in services isn't as tight.