Taiwan – will TSMC break the TWD?

There's a possibility that TSMC's success is pushing Taiwan into unchartered waters, where the CBC needs to sound hawkish, when the external imbalance is as big as it has ever been. If Taiwan's period of zero inflation has passed, there's a good chance TWD undervaluation will be challenged too.

While it is commonly recognised that Japan might be breaking out of a multi-year period of no inflation, it is less appreciated that a similar shift is on the cards in Taiwan. Core inflation is at 20-year highs, unemployment at 20-year lows, and wages, finally, show signs of rising.

TSMC's overseas investments mean its sales aren't the same proxy for Taiwan's semi exports that they used to be. But by virtue of its sheer size, in other ways the company is more dominant in the economy than ever. That TSMC's management comments last week were so bullish thus suggests the heating up of the domestic economy is likely to continue.

The market has once again started to think about rate hikes from the CBC. The big opportunity though lies with the currency. The trade surplus with the US has surged from under 2% of GDP in 2019 to almost 12% now. The current account surplus has been trending up since the early 2000s and last year was equivalent to 14% of GDP. And yet, the currency is now cheaper than it was before the pandemic began, at a level similar to that of 2016, or 2022.

That the external surplus hasn't fed into a stronger currency is partly due to Taiwan's unique geostrategic position in the world. However, arguably it is also because of the lack of any domestic inflation, meaning nominal rates have been below US rates since the early 2000s.

Given all this, there is now the possibility that Taiwan is entering unchartered waters, where the central bank needs to sound more hawkish than the Fed, at a time when the external imbalance is as big as it has ever been. If Taiwan's period of zero inflation has passed, then there's a good chance its currency undervaluation will be challenged too.

TSMC's bullishness

The region currently has two macro themes that are very differentiated from the rest of the world. On the one hand, there's China, where weak price trends are completely out-of-whack with the global cycle. On the other is both Japan and Taiwan, which for years looked deflationary, but just when global inflation is easing, seem to be breaking out to the upside.

In this context, TSMC's Q3 results were significant. The financials were strong, but so was the commentary. According to the chairman, CC Wei:

Simply, whether this AI demand is real or not. Okay. And my judgment is real. We have talked to our customers all the time, including our hyperscaler customers who are building their own chips. And almost every AI innovators is working with TSMC. And so we probably get the deepest and widest look than anyone in this industry.....The demand is real, and I believe it's just the beginning of this demand. All right. So one of my key customers say, the demand right now is insane.

This has macro significance for Taiwan, because TSMC is now so big. The company accounts for over 35% of market capitalisation, around 30% of manufacturing capex in the economy, and its sales are equivalent to 20% of exports. The previously tight relationship between TSMC's sales and Taiwan's overall semi exports has loosened over the last couple of years, perhaps because of the overseas fabs that the firm has opened. But the company now has a dominance which is negating the traditional view of Taiwan of an economy led by SMEs.

Structural and cyclical strength

Having such a dominant company feel so bullish would always matter for the domestic economy. But it is particularly important for Taiwan because TSMC's confidence is happening when other macro indicators for the economy already look firm. Taiwan was one of the few economies that emerged from covid looking stronger. The island avoided lockdowns, and so public debt didn't surge from 2020. At the same time, tech and semi sales boomed, so an economy that before covid was on a growth trend similar to that of Korea was by 2022 on a trajectory that instead resembled that of China.

This was an export-driven surge, and as a result, it also further bolstered Taiwan's already remarkably strong external balances. The trade surplus with China has moderated, but the imbalance with the US has surged to double-digits as a proportion of GDP. On an annual basis, the current account surplus has been above 10% of GDP since 2013. Even in absolute terms, Taiwan's stock of net foreign assets is the 5th largest in the world – which stands out when Taiwan's USD GDP only ranks as the 20th biggest.

While it has been given an extra boost by recent events, first covid and then the emergence of AI, this external position has been building for years. TSMC's success points to this being sustained, but what puts it in focus right now is also the unusual strength of the domestic cycle. Property prices, particularly around TSMC's home town of Hsinchu, are surging. Core inflation, which averaged 0.4% a year in 2000-20, is now at 2%. Wage inflation is clearly accelerating in manufacturing, and with the unemployment rate at 20-year lows, that can be expected to give an extra lift to services wages too.

Compared with say Korea, the domestic economy hasn't suffered since covid, with Taiwan's non-manufacturing PMI still comfortably above 50. Part of this differentiated domestic strength is because Taiwan's tightening cycle during covid was modest. Rates did rise, but only six times-, and in total only by a cumulative 87.5bps (Taiwan's usual margin for rate hikes is 12.5bp). As a result, the domestic economy wasn't hit in 2021-23 by the sharp, sudden tightening that was experienced elsewhere.

Rates, inflation and the currency

Even before the pandemic, interest rates in Taiwan weren't high: 10-year yields have been consistently below 3% since late 2002, and less than 2% since 2008. This low level of rates made some sense when neither wage nor core inflation were rising. But you don't need to get excited about big upsides to either to think that this justification is now weakening. As an example, the 10-year yield is now lower than core inflation. That situation wasn't seen before 2020, and seems particularly noteworthy now, as it doesn't allow for any possibility that the rise in inflation and growth since covid are structural and not just cyclical.

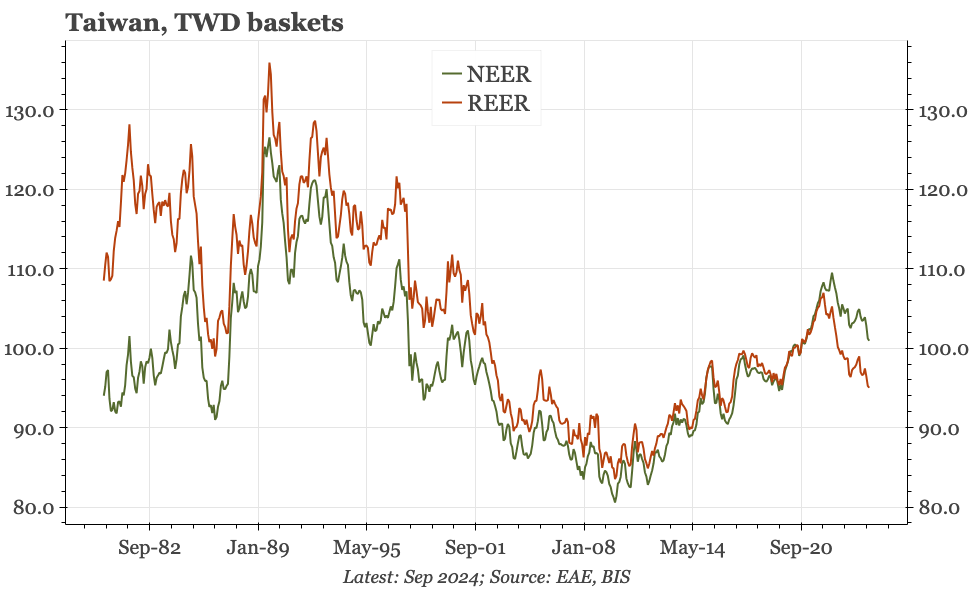

In recent weeks, the market has begun, once again, to price in more rate hikes from Taiwan's central bank, the CBC. This shift obviously is relevant for the bond market. Ultimately, however, the bigger market story could be the currency. The exchange rate against the USD continues to fluctuate around 30, cheaper than it was during the 1990s. On a real effective basis, the TWD did bottom around 2010, but even in 2021 was still below the levels of two decades earlier. Moreover, in the last three years since the TWD REER has weakened again, meaning it is now cheaper than it was before either the pandemic began, or ChatGPT was released.

That Taiwan's ever-growing external surpluses from the early 2000s hadn't pushed up the currency is partly because of idiosyncratic factors. Taiwan's imbalances do tend to get a mention in the US Treasury Department's semi-annual reports, but that attention tends to be fleeting, with Taiwan far from being the biggest contributor to global imbalances. It has also faced less substantial pressure because, unlike China, it is supported by the US – and is also an essential partner of any economy that is looking to import semiconductors. Taiwan's unique geostrategic position also allows the CBC more control over capital controls than other central banks would have been able to engineer – even if they had wanted to do so.

However, the ongoing cheapness of the currency is also explained by the lack of any inflationary pressure before 2020. Real interest rates might have made the TWD attractive, but nominal rates have been so low as to be below US yields for more than 20 years. In that period, the currency hasn't been entirely static, but rather than relative monetary policy, changes in the exchange rate have depended on capital flows driven by exports and the equity market.

Given this backdrop, it seems to me that there is the possibility of a structural repricing of the currency as two drivers come together: the out-sized external surplus, and domestic monetary policy that is continuing to tighten. This combination will look more powerful still for the currency if US rates have peaked and the Fed needs to cut further. The surging trade surplus with the US also looks likely to attract hostile political attention if Trump is re-elected as president.

In this framework, the large external surplus is assumed to be a given. The new factor would be domestic tightening, which would be driven by core inflation, wages and property prices. Thus, to think that a structural shift in the currency is possible, these are the data points to be monitoring.

In terms of the risks, the obvious one is that structural shifts are never that likely, particularly in the case of TWD where the authorities still exert close control. But there are a couple of others. The first is that despite the strength of TSMC, the overall industrial cycle still turns down. That seems possible, given the fall in the manufacturing PMIs in both Taiwan and Korea in September, and the weakness in Korea's exports through the first 20 days of October. The second is politics in the US, with the threat of much higher tariffs in the event Trump wins again in November. It does seem that a Trump would ultimately want Asian currencies to appreciate. But the path from tariffs to that outcome is unlikely to be smooth.