Taiwan - June foreign trade

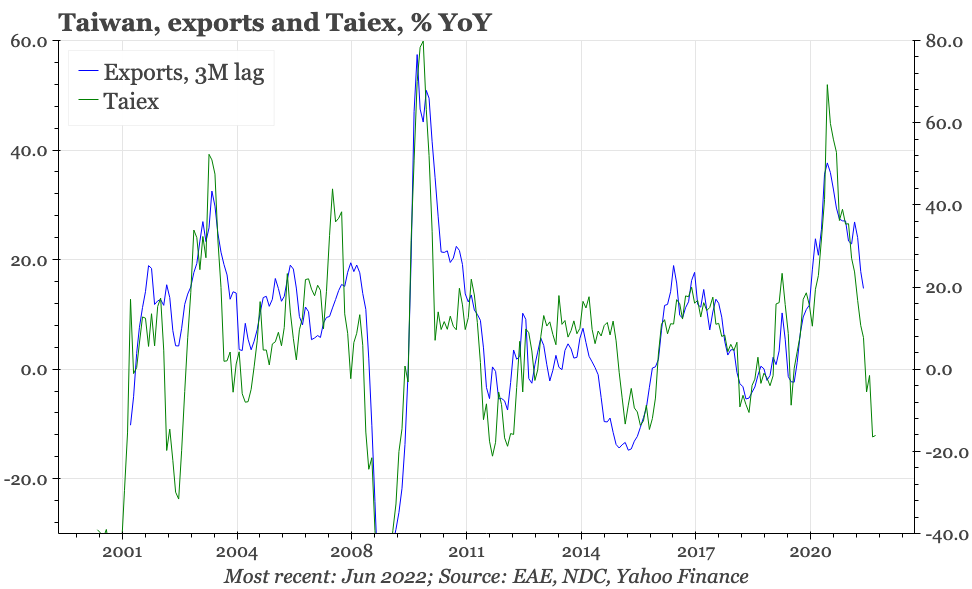

Exports held up again in June, but the outlook is changing as expectations for the semiconductor industry become more bearish. The recent equity sell-off suggests Taiwan's exports could be falling 10-20% YoY in the coming months.

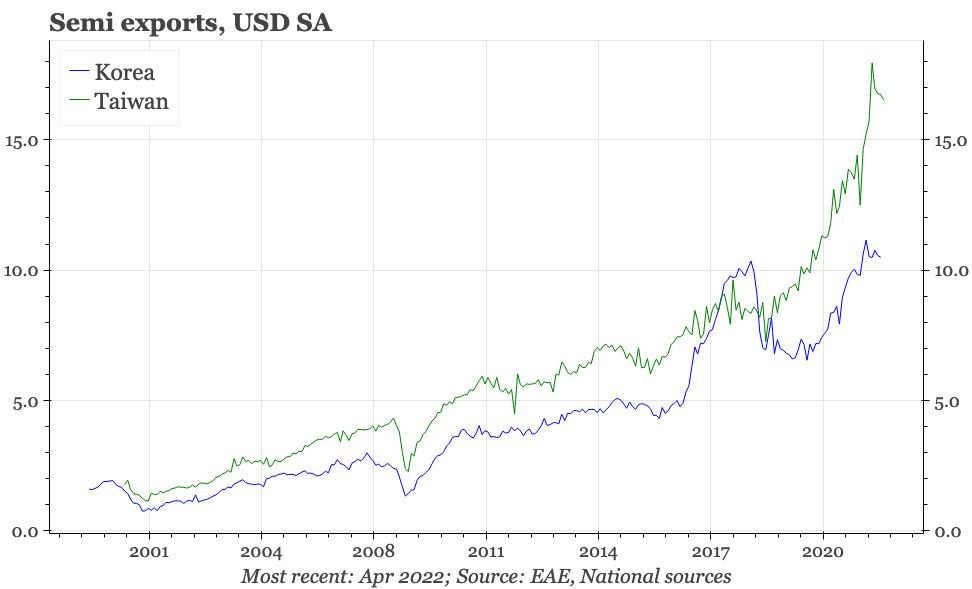

As has been the case across most of the region in recent months, Taiwan's exports held up in June. The level is still a bit below the all-time peak of USD43.1bn recorded in February, but at USD42.8bn, exports are still elevated compared with pre-covid; in 2019 Taiwan's exports averaged only around USD27bn/month.

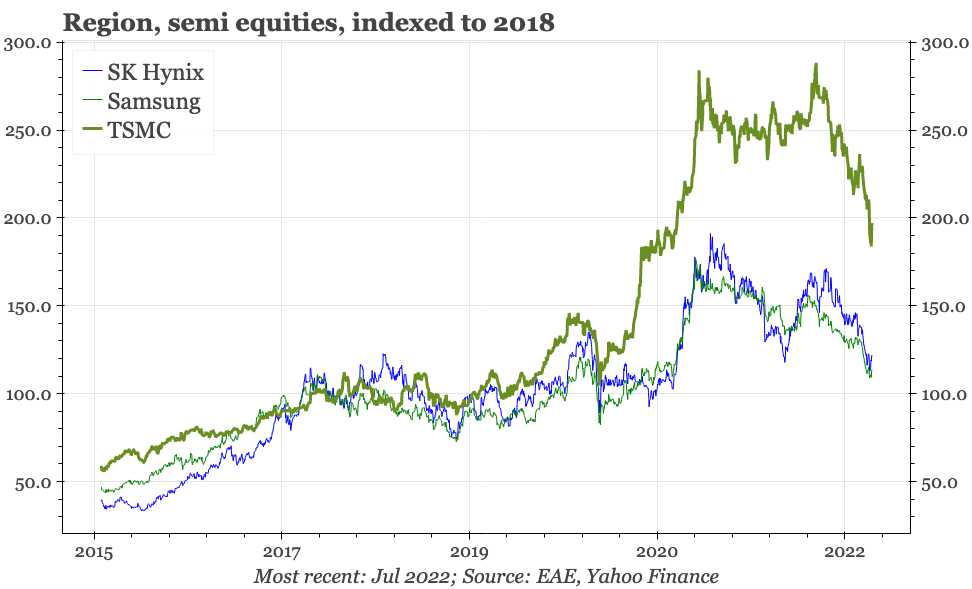

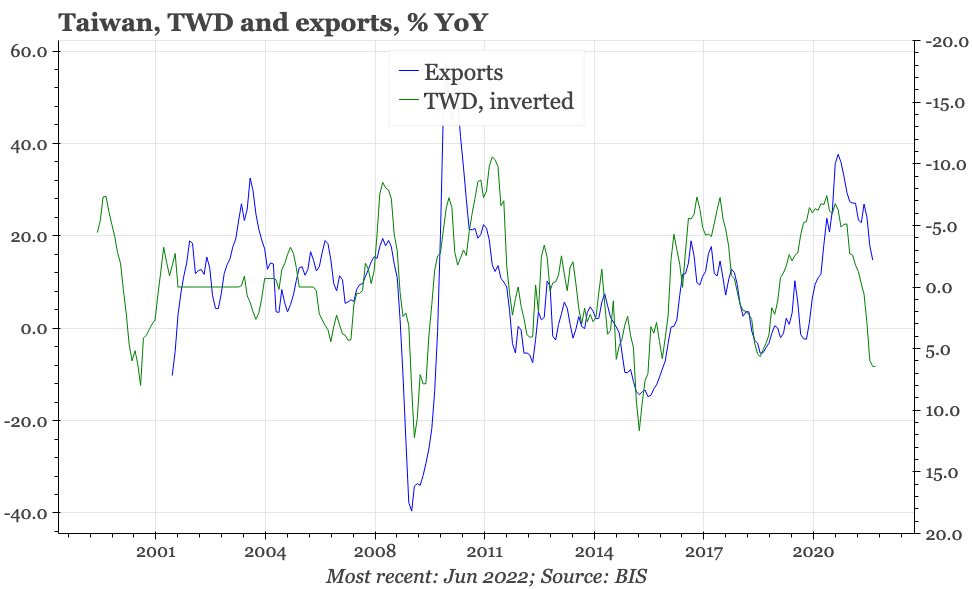

However, a peaking in level terms means the headline growth rate is slowing, to 15% YoY in June. And the leading indicators now suggest that exports are likely to be falling from here. The PMI and export orders have already softened, and it is now also significant that semiconductor equities, including TSMC, have fallen sharply the last couple of months. This change in particular suggests Taiwan's exports could fall 20% YoY by Q4.

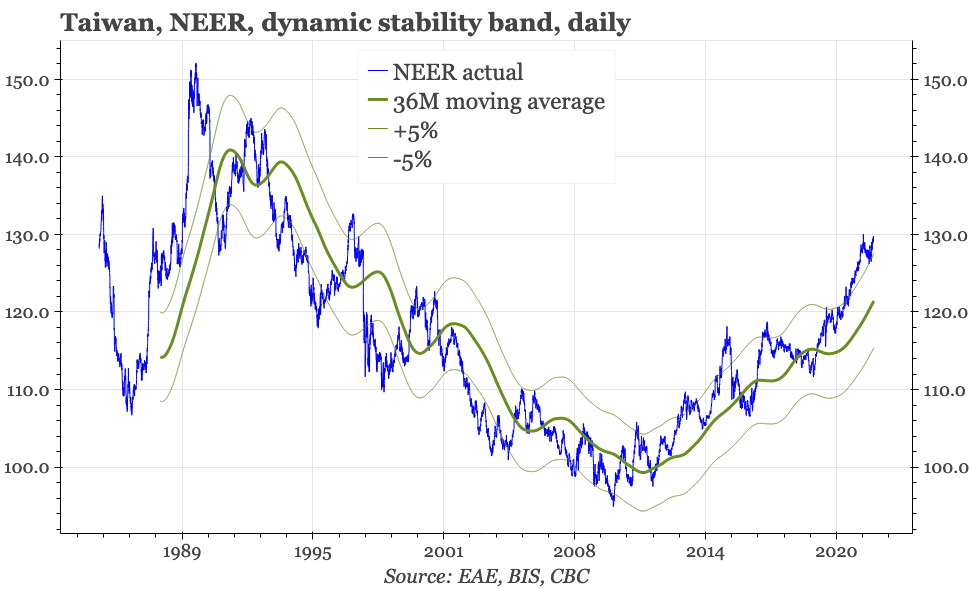

The sell-off in TSMC reflects changing market expectations about the outlook, with a sense that the semiconductor supply shortages of 2020-21 are reversing, with some reports of orders now being cut. Taiwan and TSMC were perhaps the biggest beneficiaries of the excess demand in the industry, and semiconductor shipments drove Taiwan's overall export surge of the last couple of years. In this respect, TSMC's Q2 earnings call next week is a critical event, with the company's commentary impacting expectations for the macro outlook in Taiwan, as well as for the TWD.