Region – monthly cycle slides

Reasons for upside risks in Japan, with implications for BOJ; conviction that China isn't following Japan's 1990s past, meaning rates should be low enough; unlike the BOK, the CBC in Taiwan won't cut rates, and might yet hike again.

Here is this month's cycle slidepack:

Japan

- Core inflation solid around 2%

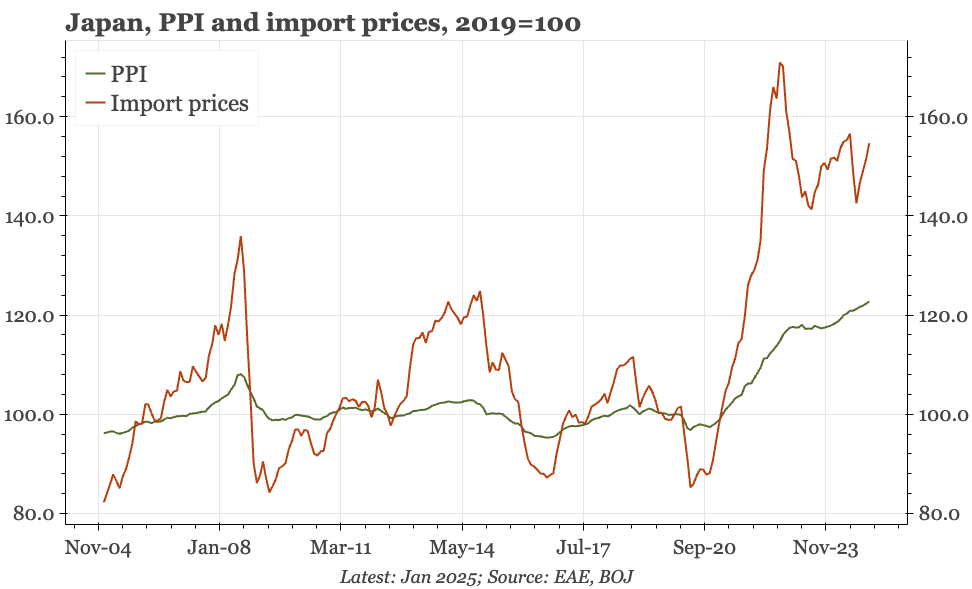

- But domestic prices still well below global prices in JPY terms

- That means upside inflation risks. BOJ to hike more quickly

China

- Cycle still soft, and global tariffs would be a problem

- But China isn’t EM – depreciation doesn’t force domestic tightening

- And it isn’t 1990s Japan. Structural strengths, and rates low enough already

Korea and Taiwan

- Korea has the weakest cycle. Taiwan the strongest

- BOK to cut more. CBC won’t cut, still might hike

- Both will find it very tricky to handle Trump