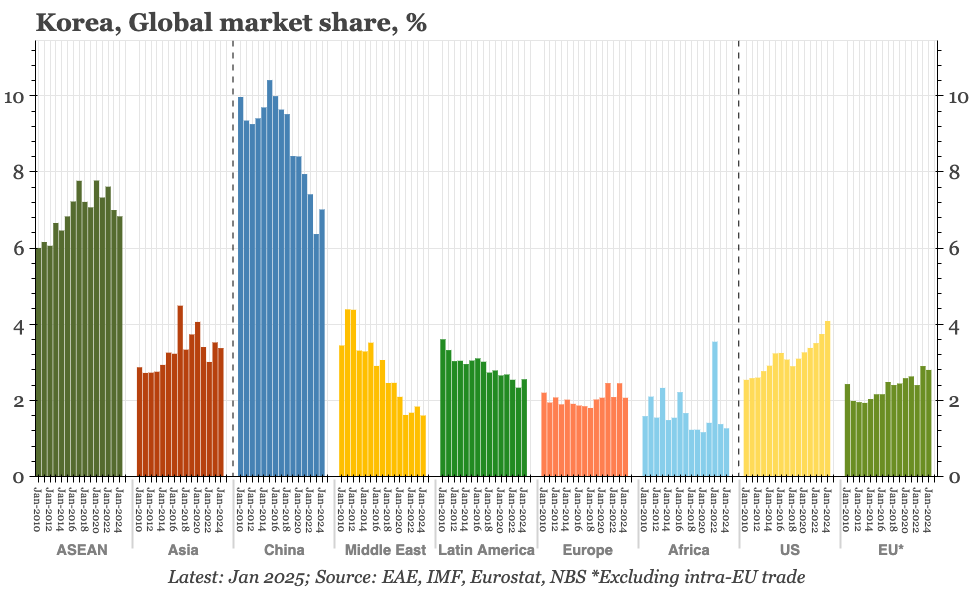

Region – an illustration of Korea's export problems

This is a shorter thematic note than usual. In the longer piece last week, I didn't come up with a chart that nicely summarised Korea's export challenge. I think I have it now. While Korea is holding on in DM, it is losing market share just about everywhere else, being pushed out largely by China.

In a note last week, I argued that while export sectors in China and Taiwan were outperforming, the opposite was true for Korea and Japan.

For Japan, that underperformance is obvious in the headline data: overall export data are going sideways, a trend that didn't change in the January data that were released yesterday.

However, while overall exports in Korea are soft compared with Taiwan and China, the trend is at least up. That doesn't seem to justify the high degree of concern expressed in a recent BOK report on trends in the export sector. In that analysis, the bank's focus was China, and bilateral trade data do show Korean firms losing market share to Chinese companies both at home and in China. That though partly reflects the swing in Asian trade towards the US, and Korea's market share in the DM– at least before Trump's re-election – has been rising.

Of course, part of the reason for the rise in market share in the US is the tariffs of Trump's first term, which have caused a sharp drop in China's direct market share. But while losing out in direct trade with the US, China's exporters have been gaining market share just about everywhere else.

If China is gaining market share, somewhere else has to be losing. And one of the losers is Korea. Geographically, Korea's market share losses are as broad as China's gains. That in turn fits with the BOK's argument that Korea is really struggling against low-cost Chinese competition.