Region – Back to the Future: East Asia and Trump 2.0

The film Back to the Future came out in 1985, and with inflation in Japan, deflation in China, and big external surpluses once again, there are all sorts of regional economic themes that have echoes of then. Here's a podcast in which I discuss the implications, with links to the underlying research.

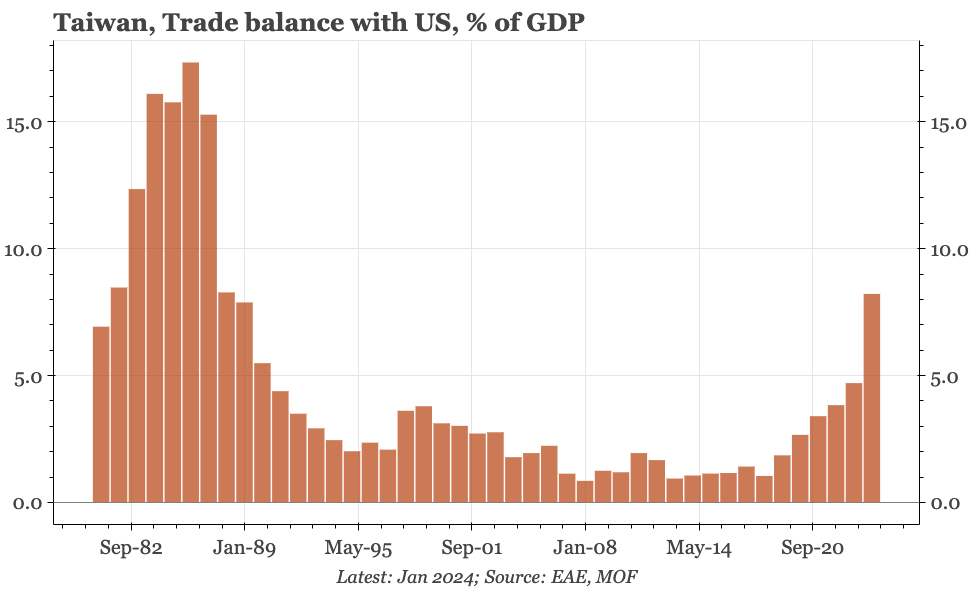

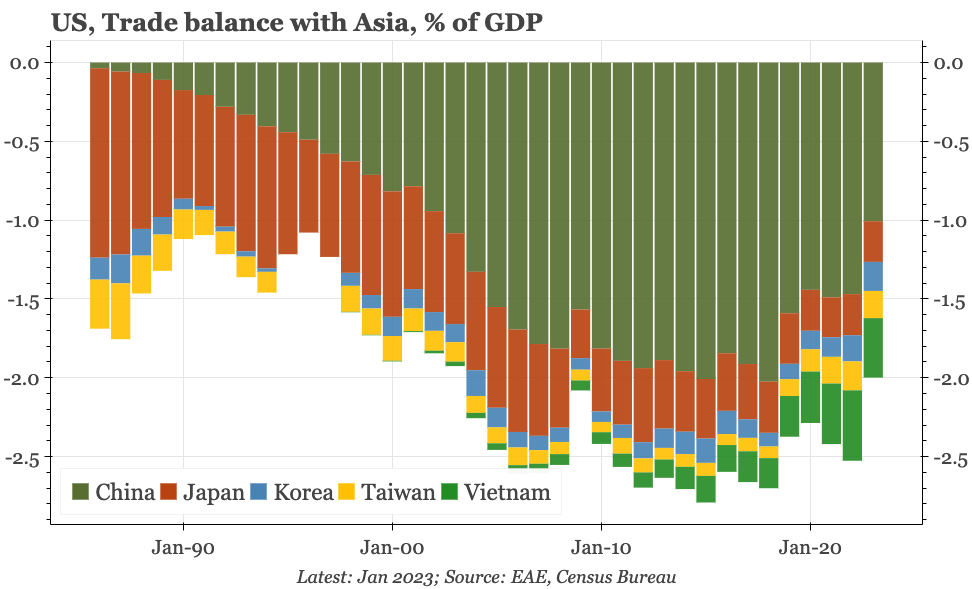

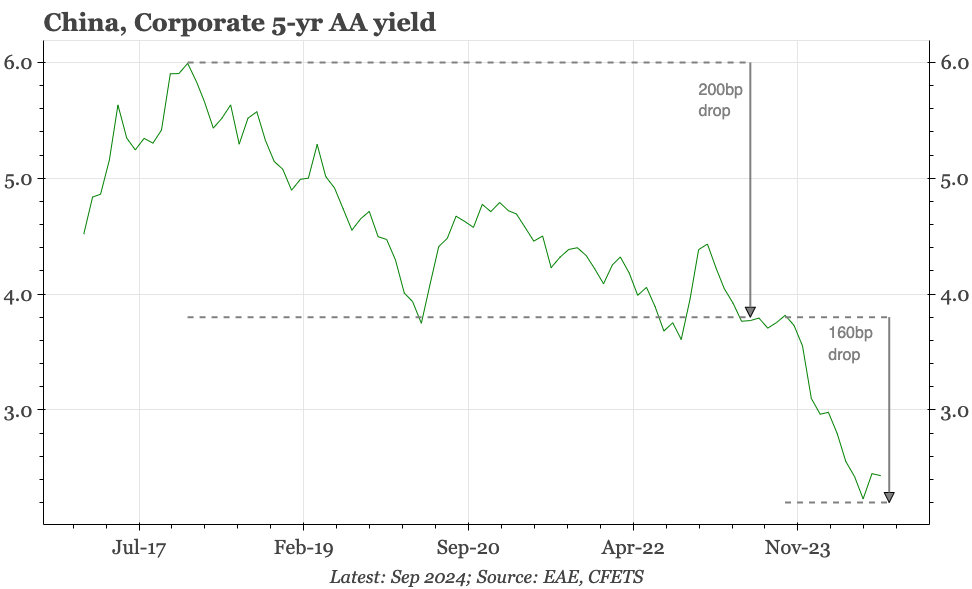

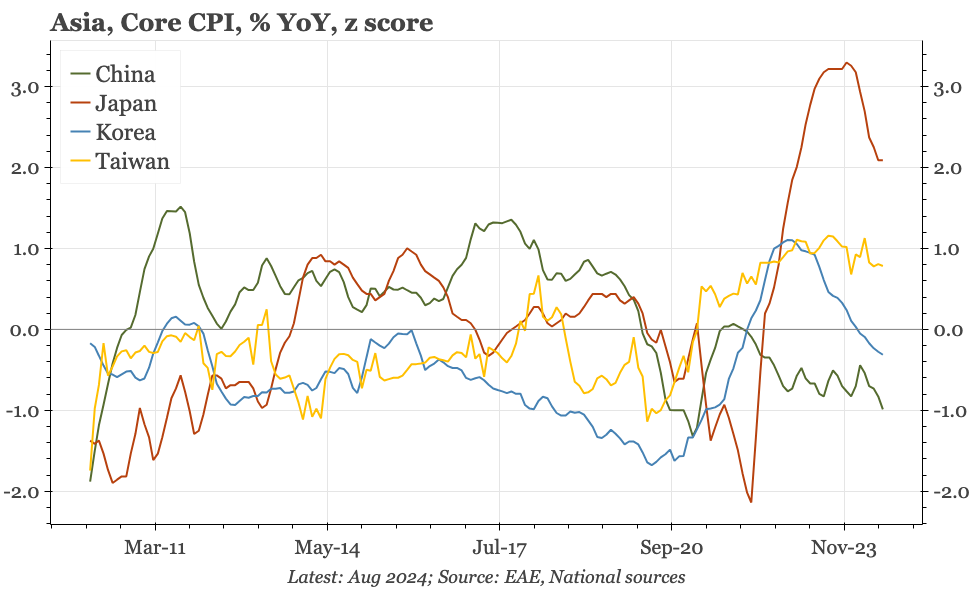

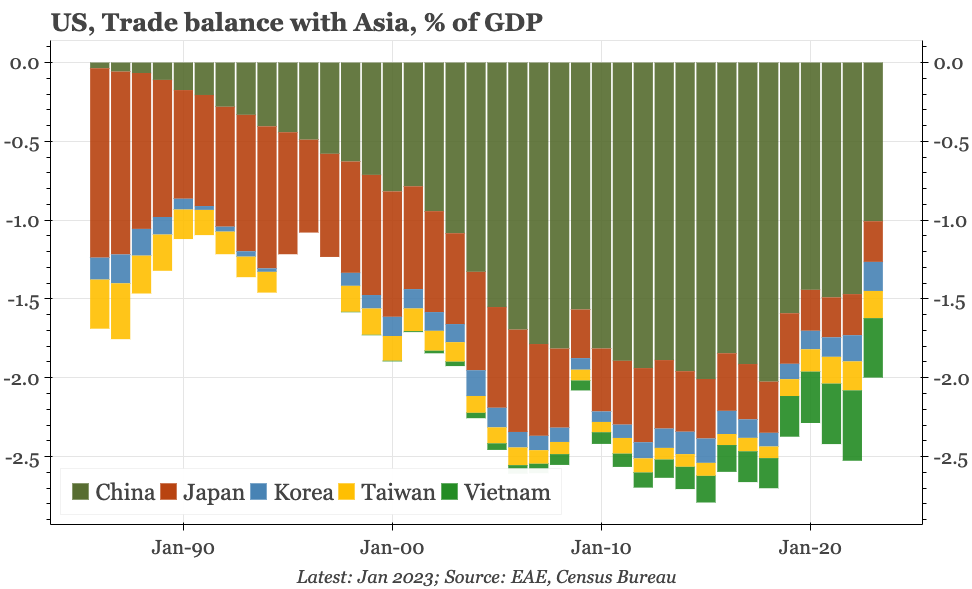

Why Back to the Future? Because that great film was released in 1985, the same year as the Plaza Accord, the currency realigning agreement that set off the big equity and property market bubbles in Japan and Taiwan. Inevitably, those bubbles popped a few years later, ushering in Japan’s multi-decade malaise. Japan is only just now emerging from that funk. That makes inflation an issue for the BOJ and CBC in Taiwan, just as China's economic challenges mean debt and deflation remain hot topics in the region still. However, while there are certainly similarities between China’s domestic difficulties today and Japan's post-1990s experience, in exports, China looks much more like post-bubble Taiwan, with a cheap currency and manufacturing strength. That in turn is feeding into global imbalances and talk of Plaza II, a theme which engulfs all the economies of the region. Indeed, if you want the clearest illustration of why it’s Back to the Future, just look at Taiwan’s trade surplus with the US, which was at over 10% of GDP in 1985, then fell, but is rapidly rising back to double-digit levels now.

These are all issues I’ve been working on the last couple of years, so it was nice to have the chance to discuss them on this podcast:

And as a reminder, here are some of the longer pieces that lay out this theme.

1990s bubbles and after

Japan v Taiwan, property v exports

Monetary policy

The role of the exchange rate

From the bottom to the top: Taiwan and Japan today

The current economic set-up in the region

Plaza II

What might a new Plaza look like?

Taiwan's USD100bn challenge

The exchange rate consequences of Taiwan's huge external surpluses: