Last week, next week

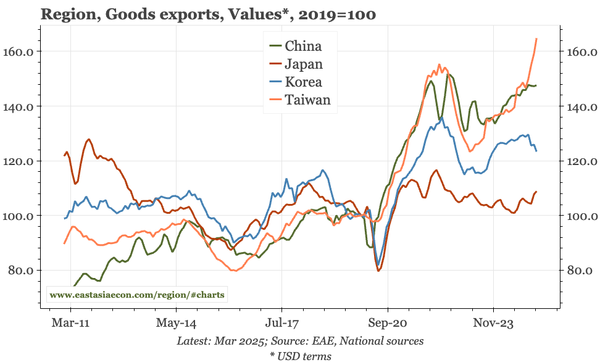

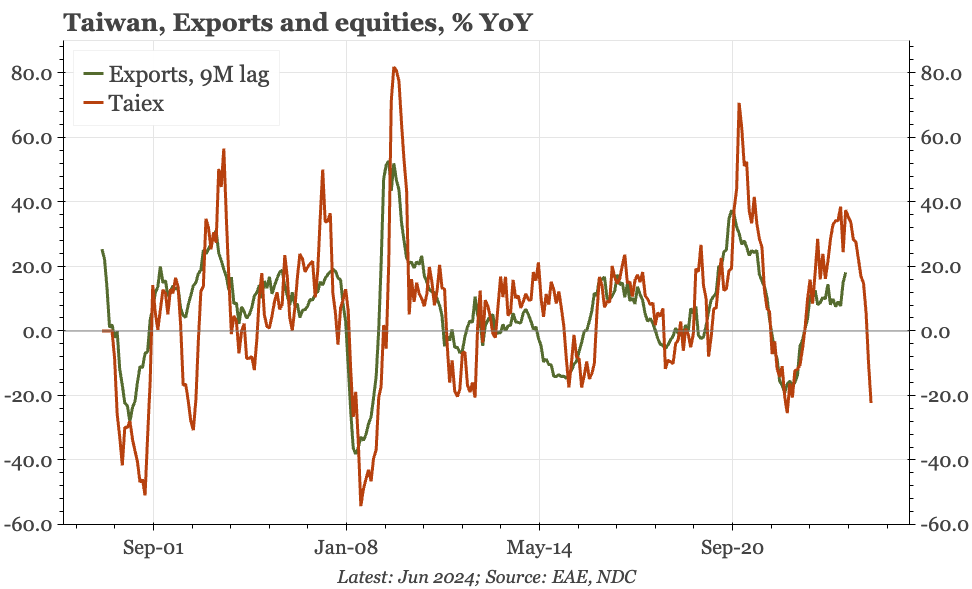

The fundamental themes for the region are rising external surpluses, improving manufacturing cycles, and lessening deflation in China. That mix should be helping currencies. The offsetting factors to be monitoring are politics in Japan, flows, and global dynamics around tech and the USD.