QTC: China – three charts that stand out

In recent weeks there hasn't been much change in the overall macro narrative of "muddle through". But that masks some important shifts in the details, with three standing out: the surge in export volumes; the rebound in food prices; and the continued rapid shift of money into time deposits.

The government's core view remains that the economy is transitioning, not collapsing. That isn't far-fetched, as the PBC's Q2 sentiment surveys showed.

But that relative macro stability doesn't mean there's no important changes happening in the economy. For us, three have stood out in August:

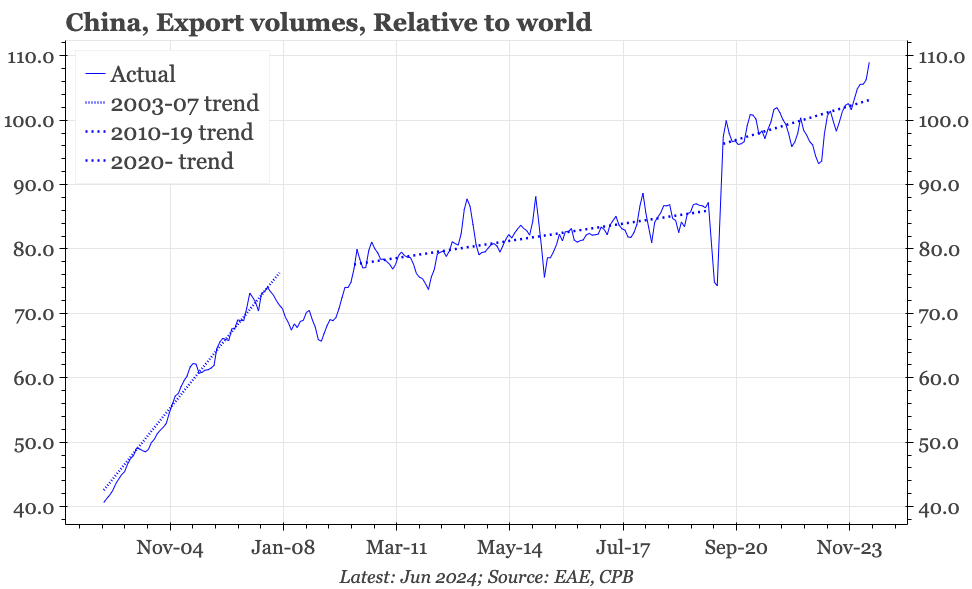

- A surge in export volumes. For all the excitement about export-led growth and over-capacity, relative performance had been no faster than pre-covid. But now, it suddenly looks very different.

- The rebound in food prices. The food price cycle had already been turning, but that has accelerated on the back of the floods and hot weather. That's important for headline CPI.

- The fall in demand deposits. The collapse in M1 exaggerates the shift out of current accounts. However, it is still clear that the deflationary move of money into time deposits is continuing.