Last week, next week

A summary of what happened on East Asia Econ last week, and what to look for in the next seven days.

This is what happened on East Asia Econ this week.

Thematic

Japan - taking stock. The huge moves in markets may well have an impact on the extent and pace of further BOJ policy normalisation. But when markets settle down, developments in the real economy will also matter. It will be particularly important to track SME wages, service prices, and consumption.

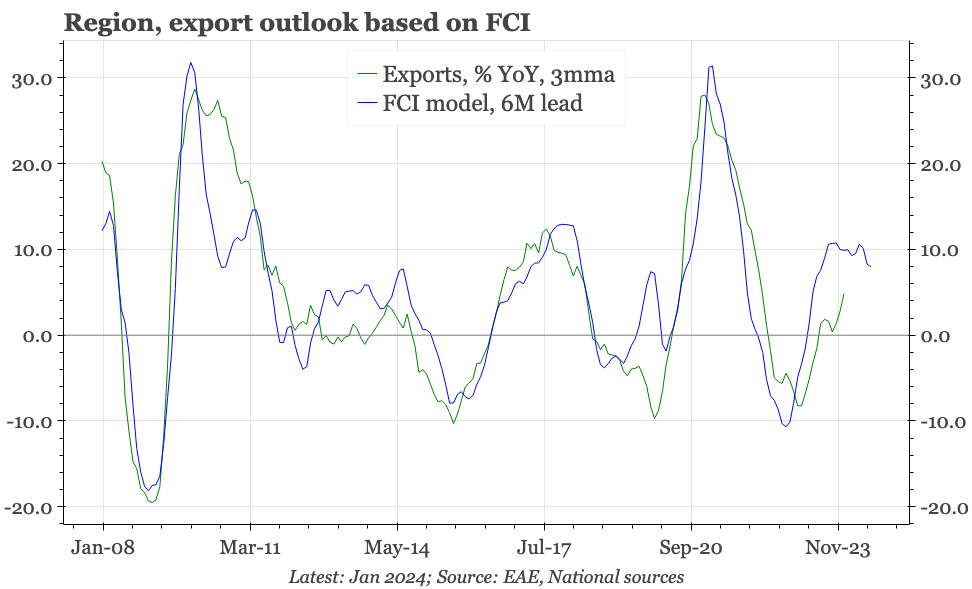

China – imports more interesting than exports. July exports fell, but it is premature to call the start of a downturn. That's partly because of market share gains. These are solid, though not impressive enough to validate over-capacity. In terms of structure, the much bigger shift is in imports, which have completely over-turned pre-20 trends.

Cycle

Cycle update – core CPI deflation again. The July price data offer more evidence that the food price cycle has turned. With less PPI deflation too, it is likely that headline CPI gets a bit of a lift. But core CPI inflation in July was once again very weak, which is enough of a reason to assume that the PBC will continue to cut rates.

Cycle update – solid wage data. The June jump in earnings was almost all about bonuses. But the details were solid: for full-timers, wage growth didn't slow much, and it accelerated for part-timers. There's also now a greater likelihood of a trend rise in real wags as the less-weak JPY dampens import prices.

Cycle update – confident but not dogmatic. In the BOJ's first comments since last week, Uchida says that policy is dependent on the economic outlook, which could be affected by market moves, particularly the JPY. However, he also reiterates confidence in the underlying changes that the BOJ has been talking about throughout this year.

There aren't any pre-announced policy meetings this week. So the focus will be on the data, particularly China with the big official July releases on Thursday. We'll be going through those in detail, but it is doubtful they will contain anything that changes the market mood. Elsewhere, there's the first release of Q2 GDP data for Japan, and the second release for Taiwan. There's also wage data today for Taiwan, which are important, as they have been suggesting a structural shift in wage (and thus inflation) dynamics. The only major release in Korea is labour market data on Wednesday.