Last week, next week

A summary of what happened on East Asia Econ last week, and what to look for in the next seven days.

This is what happened on East Asia Econ this week.

Thematic

China – the end of muddle through and the return of volatility. We don't have conviction about what the Plenum will deliver, but we are confident that with next week's meeting, and then the US election, the macro and market muddle through of the last 18M is likely ending.

Japan – more evidence of a shift. The one-off firm survey undertaken as part of its long-term policy review has allowed the BOJ to reiterate its positive stance, and provide more of the evidence underpinning it.

Cycle

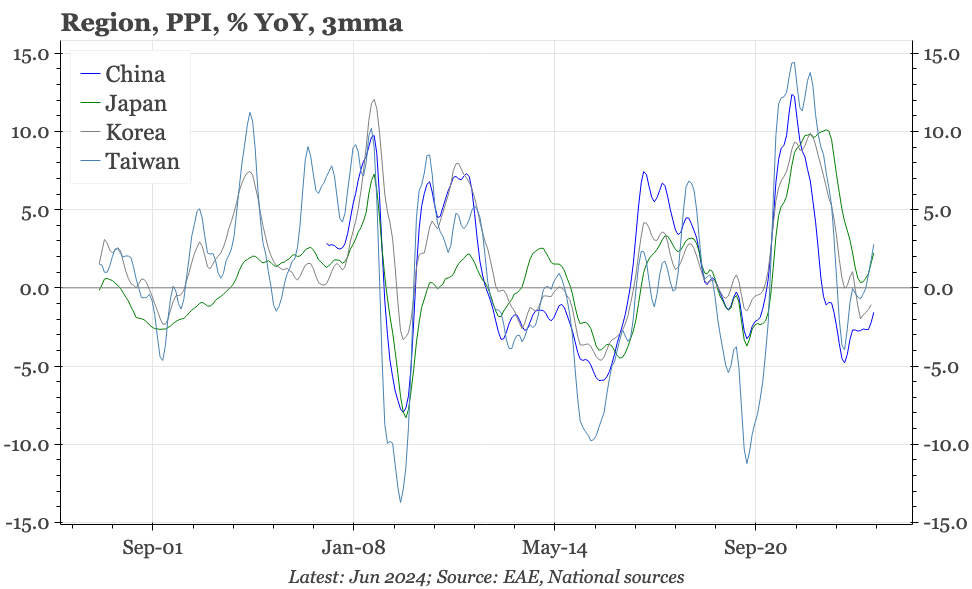

Cycle update – PPI firmer, core CPI not. PPI deflation has been more cyclical than structural, and the strengthening in Q2 should continue into Q3. But core CPI remains very weak. Inflation is too low to support rates.

Cycle update – deposits not as bearish as loans. Even allowing for a change in credit intensity, June headline credit and money data are bearish. The one positive trend is data through May showing household demand deposits no longer falling so quickly. That shift continuing would help sustain China's macro muddle through.

Cycle update – stronger inflation, less-weak activity. May data give us more confidence that wage growth is accelerating. Other data for activity aren't as robust, but don't suggest conditions are worsening further.

Cycle update – labour market and the BOK. With the labour market another sign of economic weakness, rate cuts are getting closer, but the pick-up in exports continues to give the BOK time to confirm that inflation does indeed drop to target.

Cycle update – a slight move of the goalposts. In staying on hold today, the BOK put slightly more emphasis on the KRW and household debt. The bank is moving towards a cut, but that decision now seems a bit more tied to the Fed and rate differentials.

Cycle update – still waiting for exports. After faltering in 2023, wage growth is now back on the stronger trend that began in 2021. The recovery in the manufacturing cycle gives us confidence that this can at least be sustained, but we'd still like to see a clearer lift in exports.

The centre of attention next week will be China, with tomorrow's big Q2/June data release, and the Third Plenum. We know the GDP data will be released tomorrow, and can be quite confident that Q2 GDP growth would have slowed moderately. More important for markets will be the result of the Plenum, though just when that will be released and what it will say is much less certain. As a reminder, this is how The Economist reported the kerfuffle and confusion that greeted the end of the last big economic Plenum in 2013:

Despite having overtaken Japan in 2010 to become the world’s second-largest economy, China still struggles to understand the world’s interest in its policy pronouncements. The Communist Party announced it had approved the document on November 12th after a closed-door meeting of its 370-strong Central Committee. But it had hoped, as usual, to keep its contents secret for a week while it briefed its own members. In the end it relented after three days; pressed, it appeared, by speculation (even in Chinese newspapers) that the meeting had failed to live up to its billing as a turning-point for reform. The party even took the unusual step of publishing a speech by Mr Xi in which he revealed he had personally led the document’s 60-member drafting team.

Elsewhere, it is a quieter week for data. In Japan, there's national CPI for June on Friday. We doubt that will have implications for the BOJ. There are no major data releases for Korea and Taiwan, though there will be read through for both from TSMC's quarterly earnings release on Thursday.