Last week, next week

A summary of what happened on East Asia Econ last week, and what to look for in the next seven days.

This is what happened on East Asia Econ this week.

Thematic

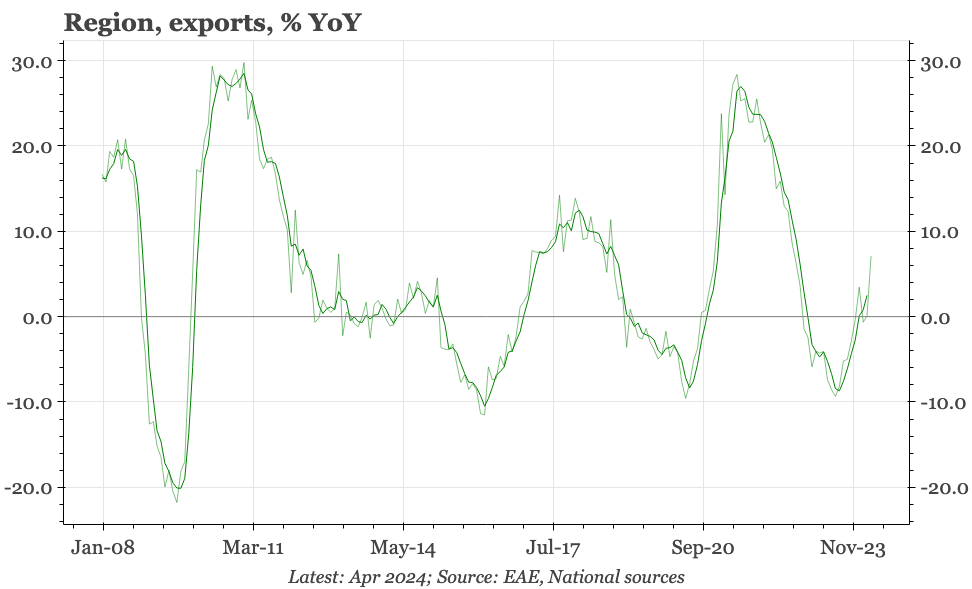

Region – monthly chart pack. Three themes stand out: the confidence of the BOJ; the significance of policy that tackles property inventories in China; and Taiwan remaining as the big post-covid winner.

China – the big shift in consumer behaviour. The big change in household behaviour isn't from spending into saving – in both respects, pre-covid trends have been regained. Rather, the shift is savings into bank deposits and out of financial and property investments. That matters for inflation, and for policy.

Cycle

Cycle update – No lessening yet of PPP deflation. CPI deflation is stabilising, though because of food prices rather than domestic demand. The surprise in April was the lack of any lessening of PPI deflation, despite some improvement in leading indicators.

Cycle update – first-ever drop in M1. The fall in credit in April, while unprecedented, can be argued away as reflecting a temporary shortfall in official bond issuance. It is more difficult to dismiss the equally unprecedented drop in M1 in the same way.

Cycle update – part-time wage growth at 5%. Part-time wage growth is now finally reflecting the labour market tightness seen in survey data, and so supports the BOJ's confidence in the macro cycle.

Cycle update – JPY weakness reinforcing BOJ confidence. It feels to us that, with so much of the market's focus being on $JPY and the MOF, not enough attention has been paid to the increasing confidence being expressed by the BOJ.

The data highlight for China will be Friday's April activity releases, as well as property prices. For Japan, it is Q1 GDP on Thursday, which, given the auto-related disruptions to IP and the ongoing weakness of consumption, is unlikely to surprise on the upside. For Korea, there's today's data for foreign trade in the first ten days of May, as well as labour market data on Friday.