Last week, next week

A summary of what happened on East Asia Econ last week, and what to look for in the next seven days.

This is what happened on East Asia Econ this week.

Thematic

China – it isn't just Japan. Last week I gave a short conference presentation updating the framework I've been using to think about China today versus Japan in the 1990s. The slides focus on deflation, manufacturing, currencies, and household consumption.

China – rates still have downside. More than 12M ago, we argued yields should fall. In that respect, today's drop to record lows isn't a surprise. We don't see anything fundamental yet to cause a change in direction. That's based on four factors: the PBC's reaction function, inflation, household savings, and the CNY.

Japan – taking stock. It is clear that the market moves that accompanied the BOJ's July policy changes are impacting prices. But it isn't obvious that they have derailed the underlying path for the economy. It seems to us the door remains open for an October hike, with the obvious risk being events in the US.

Cycle

Cycle update – core CPI still in deflation. MoM core CPI fell again in August, and while perhaps a bit too early to pronounce that China is definitively in core deflation, it is getting close. PPI deflation also worsened, and the leads suggest that will continue. Despite stronger food prices, it is likely interest rates continue to fall.

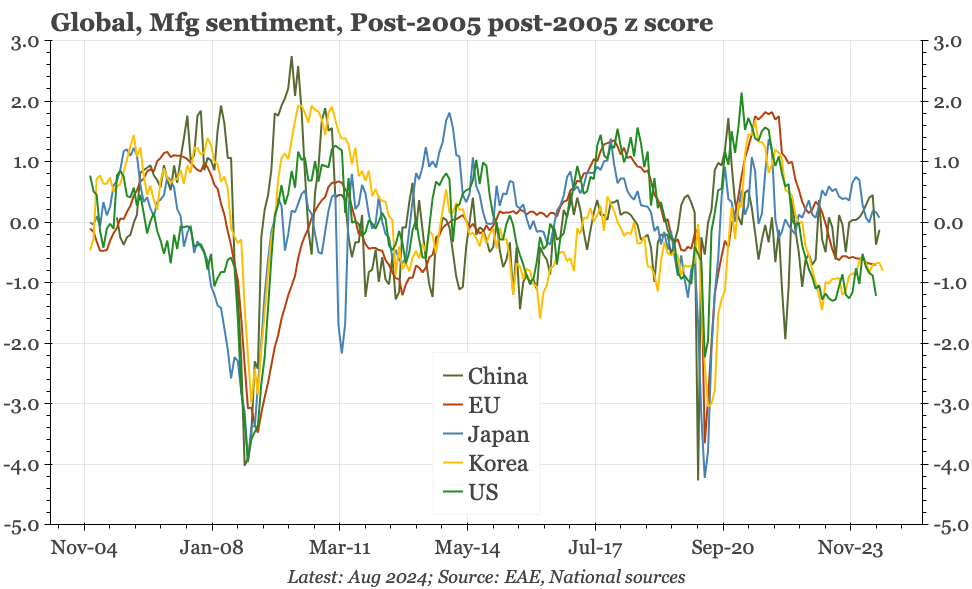

Cycle update – exports flat-lining. It seems increasingly unlikely that exports can offset the weakness of domestic demand. Today's export data for August weren't strong. Volumes might be better, but the regional export cycle is likely peaking, and that at a time when China's domestic demand seems to be weakening further.

Cycle update – still stuck in deflation. Today's industrial price data for the first 10 days of September and property prices for August show intensified deflationary pressure. Yesterday's monetary data were weak. The PBC said yesterday that it will focus on price stability, but it also said it has plenty of other things to do as well.

Cycle update – August data suggest GDP is now only growing by around 4% YoY. The headwinds remain property activity, which dropped again in August to new lows, and retail sales, which has now contracted MoM in five of the first eight months of 2024. Sustaining muddle-through is getting much more difficult.

Cycle update – activity still solid. The Economy Watchers survey improved in August. That matters, as if the market vol around the BOJ meeting in July had caused damage to the cycle, it should be showing up by now. The rise in the household score is particularly important, given the previous weakness of consumption.

Cycle update – UE down, but the BOK gets ready to cut. Data today show exports still growing, and UE still low. The BOK hasn't been ignoring exports, but the bank has been more focused on weak domestic demand. The labour market data don't suggest that weakness is disappearing, with strength in employment concentrated in state and part-time positions.

Cycle update – belated export strength. While exports jumped in August, with signs that the semi upswing is losing steam, it still seems likely that the export peak is near. Pretty much all the growth is coming from the US, which is propelling a surge in the bilateral trade surplus. That makes Taiwan vulnerable if Trump wins re-election.

After all the data last week, the focus the next few days will be policy, with the BOJ meeting on Friday, and Taiwan's quarterly MPC meeting the day before. Both are likely to be holds for the policy rate, but the tone in Taiwan especially is likely to remain hawkish, with more tightening measures likely to be introduced for the housing market.

In terms of data, the highlight for China will be the fx settlement data on Wednesday, which is about the most useful measure of capital flows. For Japan, there's national CPI data on Friday, and trade statistics a couple of days before that. There's no notable data releases in Korea or Taiwan.