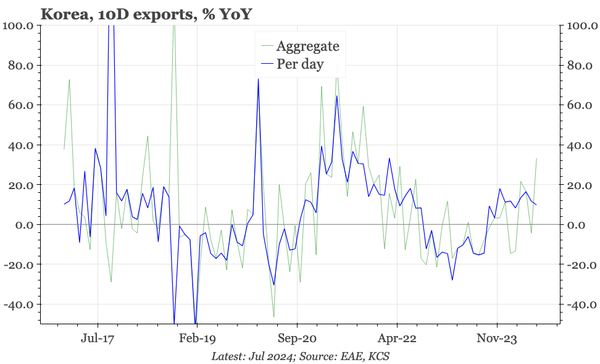

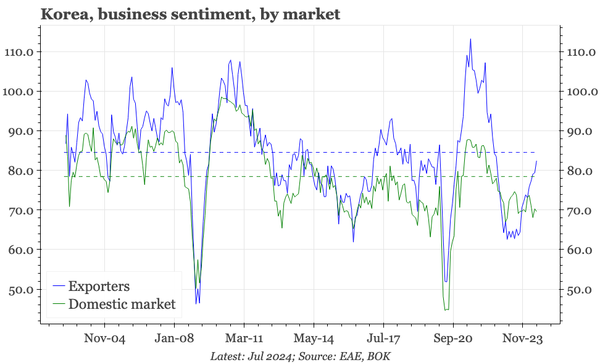

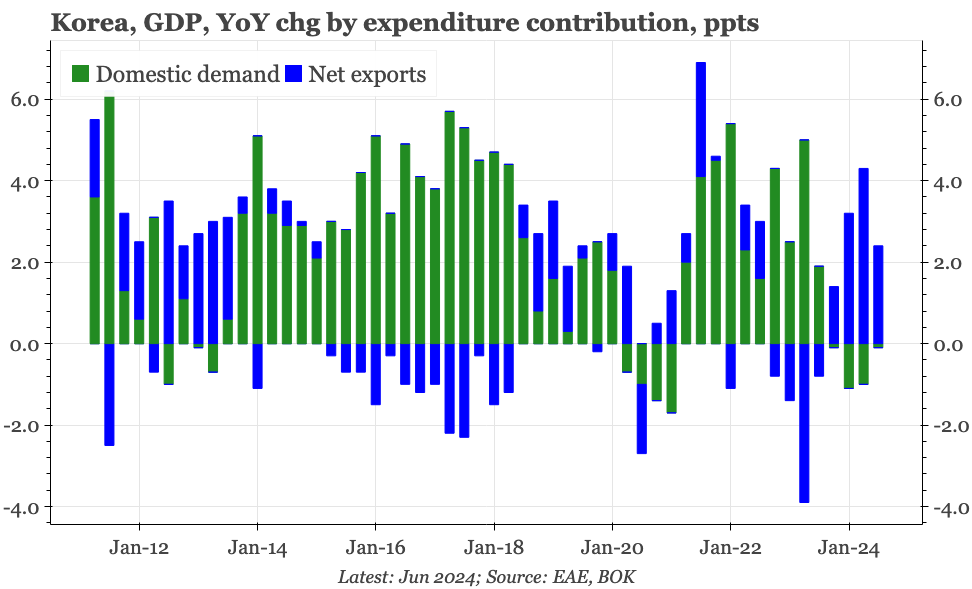

Korea – export recovery, domestic weakness

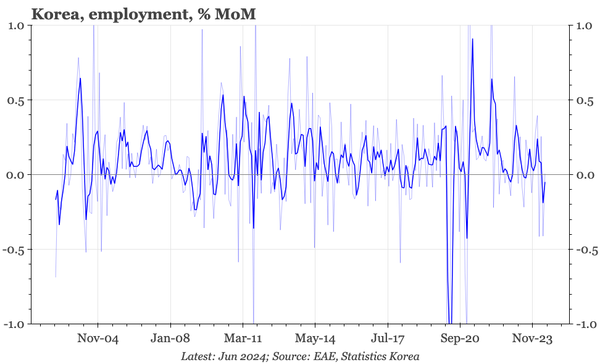

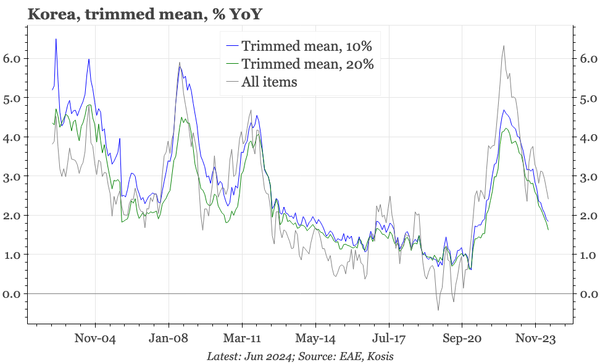

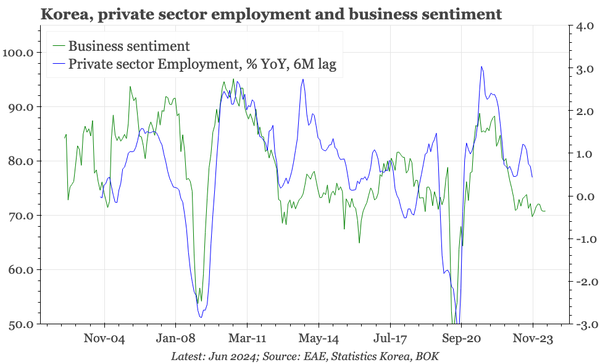

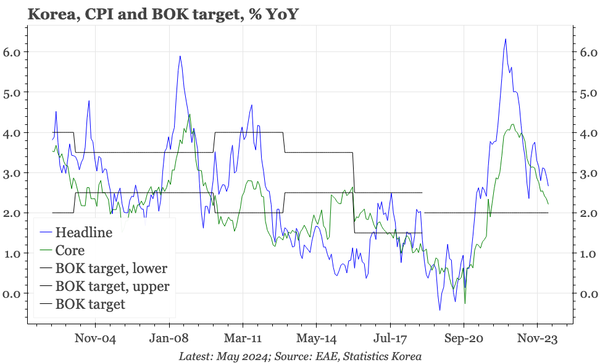

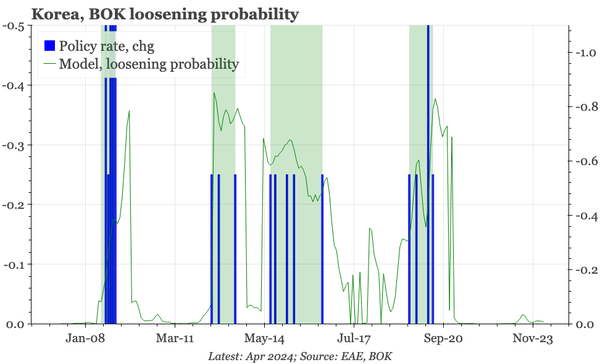

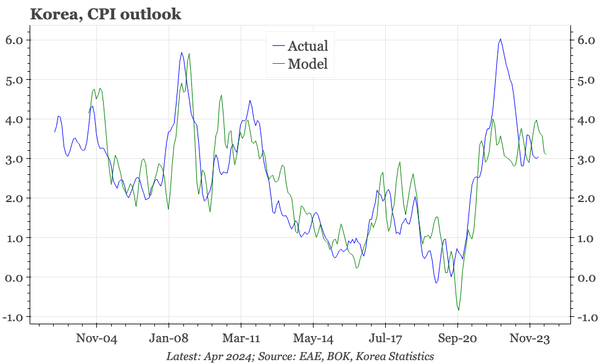

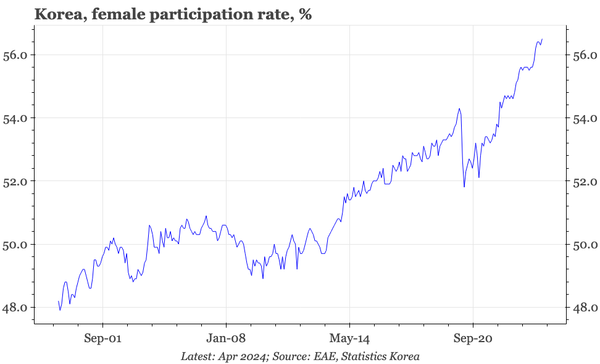

Recent data suggest an unchanged macro story: a slow moderation in inflation and a weak domestic economy, but export and property recoveries. The first two dynamics point to an interest rate cut, but the second two suggest that still isn't imminent.