Korea – May CPI

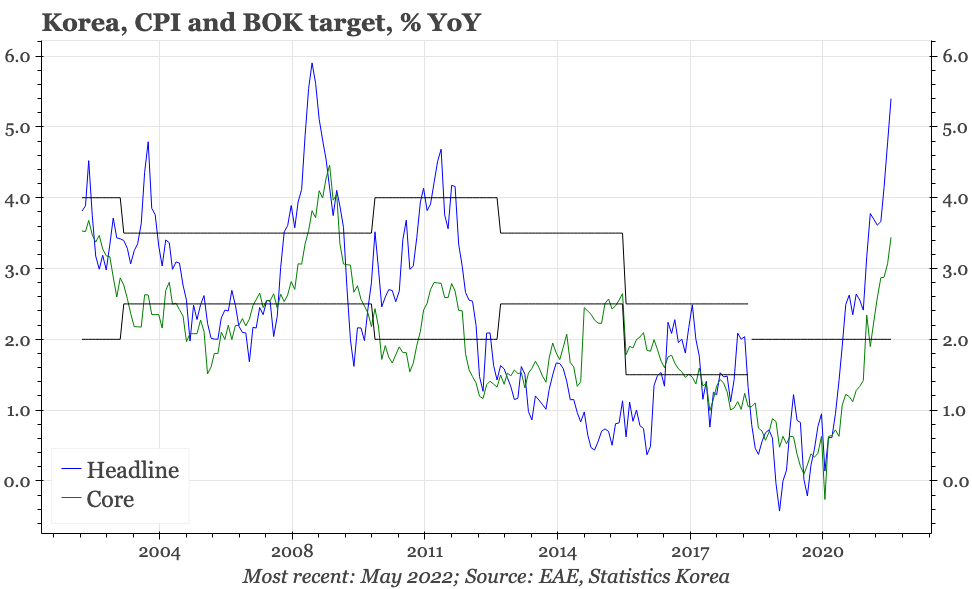

The BOK was right to be hawkish at its last meeting. There was a broad-based acceleration in inflation in May to the highest rate since mid-2008.

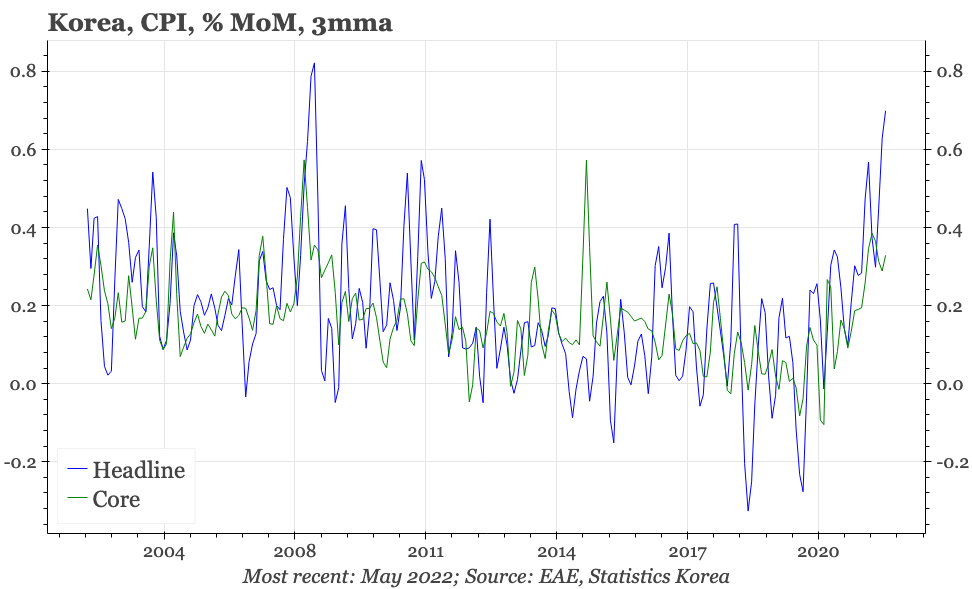

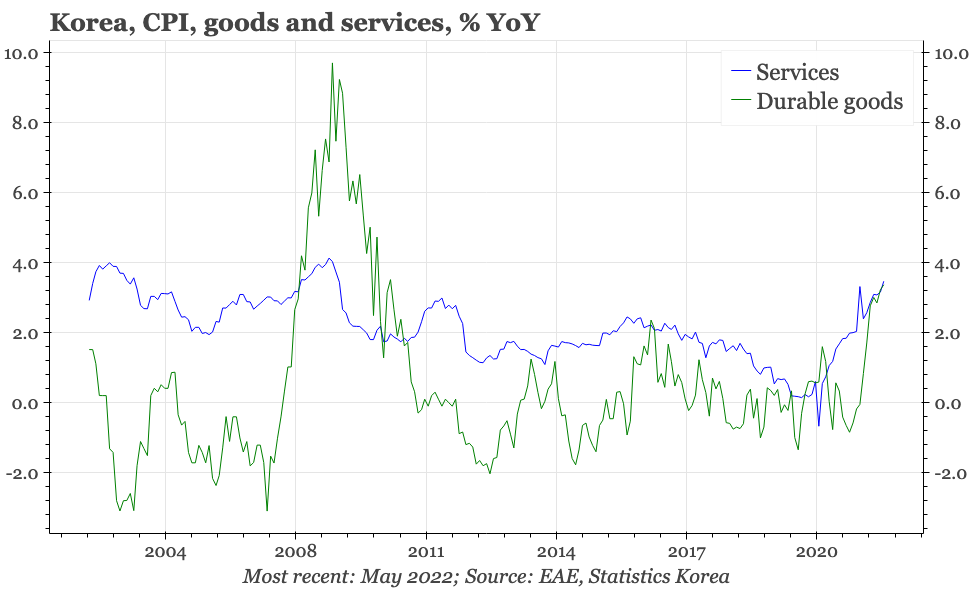

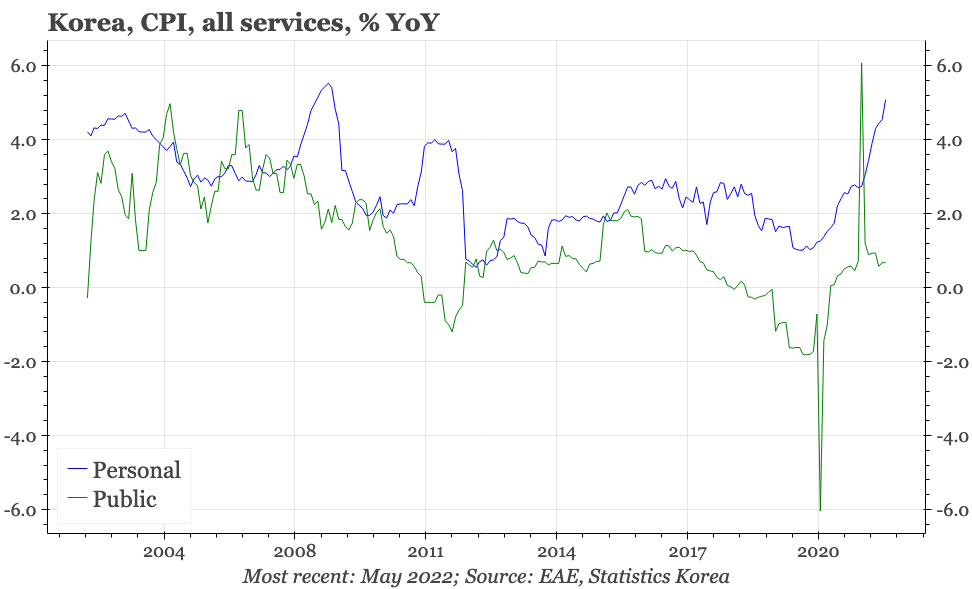

Headline CPI accelerated again in May, reaching 5.4% YoY. On a MoM basis momentum eased, but only slightly, and not by enough to prevent the average over the last three months reaching the highest since the spike just before the global financial crisis in 2008. The strength in inflation is broad-based, with both core, services and goods prices also rising at rates not seen in almost fifteen years.

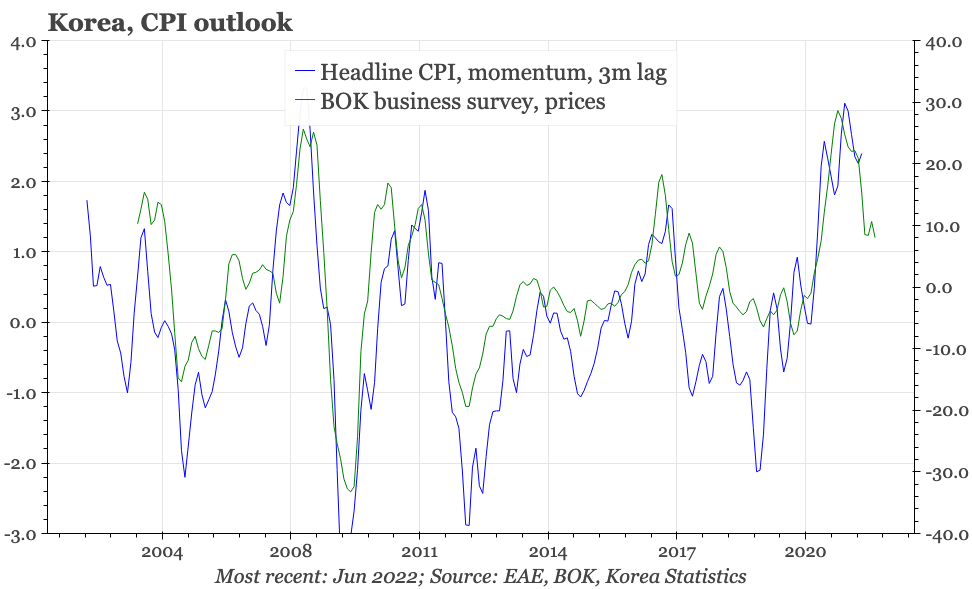

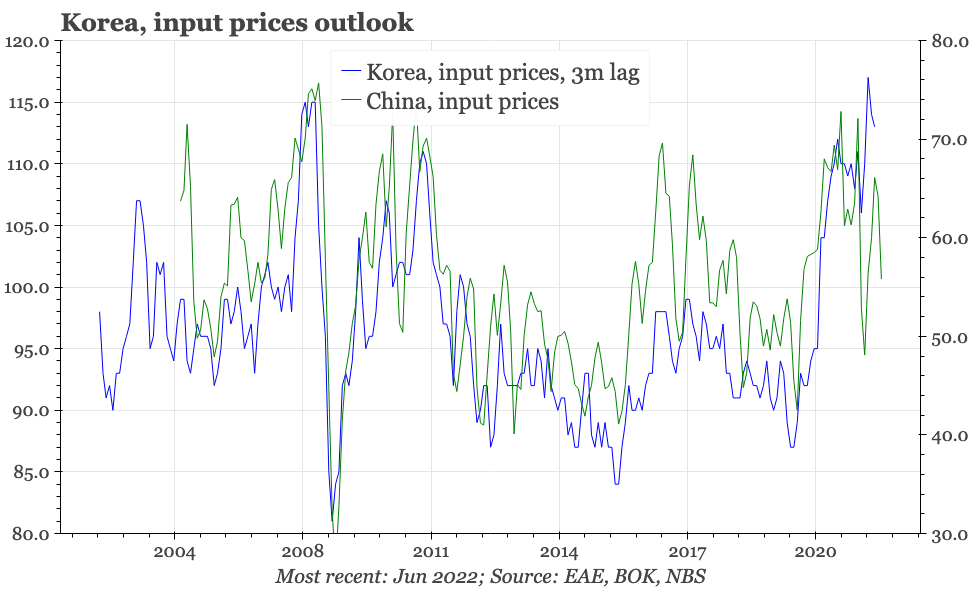

There are reasons to think that this rise in inflation does soon peak. Price measures in the business sentiment survey, input prices for China – which tend to lead those in Korea – and the global oil price all show some moderation.

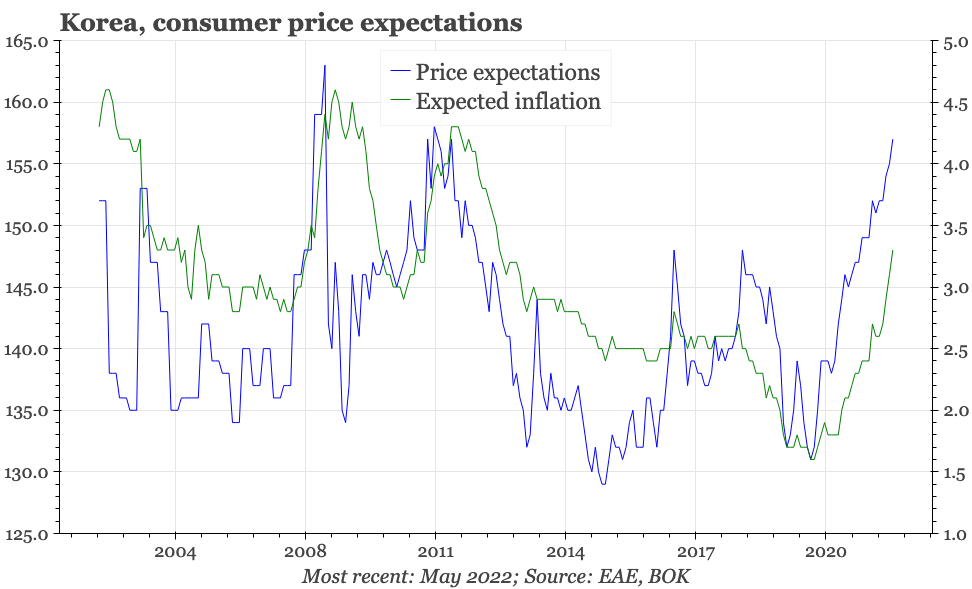

But the BOK will likely be concerned that while the oil price in YoY terms has moderated, the USD price is still rising. At the same time, all these leading indicators track goods prices. The big risk for the BOK is that even if global goods price inflation accelerates less, it will be offset by rising services prices generated by wage-price dynamics in the domestic economy. That is why the continued rise in consumer inflation expectations is important.