Korea – July foreign trade

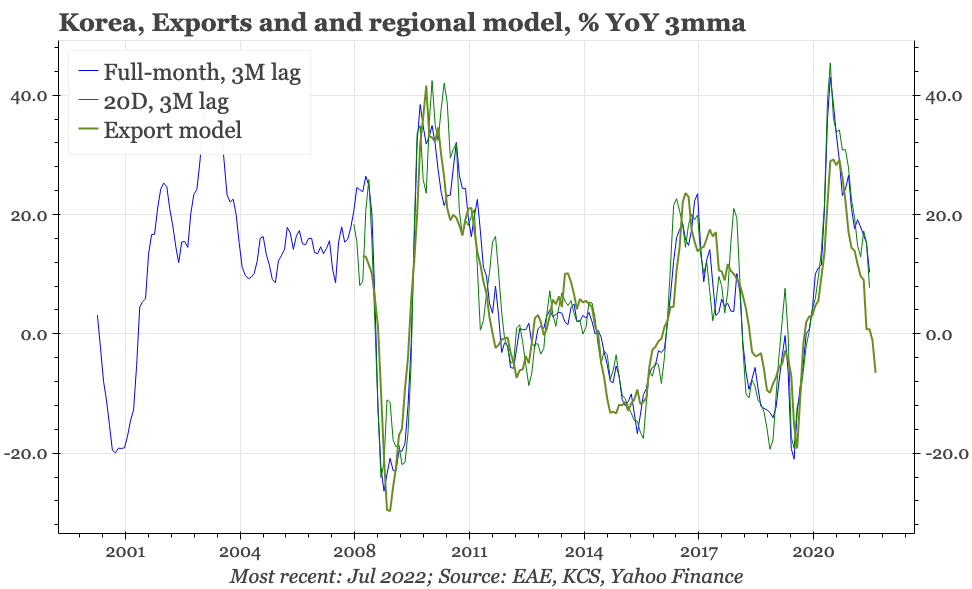

Korean July trade data were consistent with three themes for the regional export cycle: momentum is slowing; so far, it is a slowdown, not a recession; but leading indicators point to exports starting to contract before year-end.

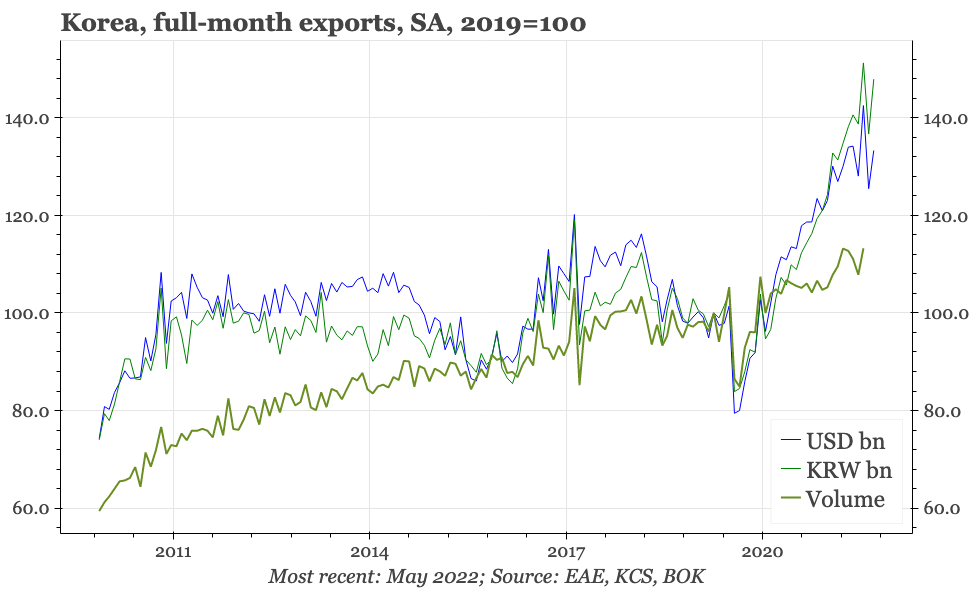

YoY export growth in July ticked up, but not by more than usual monthly volatility, and the smoothed average 0f the last few months remains firmly down. After adjusting for seasonality and working days, the level of exports in July did rise, but assessed on this basis and monthly growth in exports is only running at half the pace of a year ago. The overall slowdown in exports is following the regional leading indicator quite closely, and that points to exports falling in Q4.

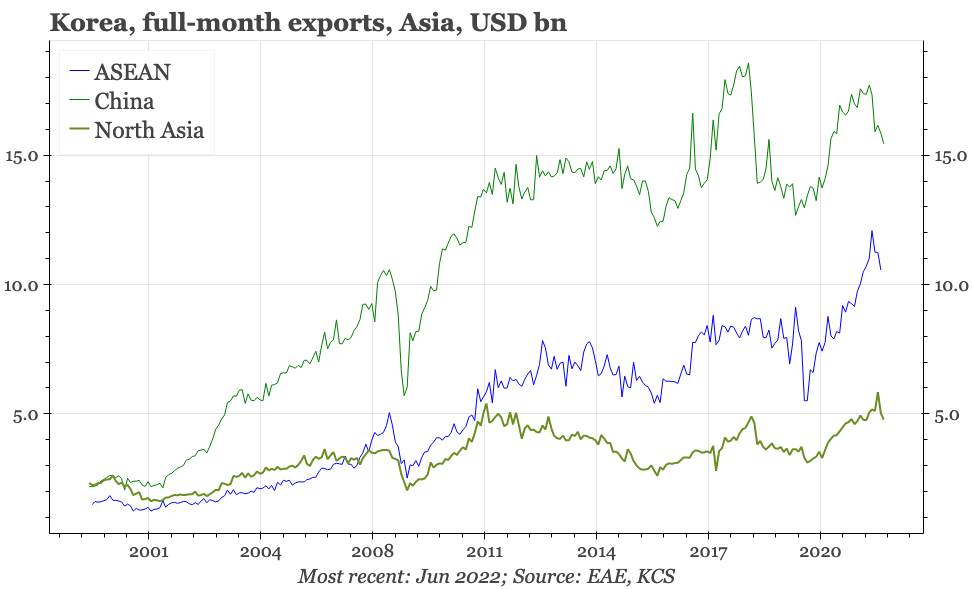

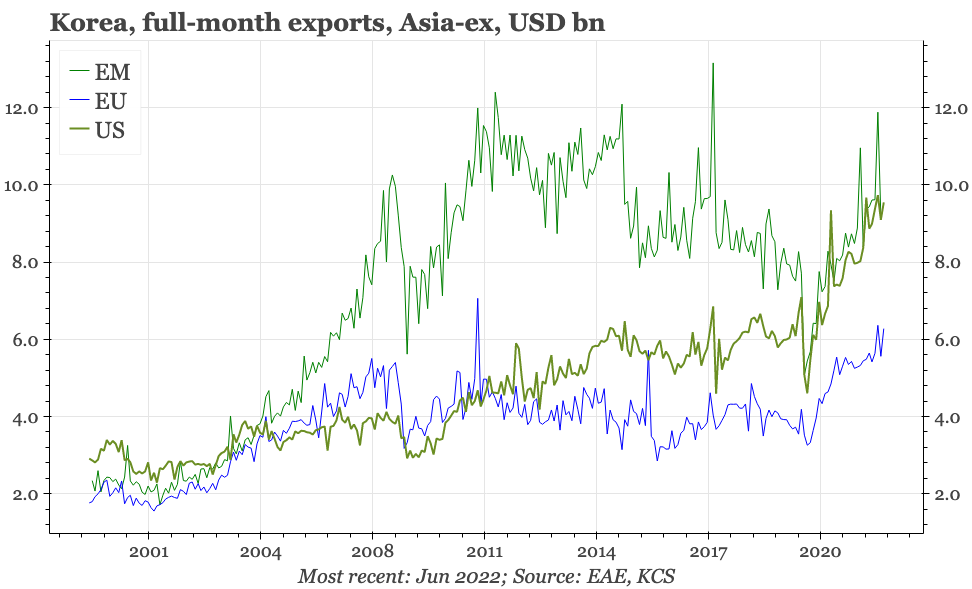

Exports to most regions remain fairly elevated, though there are some signs of a slowdown in the pace of shipments to the US and EU. Trends in Asia are already weaker. Probably the lockdowns in China have played a role in that, but the bigger problem is likely overall activity there, which remains weak.

Growth in exports of semiconductors are slowing. With DRAM pricing weakening, that downturn is likely to worsen further. Korea does have a more diversified export base than somewhere like Taiwan. Steel and petroleum products account for around 20% of all overseas sales, with overall exports therefore getting some support from the rise in commodity prices. Still, at around 20% of the total, semiconductors are the biggest single sector, so pain here will matter.

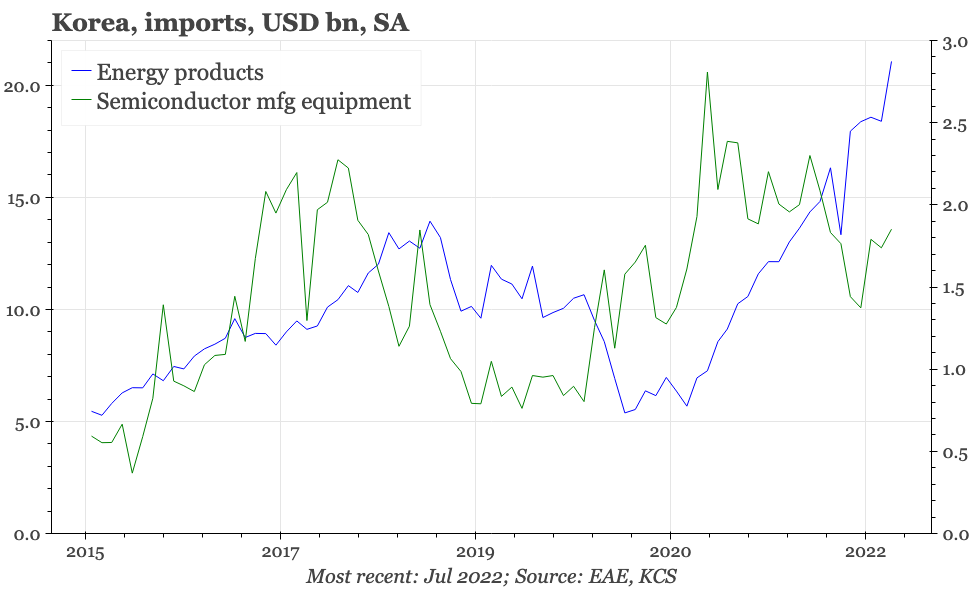

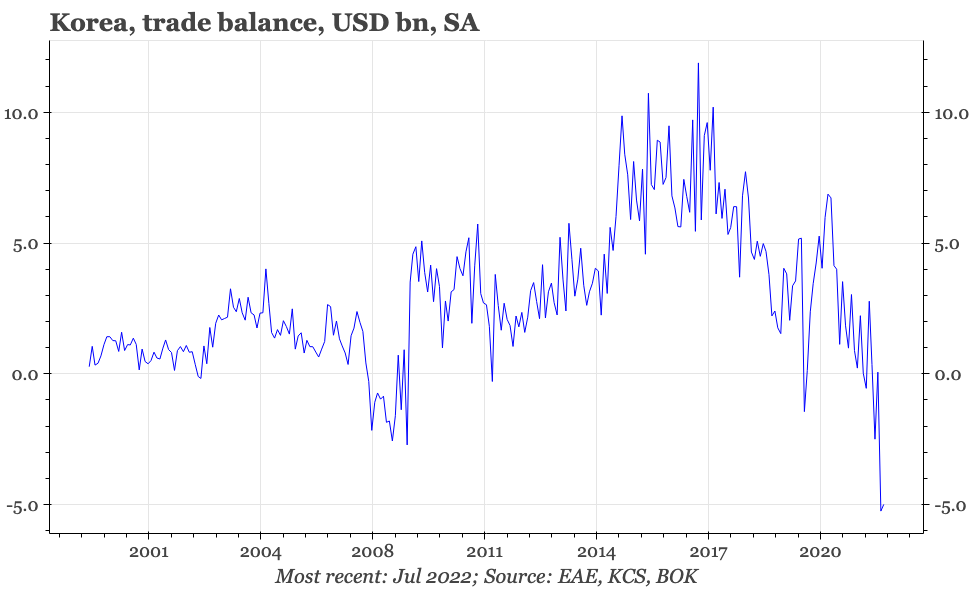

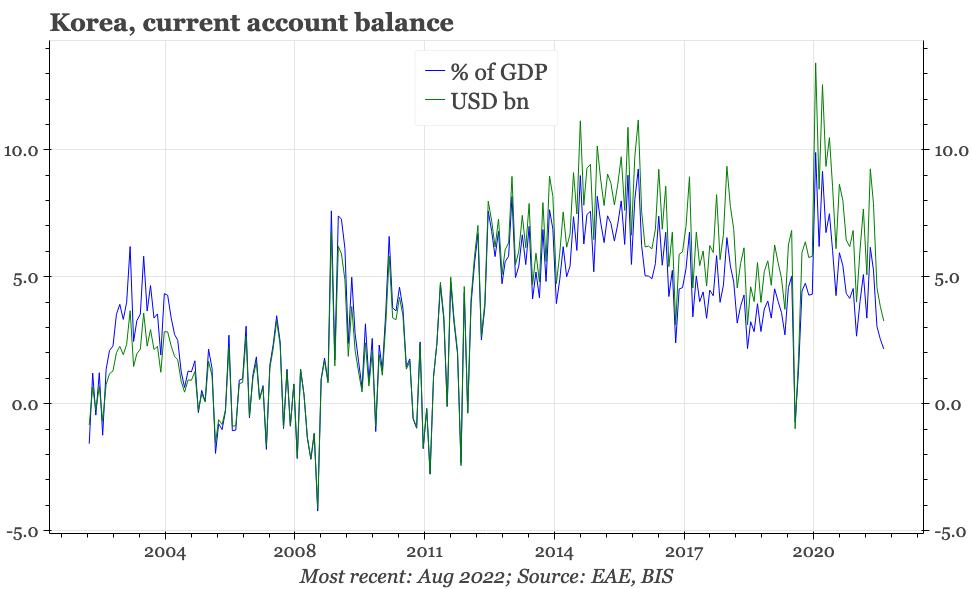

The impact of commodity prices on imports is even bigger, with the sharp rise in the fuel bill of the last few months continuing in July. That in turn continues to weigh on the trade balance, which has fallen into deficit this year. Data released on Friday do, however, show that the current account through June remained in surplus.