Korea – and now the hit from auto tariffs

Pulled by the policies of previous US administrations and pushed by rising China competition in EM, Korea has focused more on the US market. As a result, US tariffs will hurt more than they would have a few years ago, and with domestic demand weak, there's not much else to support the local economy.

Economically, US auto tariffs are particularly unfortunate for Korea.

By late 2024, the strength of exports, which until then had offset the weakness of domestic demand, was already starting to falter. In the three months since, domestic sentiment has been further undermined by the political crisis in Seoul. And now exports are being dealt a new blow by Trump’s tariffs.

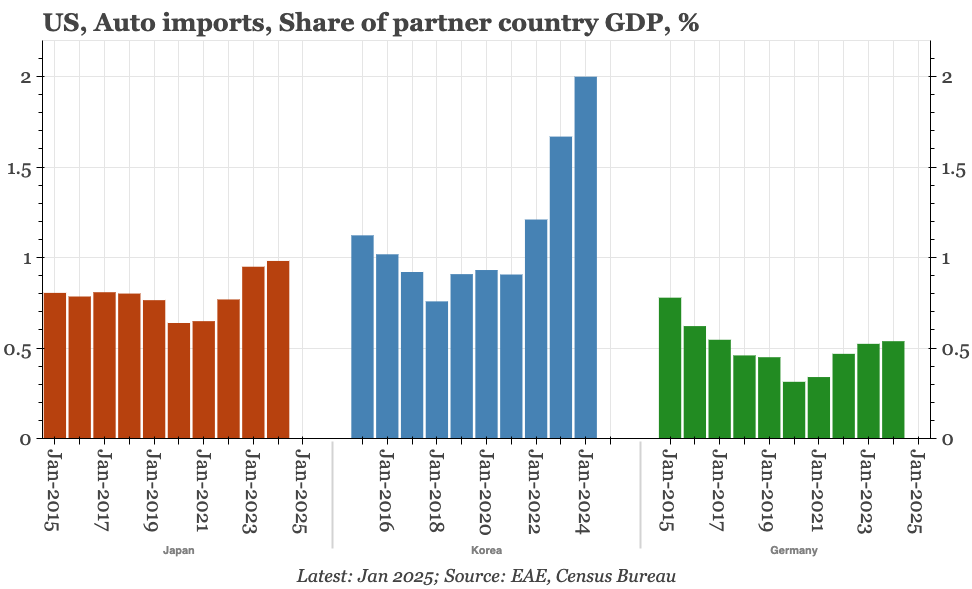

The auto tariffs in particular are a big deal for Korea. Across EM, Korea has already been suffering from competition with China, with market share gains only seen in the US and EU. Auto sales to the US had grown particularly strongly, and are now equivalent to 2% of Korean GDP.

This concentration on the US had been encouraged by previous US administrations: the free trade agreement negotiated from 2006 and implemented in 2012, and Biden’s IRA. So, precisely because Korea reacted to policies deliberately pursued by previous administrations, it is now suffering a hit from the policies being implemented by the current administration.

Economically, this really is unfortunate, given the economy is already so weak. Politically, Korea seems unlikely to align itself with US economic policy in the future in the same way it has in the past.

If you find these Quick Take Charts interesting, you will like our full research service even more. For details, please get in touch: paul@eastasiaecon.com