Korea - April business sentiment

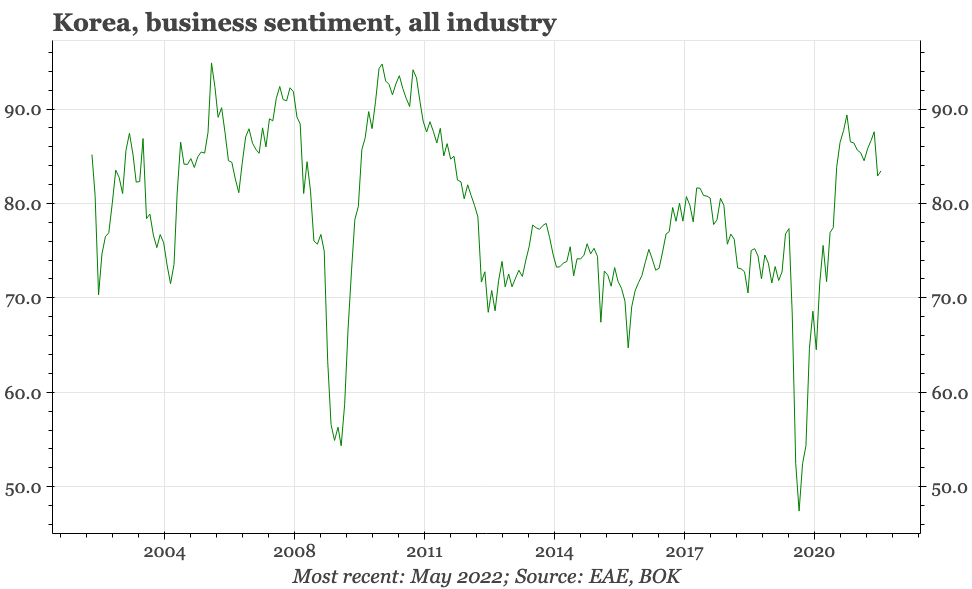

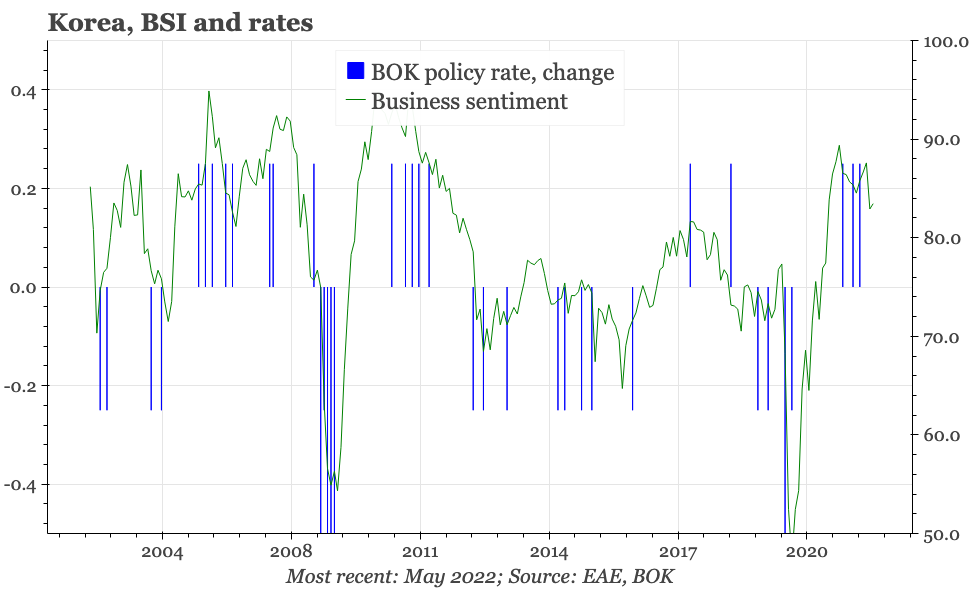

Korea's April business sentiment survey reaffirms recent themes for the economy. The cycle is now slowing, but not yet weak, and in fact on its own still strong enough to keep the BOK in tightening territory. At the same time inflation risks remain high. The central bank is likely to remain hawkish.

Korea's April business sentiment survey reaffirms recent themes for the economy. The cycle is now slowing, but not yet weak, and in fact on its own still strong enough to keep the BOK in tightening territory. At the same time inflation risks remain high. The central bank is likely to remain hawkish.

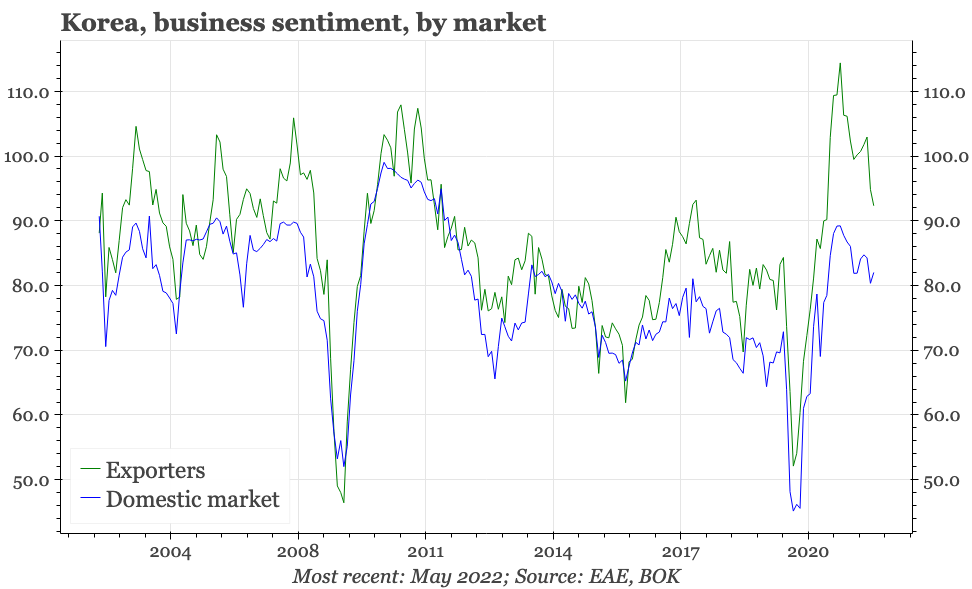

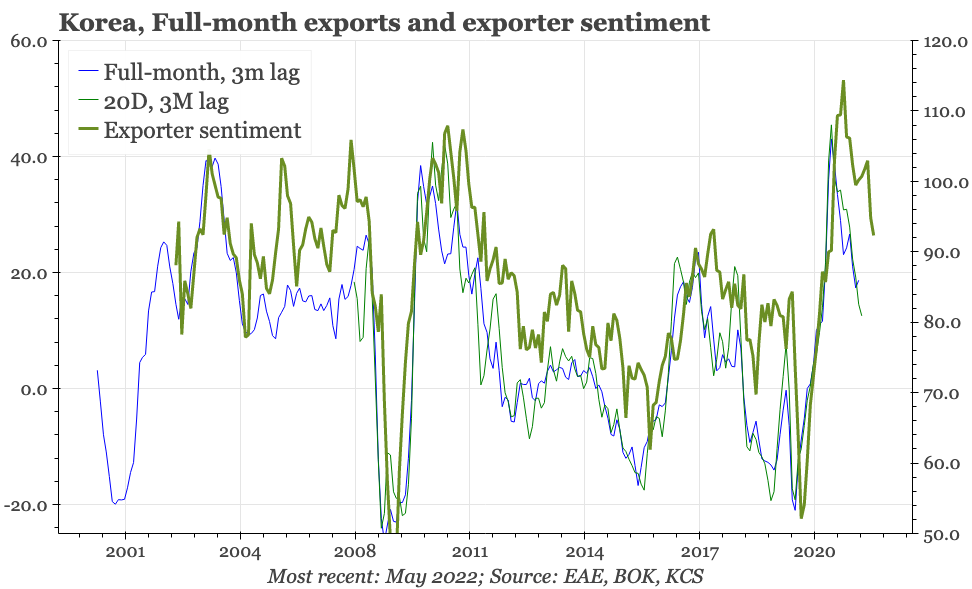

The business sentiment survey is probably the most reliable leading indicator for the cycle. In the April survey, the fall in exporter sentiment that began in March continued. That is significant as a sign for Korean exports, but given Korea's role in the manufacturing supply chain, also for the global cycle. Domestic sentiment though remained quite strong, probably boosted by the easing of covid restrictions.

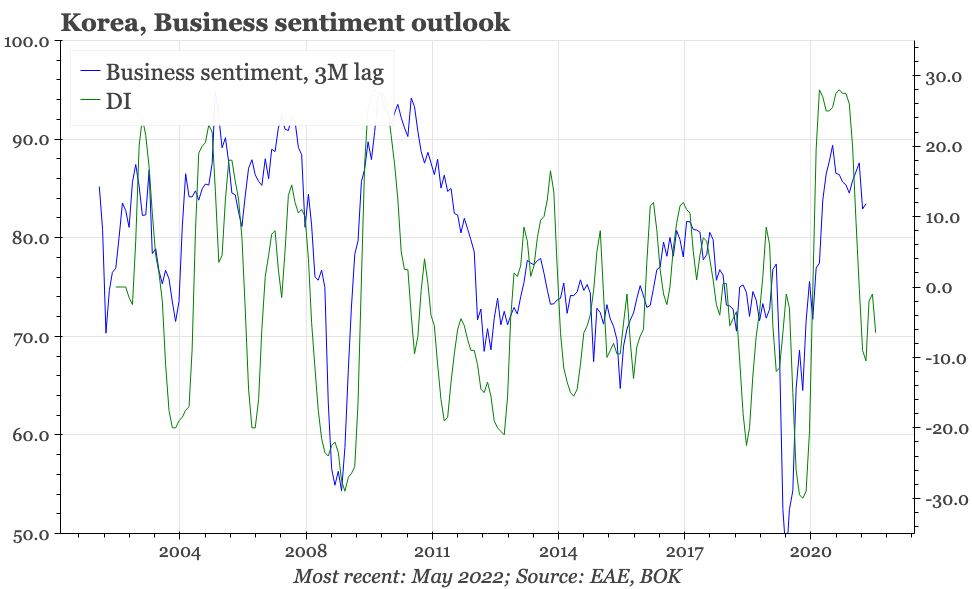

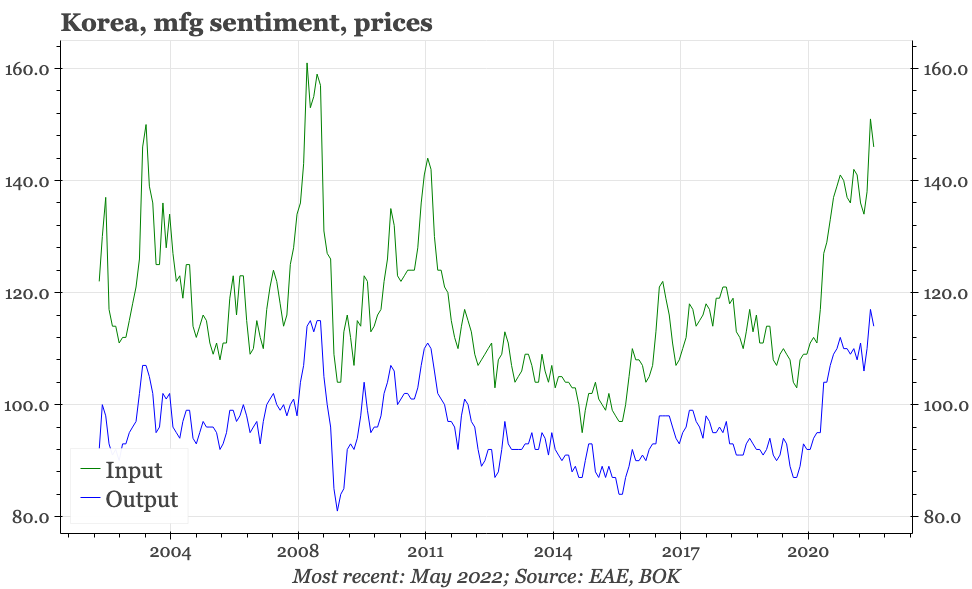

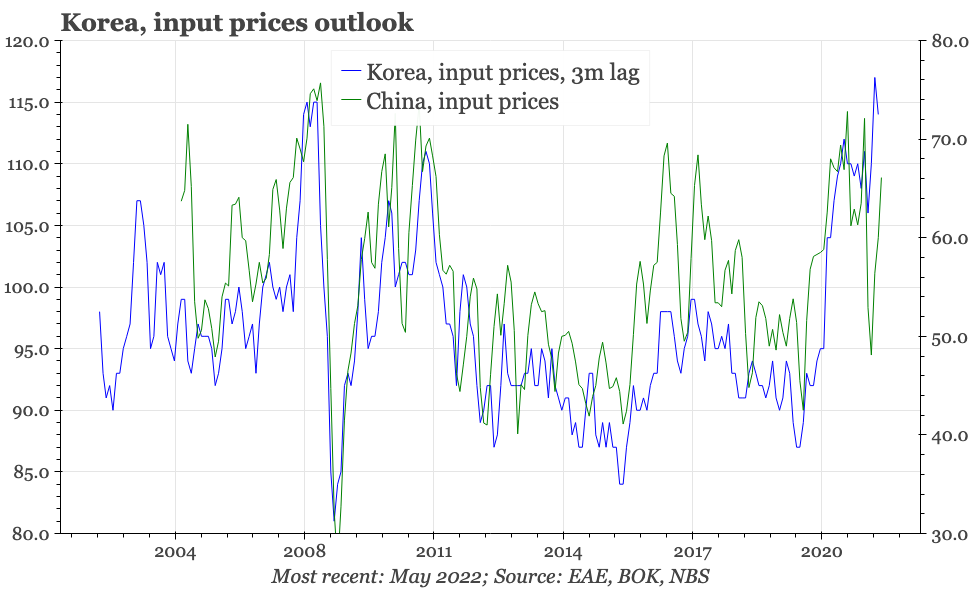

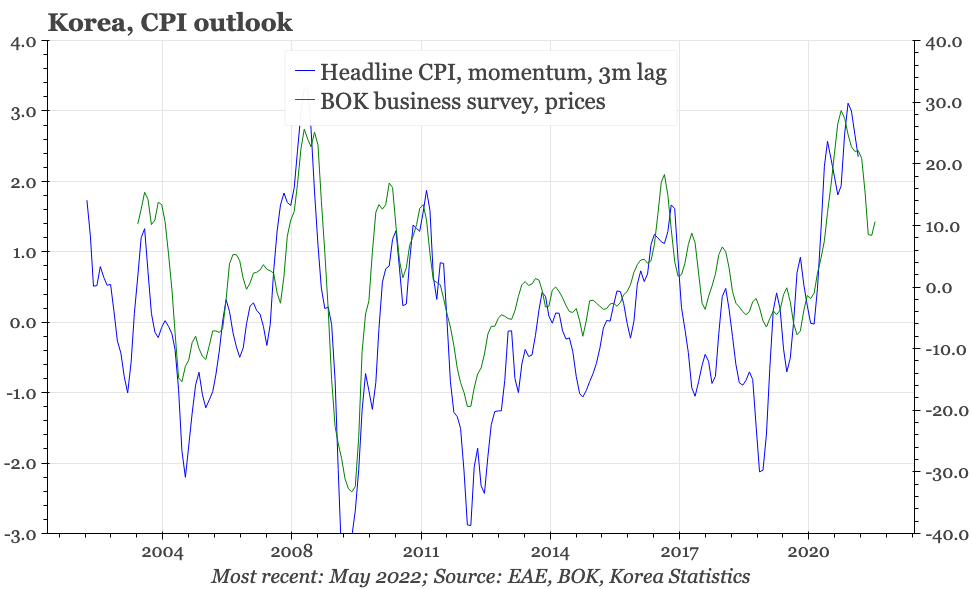

The diffusion across industries suggests that overall there is more downside ahead, which will make 2H22 more interesting for the BOK. But as of now, sentiment is still high relative to history, and on its own at a level where the central bank would usually be hiking. At the same time, inflation indicators remain strong. While prices in the survey did fall a bit compared with last month, they didn't change by enough to suggest any substantive weakening in the recent trend of strong CPI.