Japan – warm, not hot

Japan's economy is warm, not hot. That will change if the positive consequences of JPY weakness (corporate competitiveness) start to outweigh the negative (lower real incomes). At that point, some of the nonlinear upwards pressures on prices identified by the BOJ will start to become important.

BOJ economic outlook, Sep labour market, Oct Tokyo CPI, consumer confidence

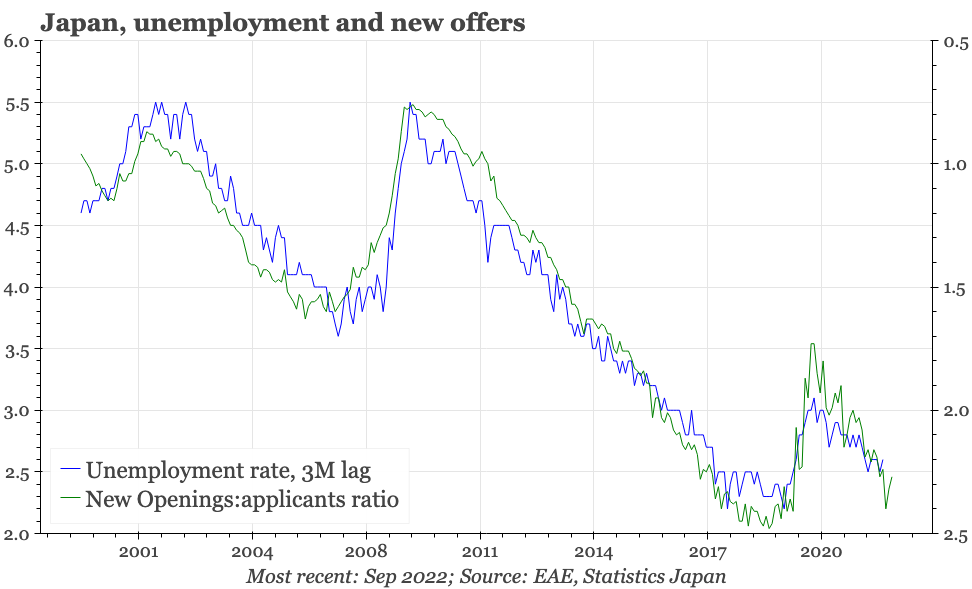

Employment ticked up in September to the highest level since March 2020. However, at 67.4m, the number of working people is still 0.7% below the pre-pandemic peak. Unemployment was stable at the top of the 2.5-2.6% range in which it has been stuck since March. The joblessness rate should fall a bit from here, but the degree of tightening looks likely to be more modest than it seemed a couple of months. That's because the new offers:applicants ratio, one of the most accurate leading indicators for unemployment, has given up most of the sharp rise recorded into July.

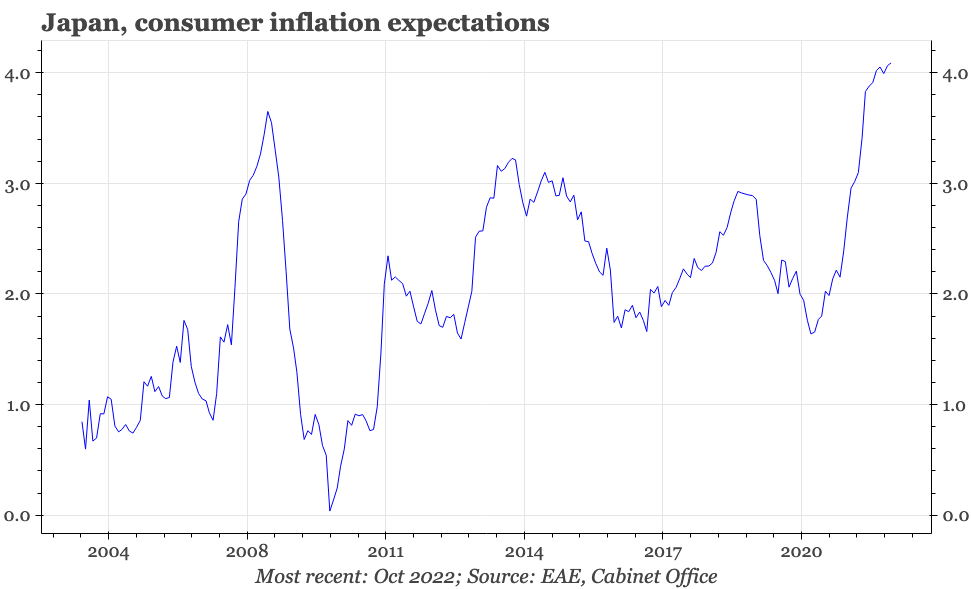

So, it looks probable that there will continue to be an incremental rather than sharp tightening of the labour market. That being the case, a big acceleration in nominal wage growth is unlikely, and without that, real wages will continue to stagnate. That is getting reflected in consumer confidence, which fell again in October back to the lowest since January 2001, a change that closely matches the lagged effect of the continued rise in consumer inflation expectations.

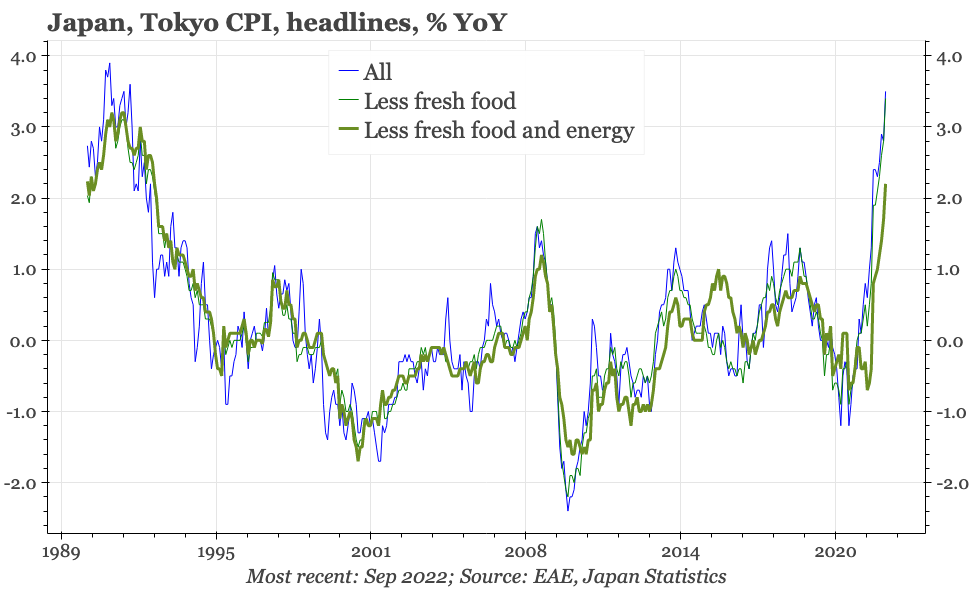

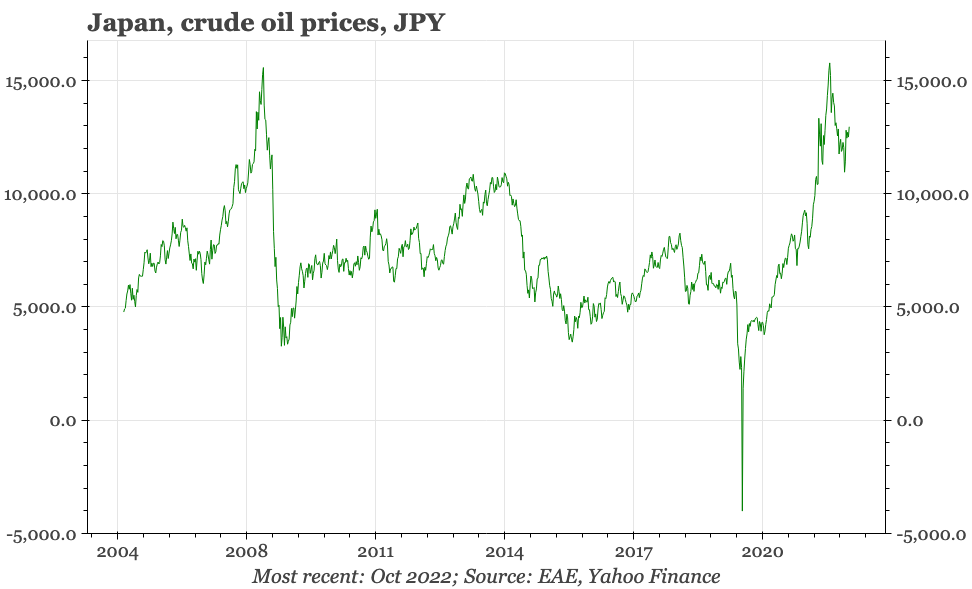

The backdrop to the increase in price expectations is the continued rise in actual inflation. CPI data for Tokyo for October, released Friday, show price rises continuing to accelerate, with core inflation in the capital exceeding 2% for the first time since the early 1990s. With economic activity and the labour market warm rather than hot, the key driver of this rise in inflation remains the weakness of the JPY. The currency has been so weak that oil prices in local currency terms have recently started to rise again.

At its meeting last week, the BOJ reiterated its core belief that the rise in inflation remains narrow, concentrated in energy, food, and durable goods prices. Given that, it expects the current rise in inflation to prove temporary, an assessment which in turn is the justification used by the bank for keeping monetary policy unchanged. Needless to say, it is this stance, combined with the Fed's hawkishness, that is driving $JPY ever higher.

That inflation will be a temporary – dare we say transitory – phenomenon is the bank's official view. However, the BOJ's own diffusion of movements in all items in the CPI does suggest that inflation pressures have broadened. In addition, analysis of corporates' price-setting behaviour included in the bank's revised outlook for the economy that was released last week identifies a dynamic that adds upside risks to inflation. That's because companies are:

taking into account their competitors' behavior when changing their price-setting stance....The results indicate that, when input prices rise, there seems to be a relationship in which the number of firms passing on cost increases goes up in a nonlinear fashion as more competitors raise their selling price

This analysis appeared right at the back of the BOJ's report, but the inclusion of the term "nonlinear" made it stand out. It still seems difficult to think that inflation really catches hold when the economy is only experiencing the negative consequences of the rise in the JPY in the form of higher prices. But if that changes and the JPY starts to provide some tailwinds, for example by encouraging re-shoring and increasing FDI, then the labour market should tighten more, domestic inflation pressure grow, and the BOJ start to look increasingly behind-the-curve.