Japan – remarkably profitable

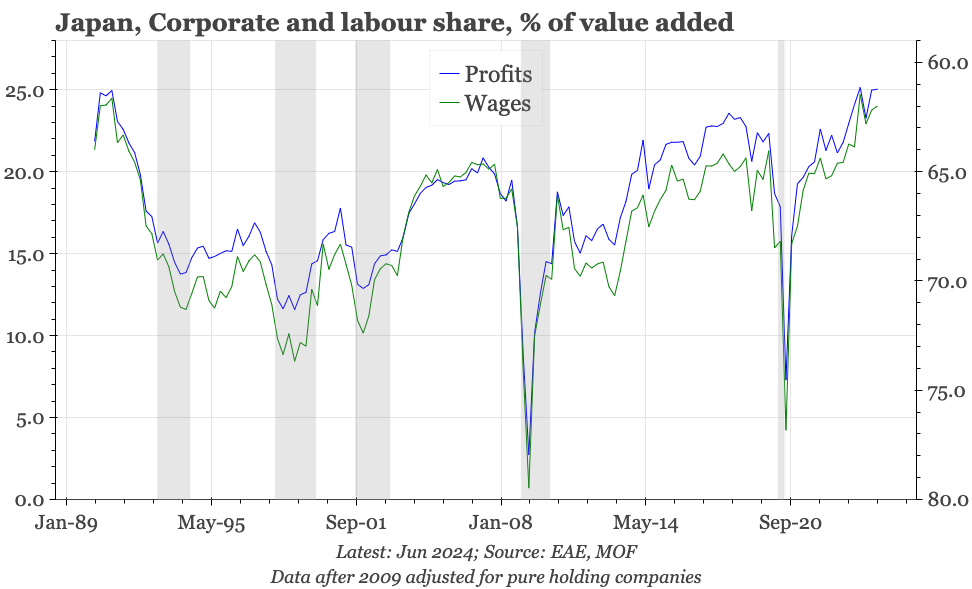

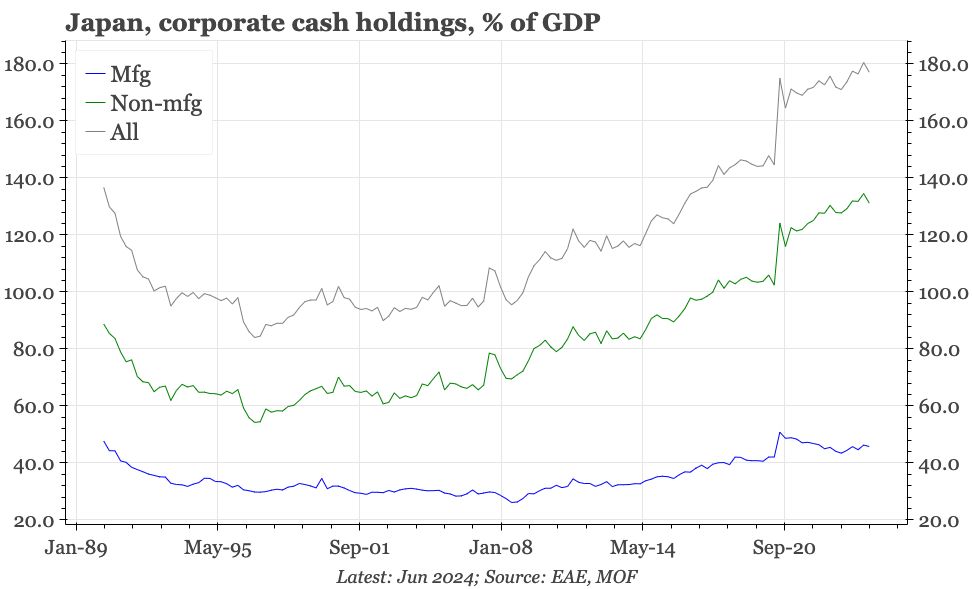

There's a lot of concern about weak profits in China. In Japan, profitability by contrast continues to get stronger, boosted in Q2 by sales and a further rise in margins. After a sharp fall in 2023, the labour share has stabilised, but with capex modest, cash holdings remain large.

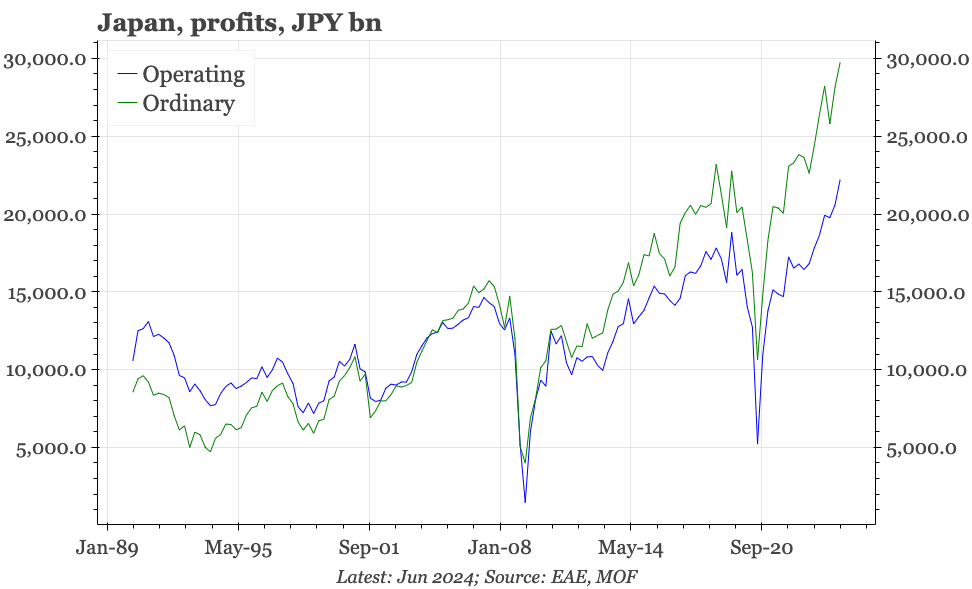

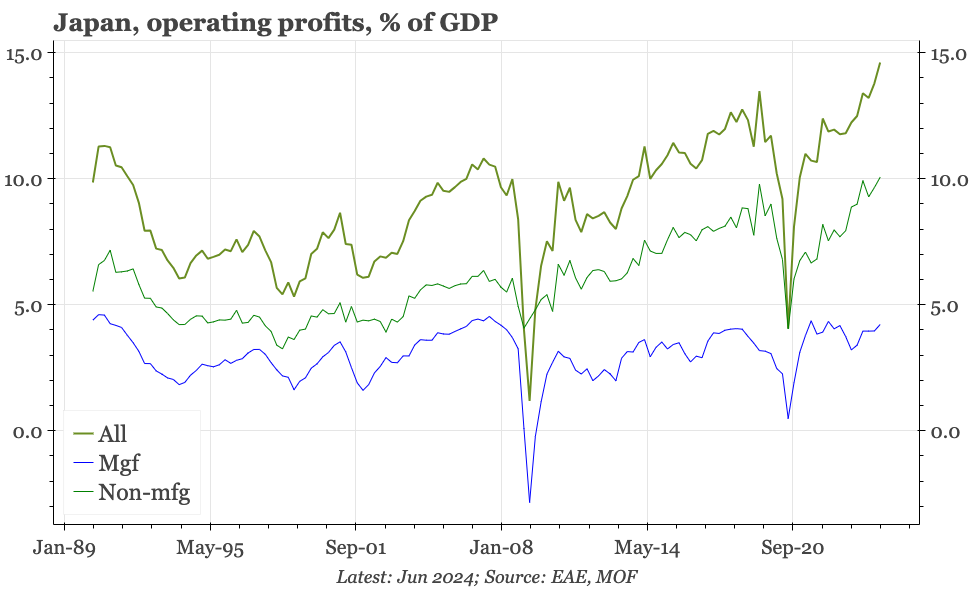

The stand-out strength of corporate profitability showed no sign of reversing in the three months to June. Whether measured in absolute terms or relative to GDP, new highs were reached in Q2. Profits now stand at almost 15% of GDP. By comparison, at the peak of the bubble in 1989, the ratio was 11.3%.

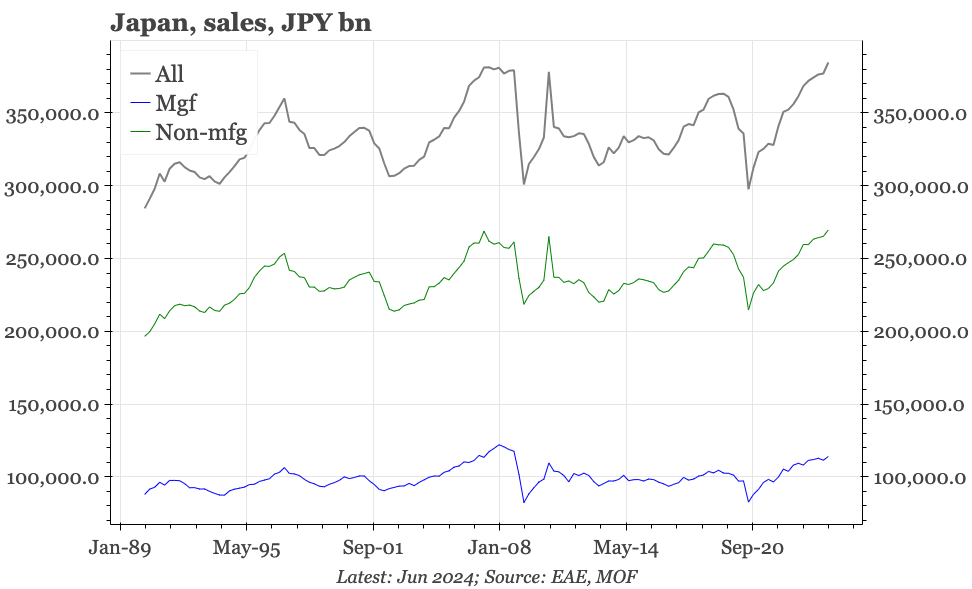

Scale, at last, seems to be playing a role in the rise in profits, with sales in Q2 rising to a new record high. The previous record high had been recorded in March 2007. However, it is too early to be confident that sales have really broken through the top of the range of the last thirty years.

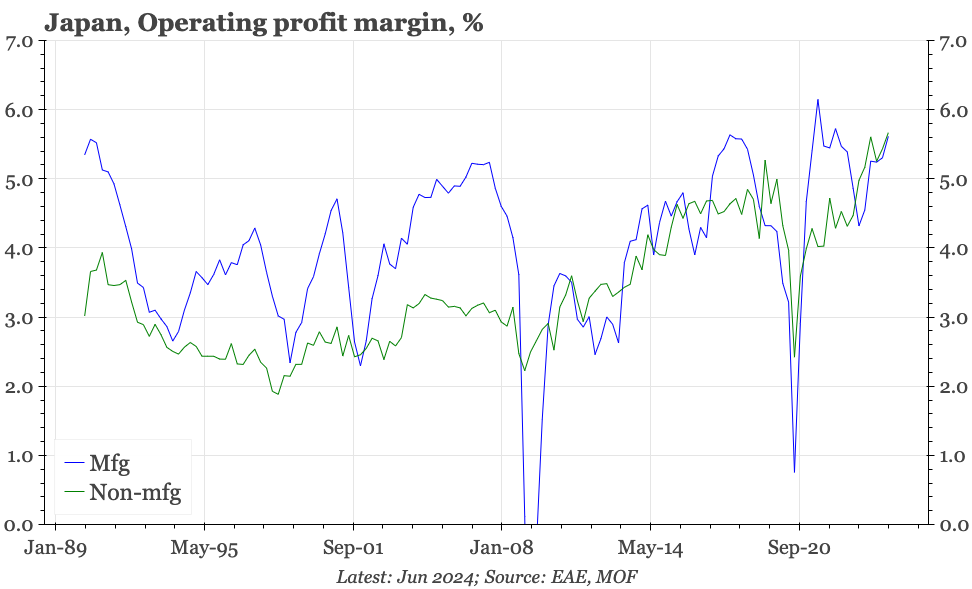

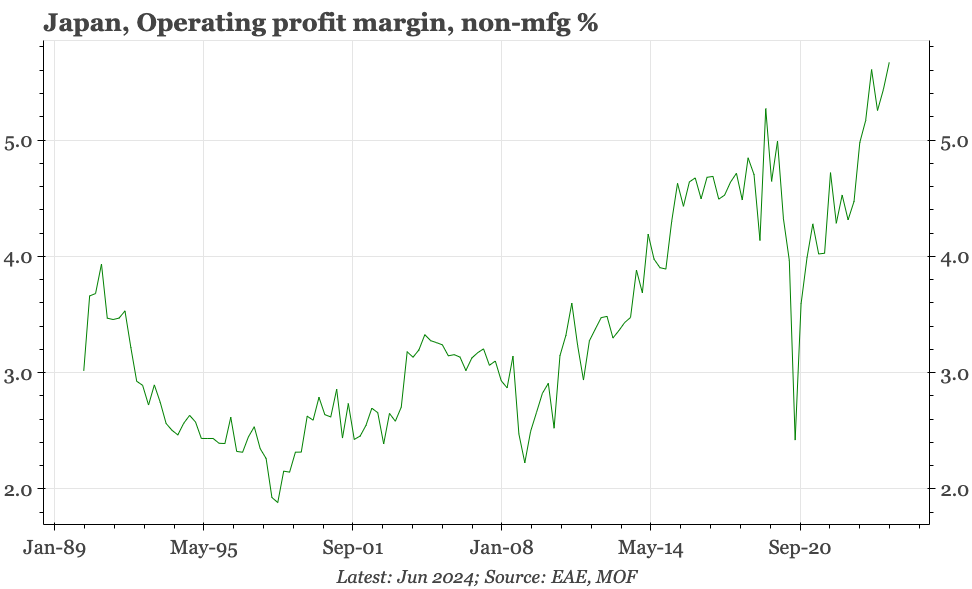

Rather than sales, the bigger driver remains cost control, which is boosting margins. Across industry, and in terms of both total profits and operating earnings, margins expanded in Q2. The trend is strongest in nonmanufacturing, where the secular rise since 2013 is continuing; average operating margins have now reached 5.7%, which is 1ppt higher than 2015-19, and almost double the rate before 2008.

Labour is no longer feeling the main brunt of the cost control efforts. For all firms, wage payments have ticked up as a proportion of revenue in the last 6M. Excluding holding companies – the BOJ's preferred approach – and the sharp decline in the labour share seen in 2H23 has stabilised.

Capex spending was flat in Q2. That isn't particularly bearish, given it follows a big rise at the end of 2023. It is also enough to mean cash holdings in the corporate sector didn't rise. But nor did they decline, and at 180% of GDP, remain very large.