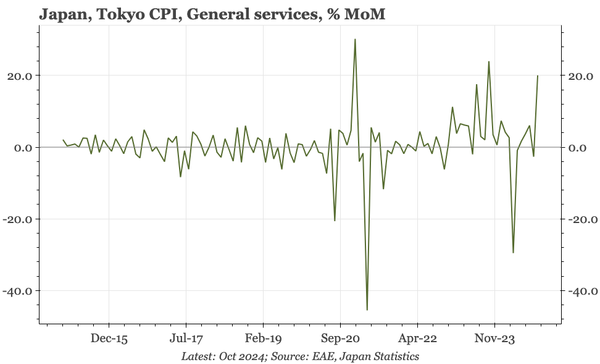

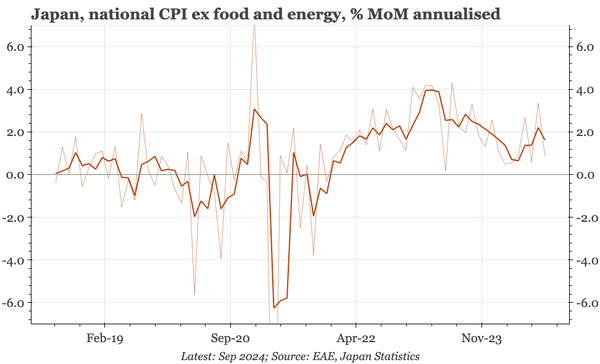

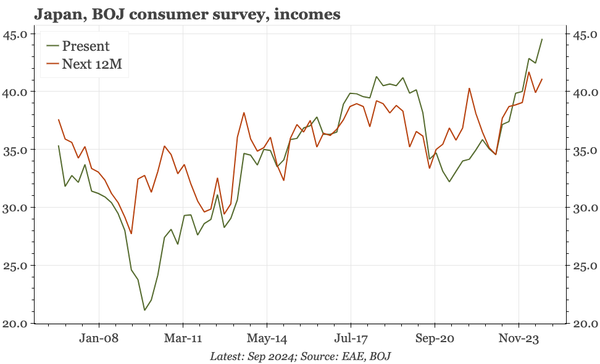

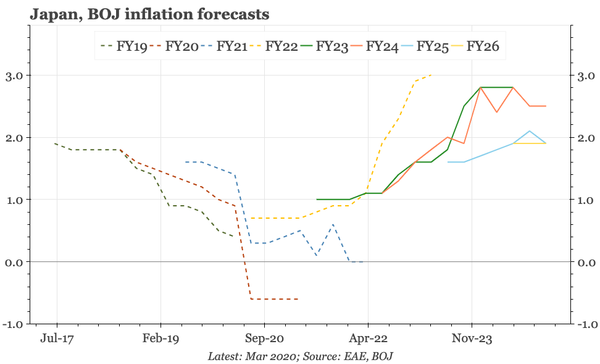

Japan – no surprises from the BOJ

No surprises from the BOJ (yet): the July forecast for underlying inflation to remain around 2% was maintained, as was the policy caution since August that stresses uncertainty in outlook for the US. There's still the press conference and full outlook report to come.