Japan – BOJ officials still leaning positive

The renewed tariff threat is a dominating issue for Japan. Yesterday's debate among leaders of the political parties didn't reveal any new strategy to head off the risk. But today's services PMI was firm, and in an interesting speech, board member Takata continued to sound cautiously constructive.

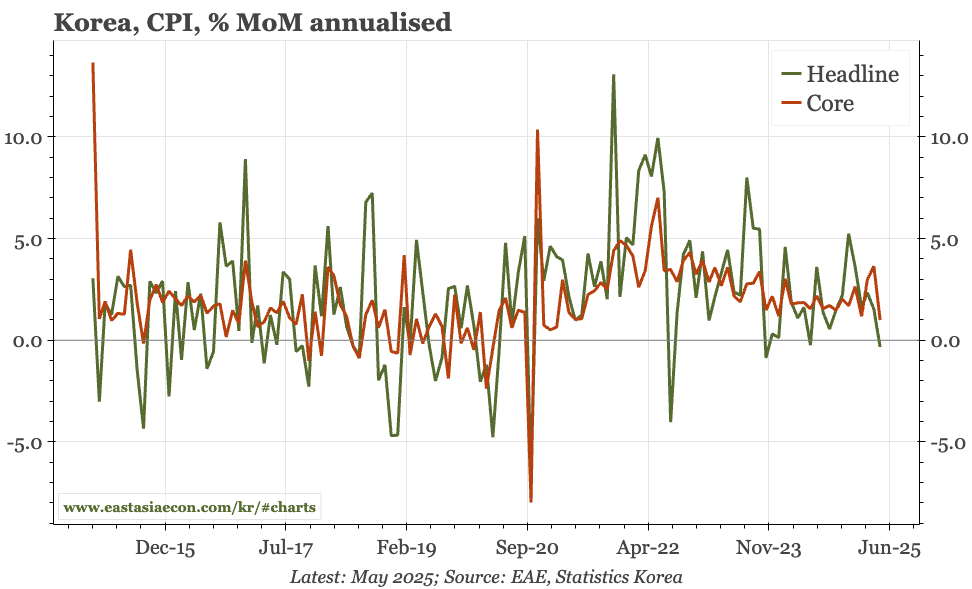

Korea – headline CPI ticks up, but should now fade

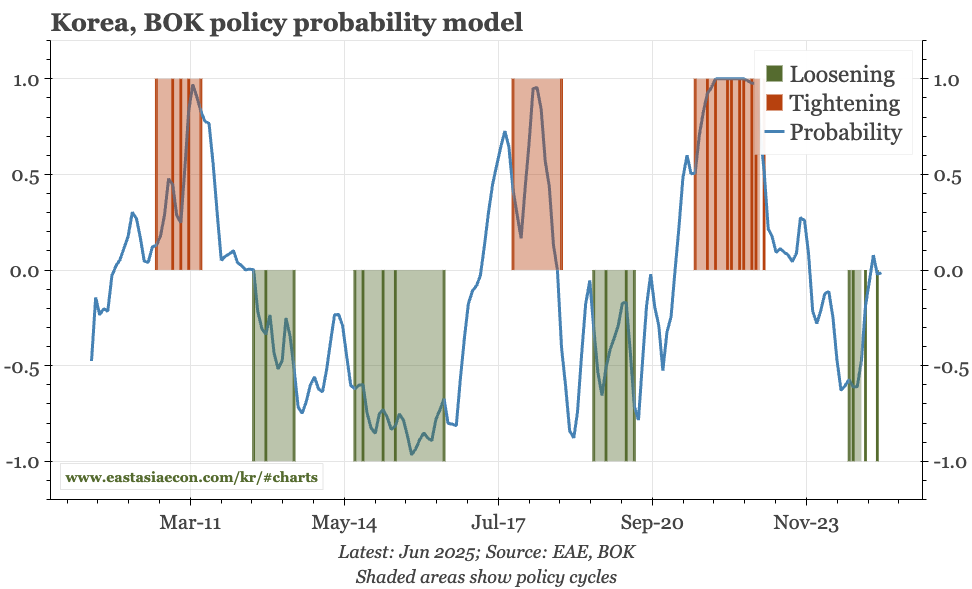

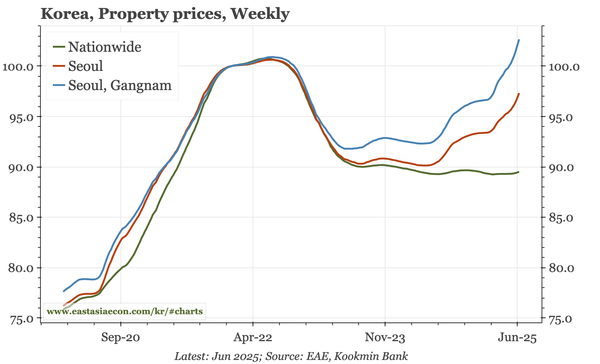

Leads suggest the mild rise in headline CPI in June should now fade. Core inflation is more stable, in part because services inflation remains on the high side. In next week's meeting, the BOK is unlikely to show much concern about that, with the focus instead being the rebound in property prices.

Japan – issues sharpen for the BOJ

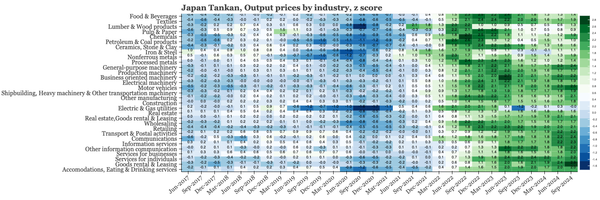

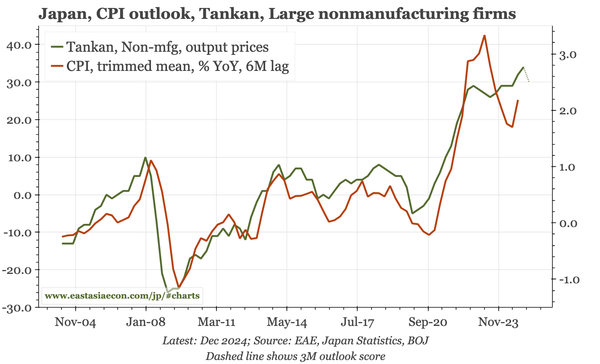

In terms of inflation, the details of the Tankan were stronger than yesterday's headlines. Output prices – a good lead for underlying CPI – rose to another new post-1980 high. However, President Trump, as had seemed likely, is now threatening Japan with yet higher tariffs.

Japan – helpful rebound in consumer confidence

In recent months, Japan has encountered two headwinds: higher tariffs which threaten exports, and rebounding inflation which reduces consumer purchasing power. Inflation expectations eased in June, allowing consumer confidence to rebound. That is helpful in offsetting the pain coming from tariffs.

Korea – finally, export perk up

Today's full-month June export statistics show exports finally breaking out of the range of recent months. I wouldn't think that will continue. It is all because of semi, big exporters like Samsung, Kia and Hyundai haven't benefited from the recent Kospi rally, and exporter sentiment remains weak.

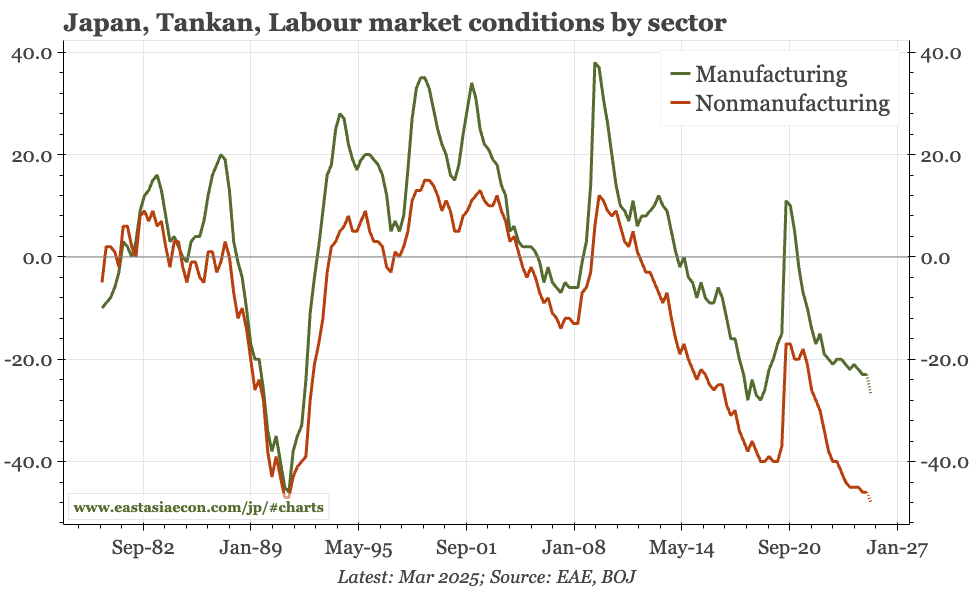

Japan – another solid Tankan

For reasons I have yet to understand, the BOJ's Tankan is published over two days, so we won't get the full picture until tomorrow. But first impressions from today's summary are quite strong, with business sentiment holding up, and only small deteriorations in prices and employment.

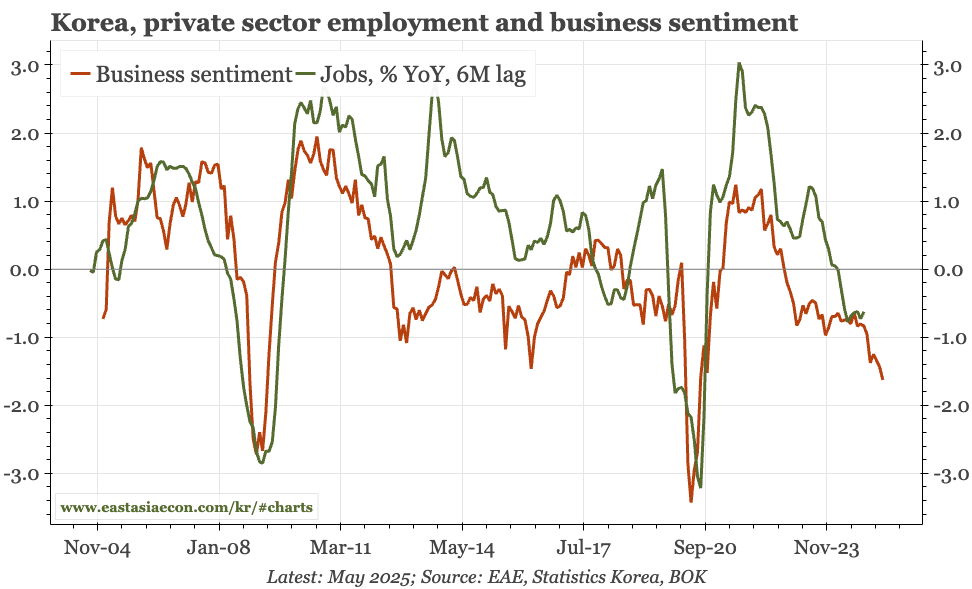

Korea – a change, even if it's not fundamental

Inflation is likely declining, the labour market continues to weaken, and business confidence remains poor. So the fundamentals are weak. But consumer confidence, the DRAM price, Kopsi and house prices have all rebounded. The latter changes the BOK outlook. Further rate cuts will take longer.

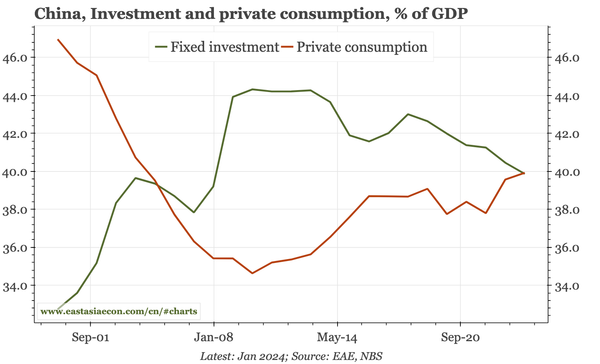

China – structure of GDP shifting, but slowly

Recent data show investment fell in 2024 to under 40% for the first time since 2008. On the flip side, consumption edged up, helped by a stabilisation of the savings ratio and a rise in welfare spending. But none of these changes are happening fast enough to boost the cycle.

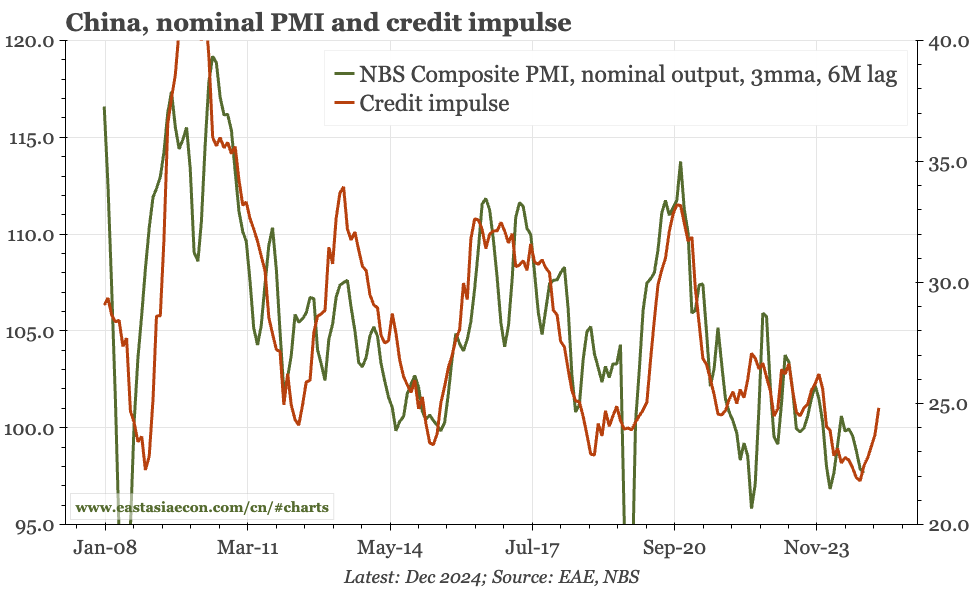

China – still looking like a soft floor

At a headline level, the industrial PMIs were better in June, but the details were weak, and there was no improvement in the services PMI. The rise in the credit impulse is taking away some of the downside risk for the cycle, but there aren't indications that the cycle is about to really improve.

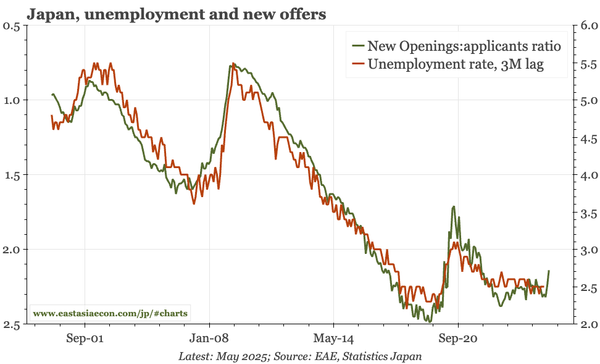

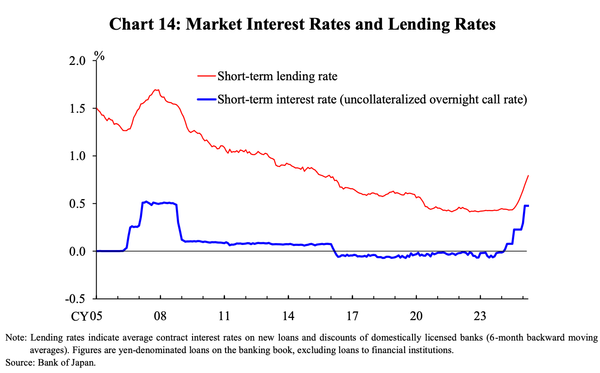

Japan – cycle review and BOJ scenarios

A review of the cycle, and three scenarios for the BOJ: 1) no more hikes; 2) hikes on the back of a firm nominal cycle, and 3) tightening because it is already too far behind the curve. My base case is 2, but the factors to watch are tariffs, the labour market, and the continued weakness of the JPY.

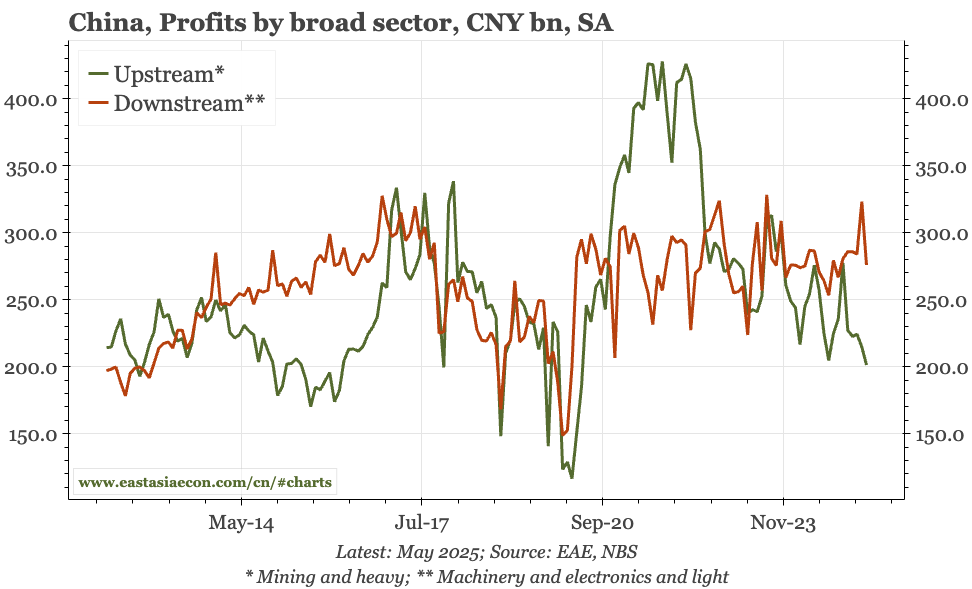

China – prices dragging down profits

Profits fell 9% YoY in May, and are now close to 5% of GDP, a level that's only been breached twice in the last 15 years. The driver is more demand- than supply-side, in the sense that the upstream profits, hit by the property downturn, are weakest. But even in machinery, profits aren't rising.

Japan – Tamura's case for further hikes

I'm just starting to catch up with things, and one of the first things I've made sure to look through is yesterday's speech by BOJ Monetary Policy Board member Naoki Tamura. He doesn't represent the majority view, but his speeches are well worth reading, and this one was no exception.

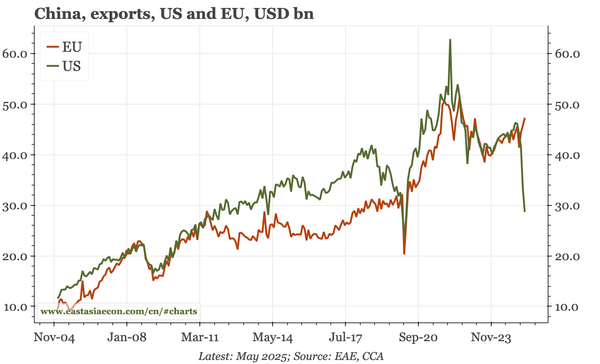

China – two unusual features of the export transition

Given regional history, China's transition to exporting more capital goods shouldn't be unexpected. More unusual is that 1) this transition hasn't been accompanied by slower overall export growth, and 2) has occurred at the same time as a sharp slowing of imports. Chart pack attached.

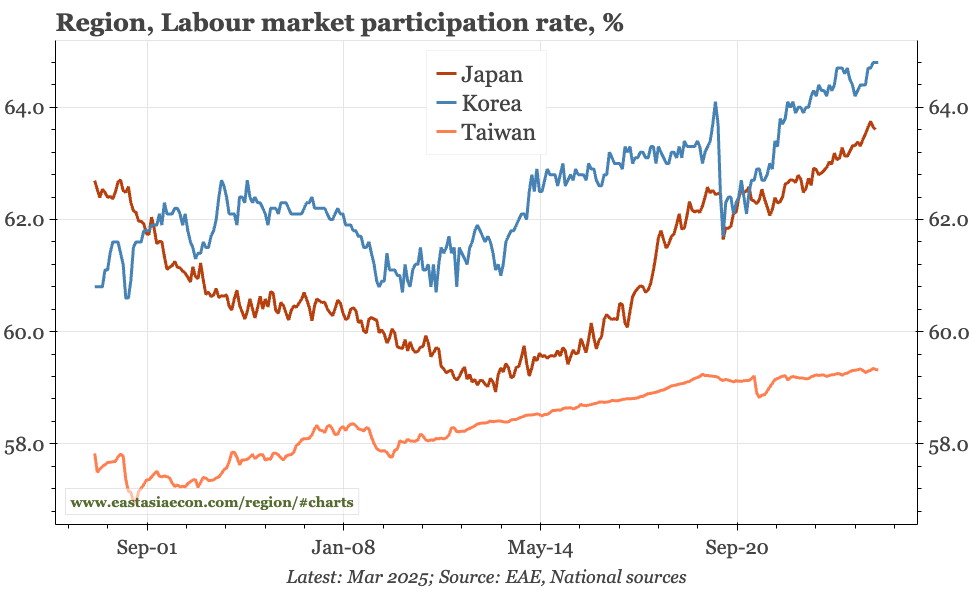

Korea – defying demographics

My latest video, discussing how Korea is managing to avoid the labour market decline that would usually be expected as the population ages. This is likely to dampen wages – and potentially inflation – in Korea relative to Taiwan, where the part rate isn't rising in the same way.

Japan – more subdued

Today's quarterly business outlook survey shows more incremental weakness in business sentiment, led by manufacturing. That's another sign that tariffs in particular have taken the edge of the cycle. However, there's not yet signs of real deterioration, which capex firm and employment still tight.

Korea – employment and exports still sluggish

Today's labour market data show unemployment low but private sector employment weak. Business confidence should improve after the election, but other data released today for trade in the first 10 days of June show overall exports remaining lacklustre, even as semi exports start to pick up again.

China – sharp drop in exports to the US continues

Overall trade trends – strong exports, weak imports, and a big trade surplus – remain in place. But the Trump tariffs are causing big shifts in the structure of exports. Direct shipments to the US have fallen 40% this year, and excluding the pandemic, haven't been this low since 2013.

China – PPI pulls inflation down further

CPI was surprisingly firm in May, with core continuing to show a reversal from the deflation of 2024. Overall, however, nominal indicators remain very weak. Leads for core have started to deteriorated again, and PPI deflation accelerated in May. The GDP deflator will be negative once again in Q2.

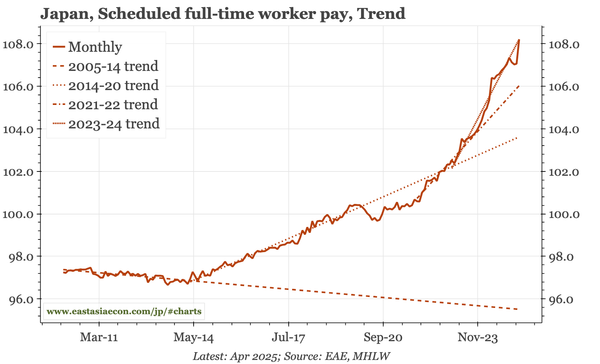

Japan – wages jump in April

With the bigger shunto rounds since 2023, wages have tended to jump early in the fiscal year. That was true this year, with full-time regular wages in April back to the faster post-2023 trend. However, part-time wages were flat, which will matter if confidence and the cycle don't rebound in 2H25.

Korea – core CPI lower in May

The important detail in today's CPI release for May was the drop in MoM core. Given the weakness of demand – now beginning to show up more clearly in the labour market – that moderation should persist. With global commodity prices weighing on headline, inflation should be less of an issue in 2H25.

Japan – Ueda upbeat

The tone of Ueda's speech today was rather constructive. Of course, he discussed the risks from tariffs, but didn't think they were likely to derail the economy. If some kind of Japan-US deal can be reached – and progress is reportedly being made – BOJ hikes will quickly be back on the table.