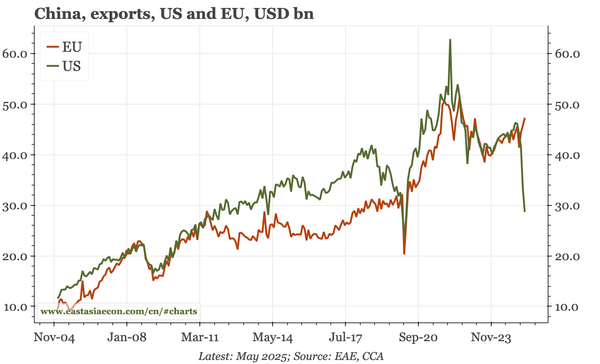

China – property prices weaker again

Property price deflation intensified in June, albeit only mildly. Leading indicators suggest there shouldn't be a new step-down, but only interest rates point to real upside – and interest rates stopped being a reliable lead for the property market some time ago.