China – is that it for the export pause?

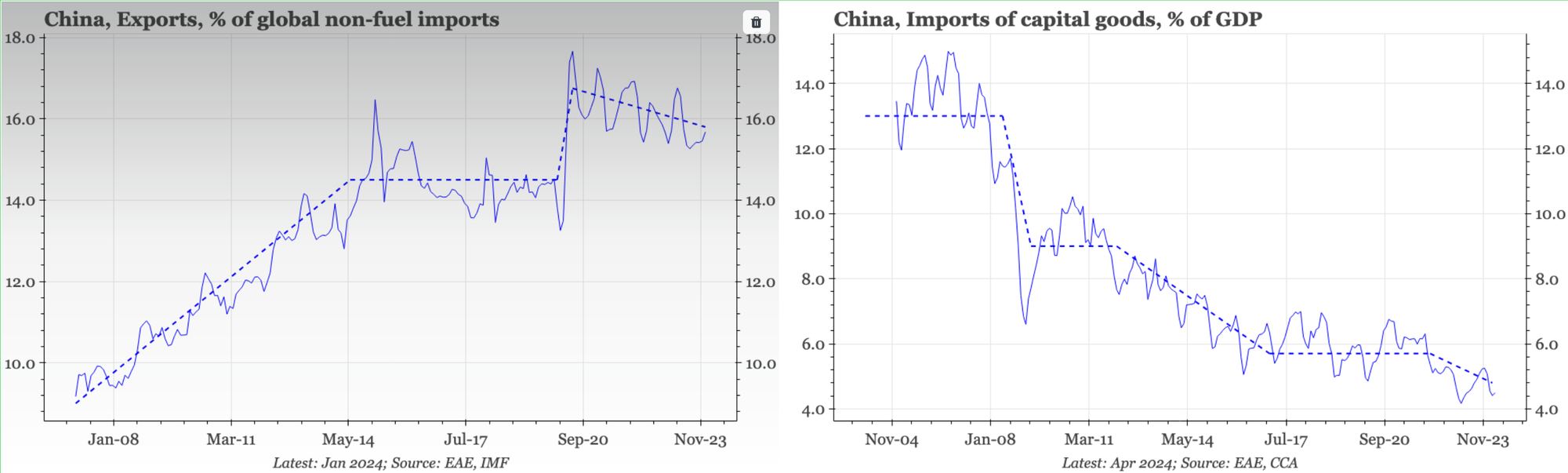

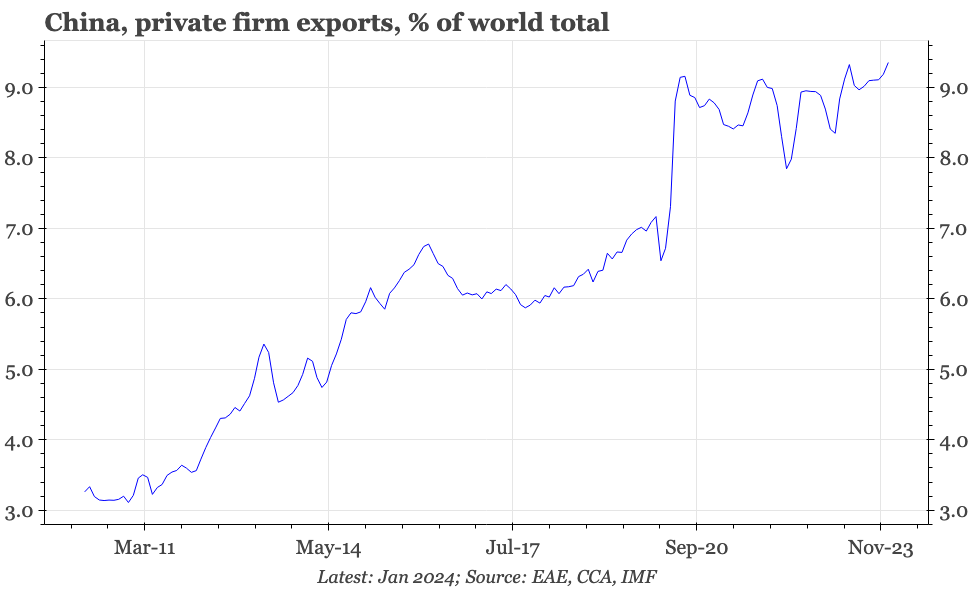

So far, the much-discussed rise in China's competitiveness has been most obvious in import substitution. With the export cycle now recovering, it is likely this year to also be seen in a renewed increase in China's global market share.

A cyclical pick-up in export, and probably a structural, one too

During 2023 we worked on a couple of pieces looking at China's manufacturing share grab. Since then, the idea of China as an unstoppable export juggernaut has become even more popular, powered by manufacturing upgrading, overcapacity, falling prices, and a US-EU led-push against rising Chinese imports.

In reality, export data in recent months haven't aligned so well with this narrative. China's global export market share has actually been softening; to the extent that prices have been cut, the changes haven't been out of line with trends in other economies; and export volumes of growth products like EVs have been rangebound.

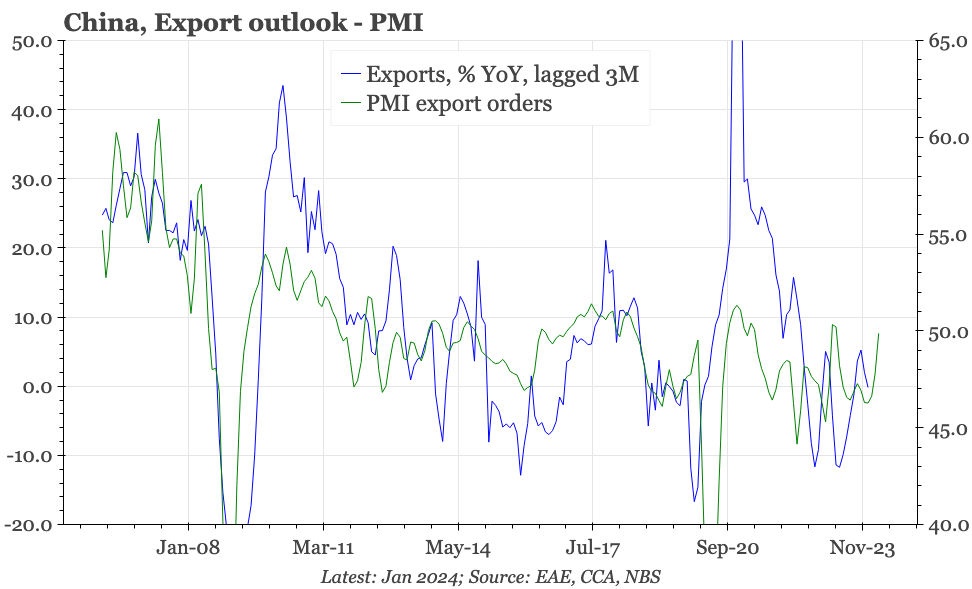

Some of this was always likely to be a pause, and through April, there are signs that export momentum might be picking up again. That is because of the global cycle, but in China's case, probably also because the structural resetting after the pandemic-era surge has now been completed.

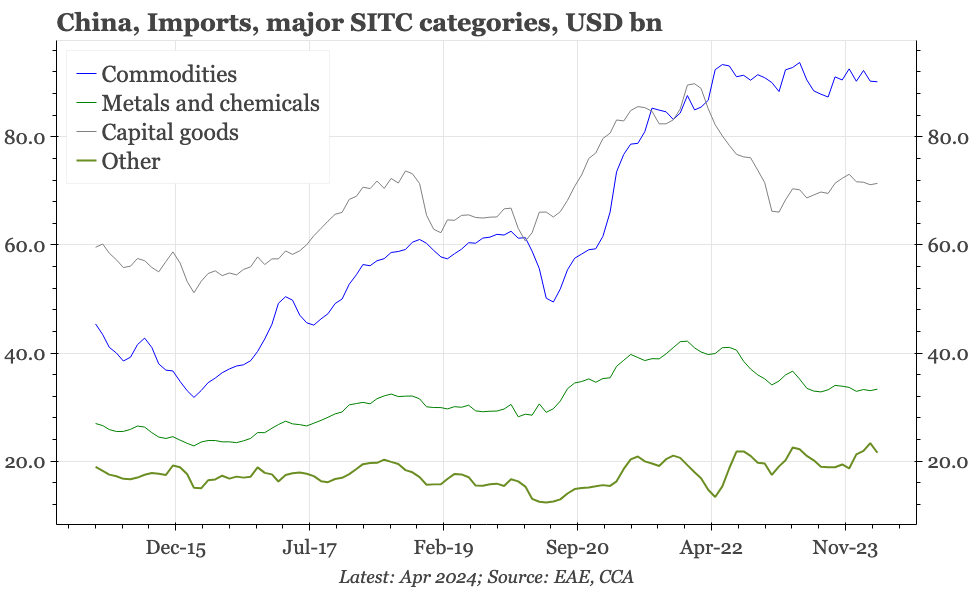

At the same time, while recent export data haven't quite fitted with the theme of China grabbing manufacturing share, import data have. Despite the strength in domestic manufacturing capex, and the signs of an upturn in export demand, capital goods import penetration has continued to fall.

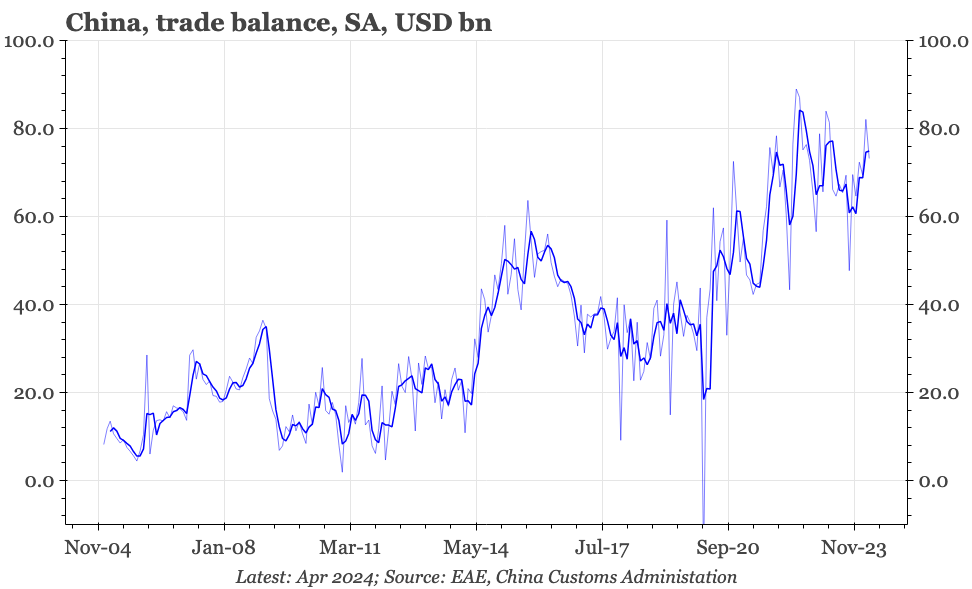

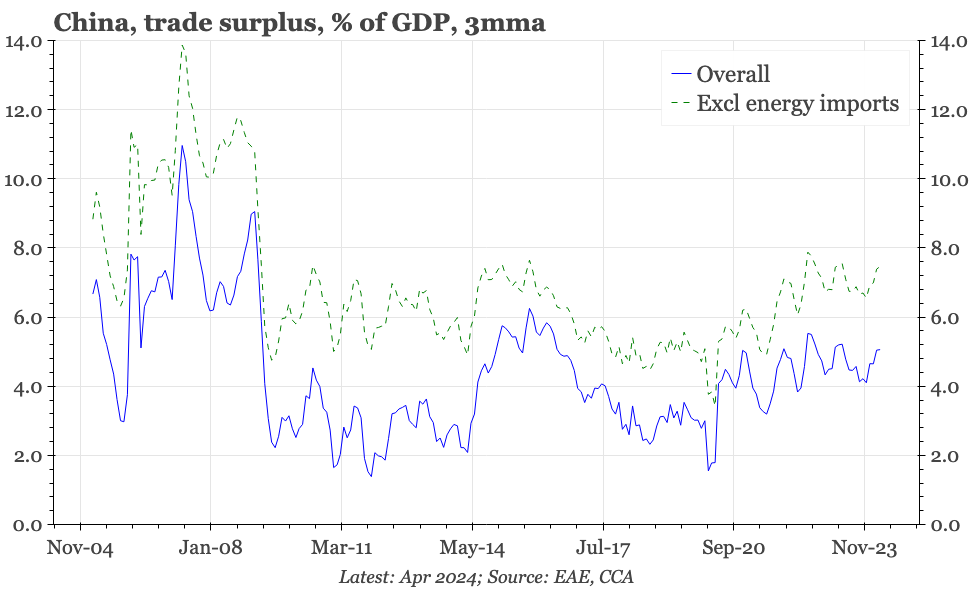

A re-acceleration of exports is helpful for China's cycle. But particularly if imports continue to flat-line, then it also means a further rise in global trade tensions. That's particularly because the starting point for a rise in exports is a trade surplus that is already large.

One change that could defuse some of these tensions would be CNY appreciation. That clearly isn't on the cards right now, with stronger capital outflows in April. Depreciation pressure won't fade while China has such low inflation and fx markets are trading nominal rate differentials. If those things change, however, then China's global competitiveness should mean a stronger currency.

Exports

Contrary to the tone of much of the popular discussion, China's global export market share has been edging down. This softening was perhaps inevitable after the big run-up during covid. The subsequent weakening of the global export cycle also likely didn't help. That cycle though is now improving once again: China's trade data show that exports bottomed in Q323, with the pick-up continuing through April this year. Given exports were largely missing as an engine of growth in 2023, this rise will be helpful for China's cycle.

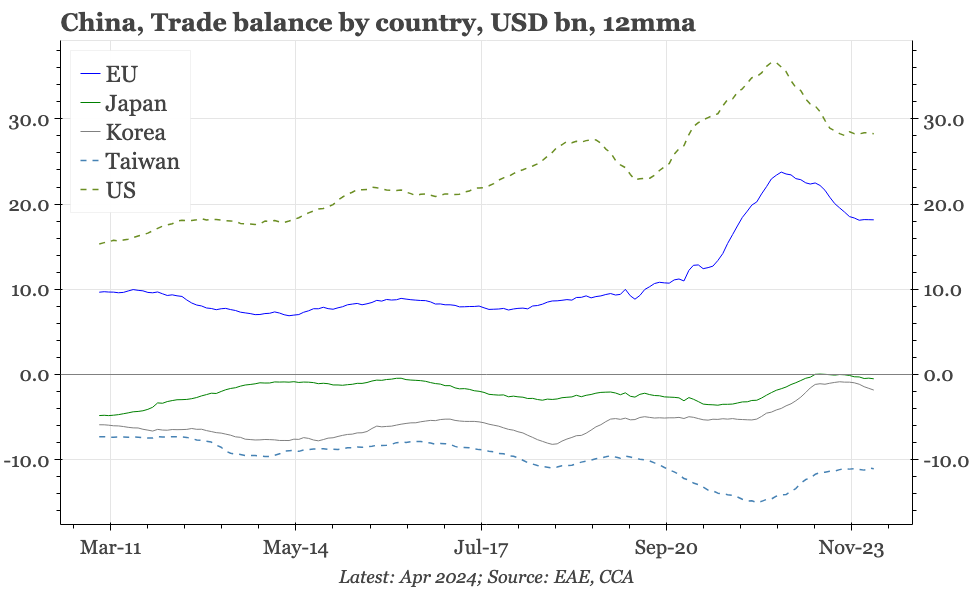

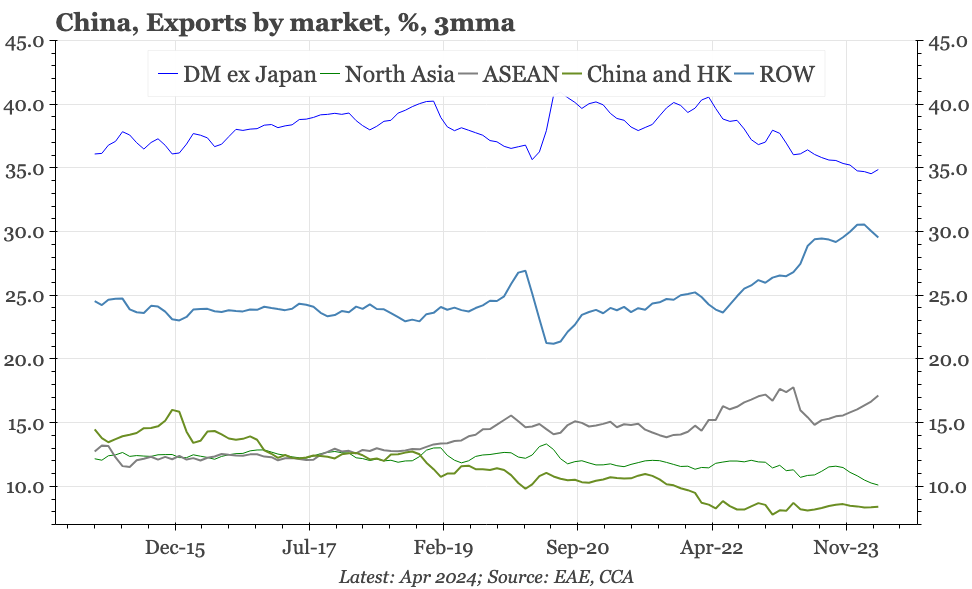

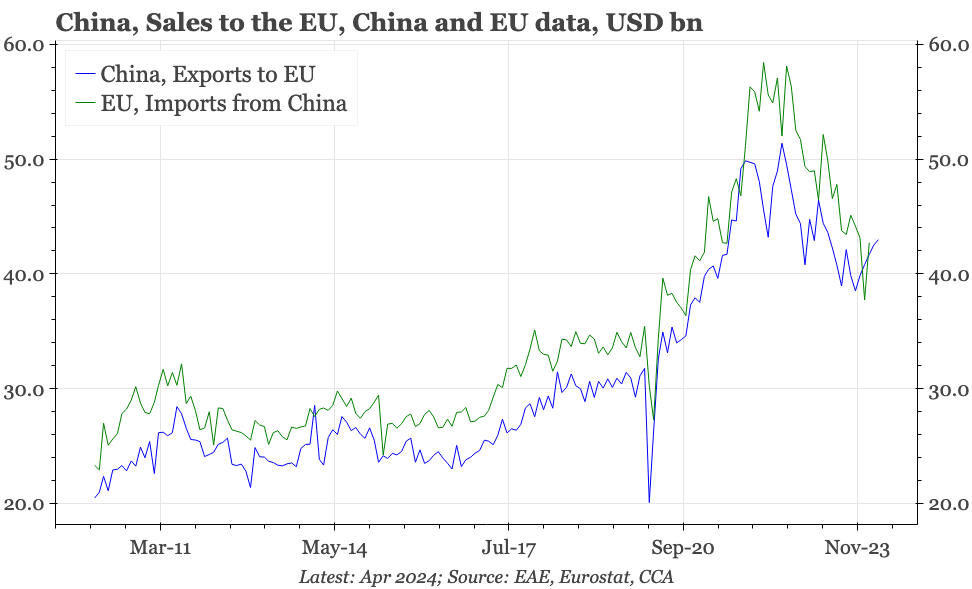

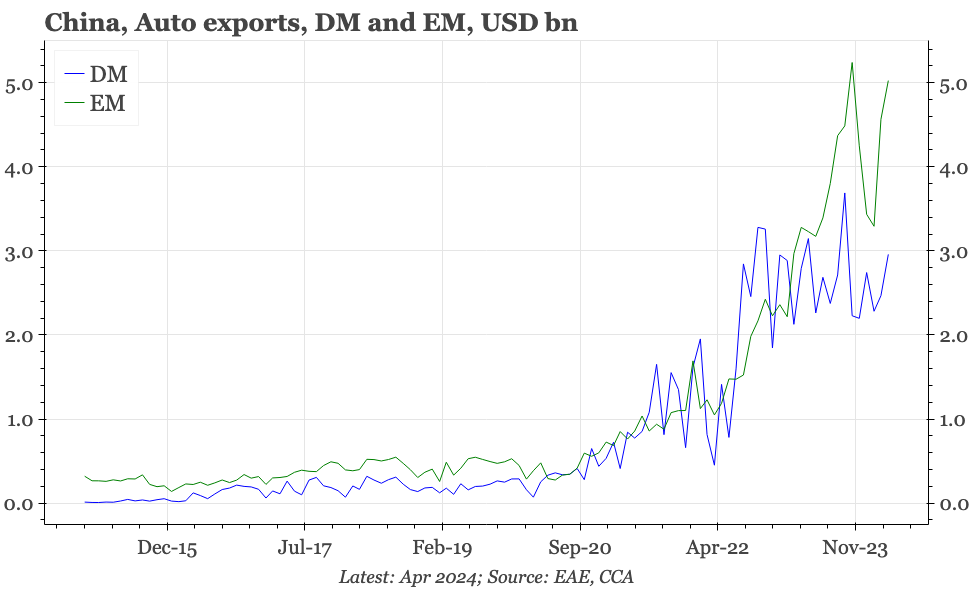

Geographically, this rise is being led by rising sales to EM. However, while the share of China's overall exports going to DM has been falling, it is China's trade with the EU that suggests the recent downturn in its global share might be bottoming out. Some of China's pandemic-era gains in Europe were particularly big, and the data are hinting that the subsequent reset has now been completed.

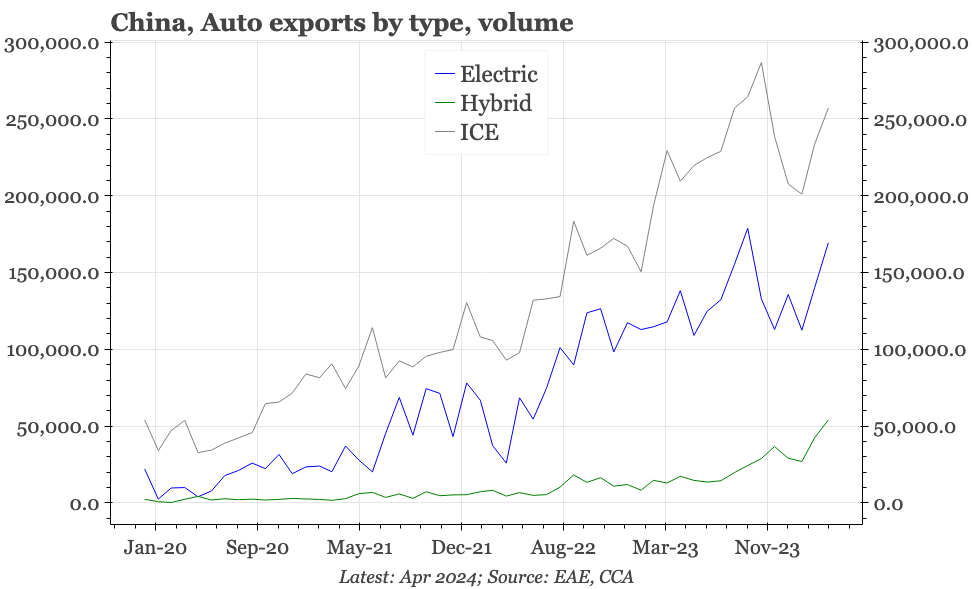

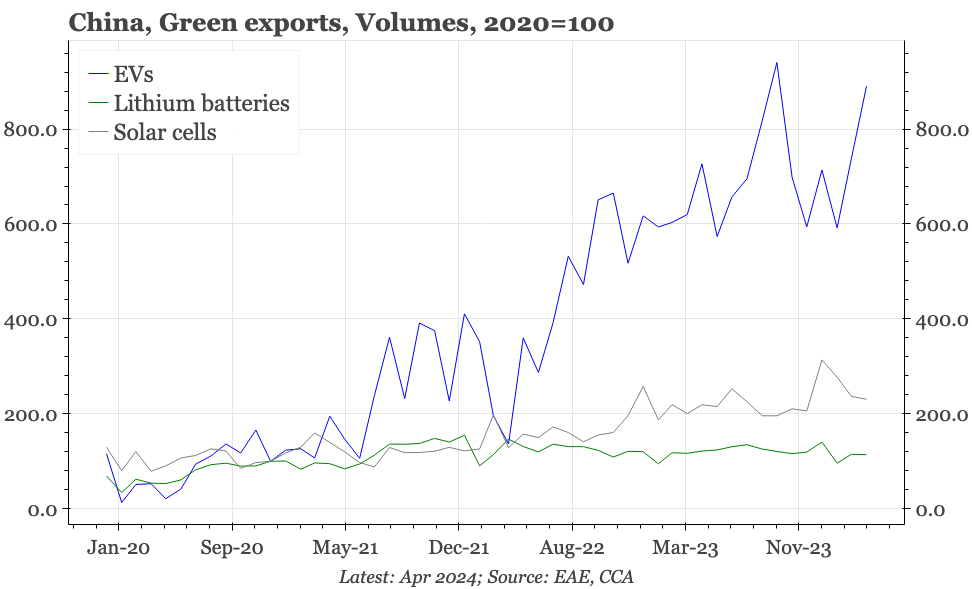

While the headlines seem to suggest it is all about EVs, the actual data show that China's gains in Europe have been broad-based. For EVs in particular, China's exports to the EU – and indeed to the world – rose quickly in 2022, but have, in fact, been going sideways since. The April data suggest that perhaps another increase might now in the offing, though in autos the biggest recent lift has been in shipments of hybrids.

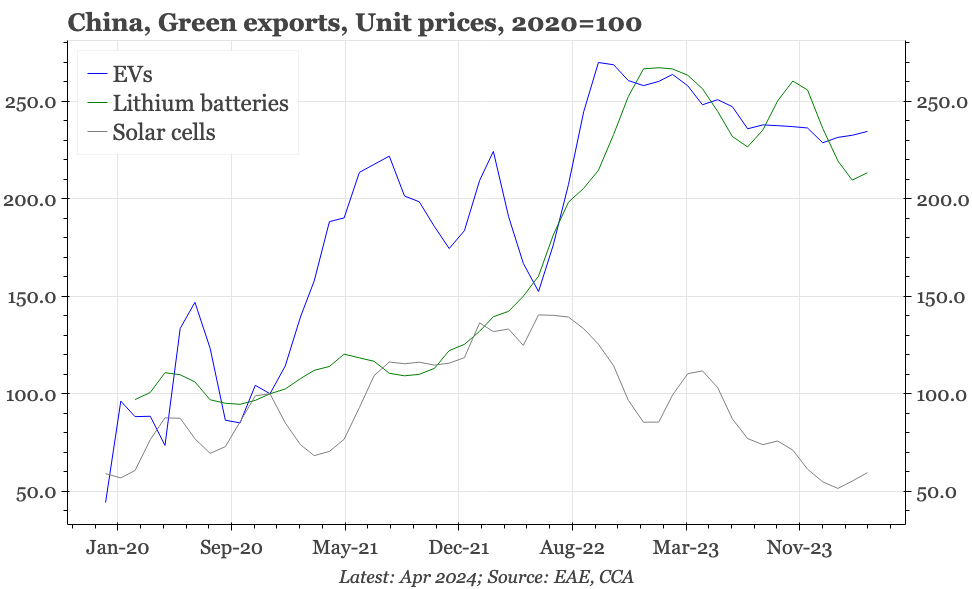

Hybrid prices have come down a bit, but overall, unit prices for auto exports don't yet fit the narrative of over-capacity feeding into falling prices (though, of course, while Chinese firms aren't cutting prices, they could still be entering markets with vehicles cheaper than those already available). Nor, yet, do lithium batteries. The one standout product where prices are obviously falling is solar panels, the last of China's so-called New Three export categories.

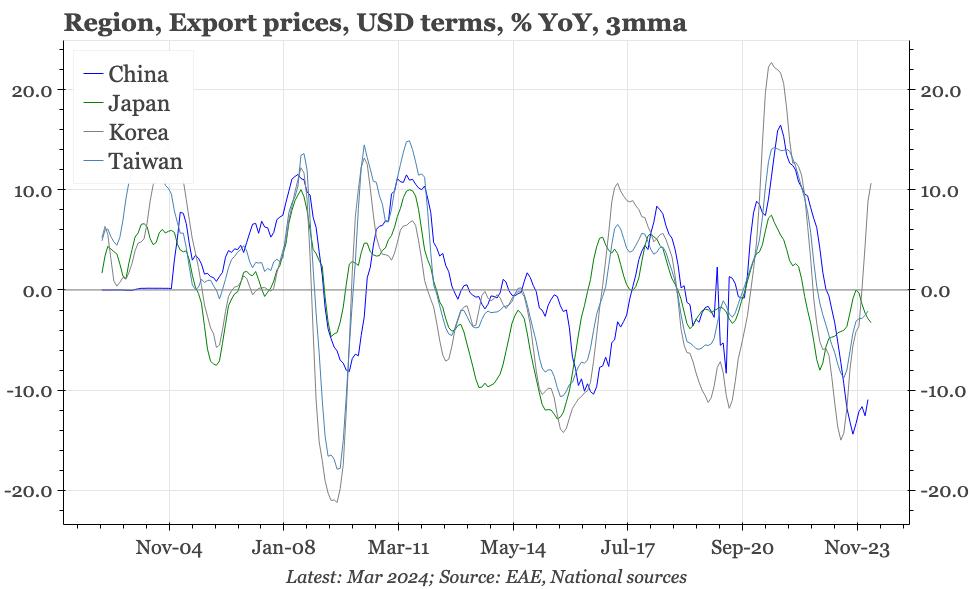

Aggregate price indices for China's April trade haven't yet been released. Data through March did show overall prices falling. However, as with trade overall, that followed a big run-up during covid and, so also likewise, some subsequent moderation doesn't seem unreasonable; the falls aren't out-of-whack with trends in the rest of the region; and the rate of decline has been easing, which again is in line with the direction of travel shown in data for neighbouring economies.

Imports

In comparison with exports, import trends have been more stable. At an overall level, imports fell after the pandemic surge, but haven't recovered with the recent pick-up in exports, being pretty much flat since September last year.

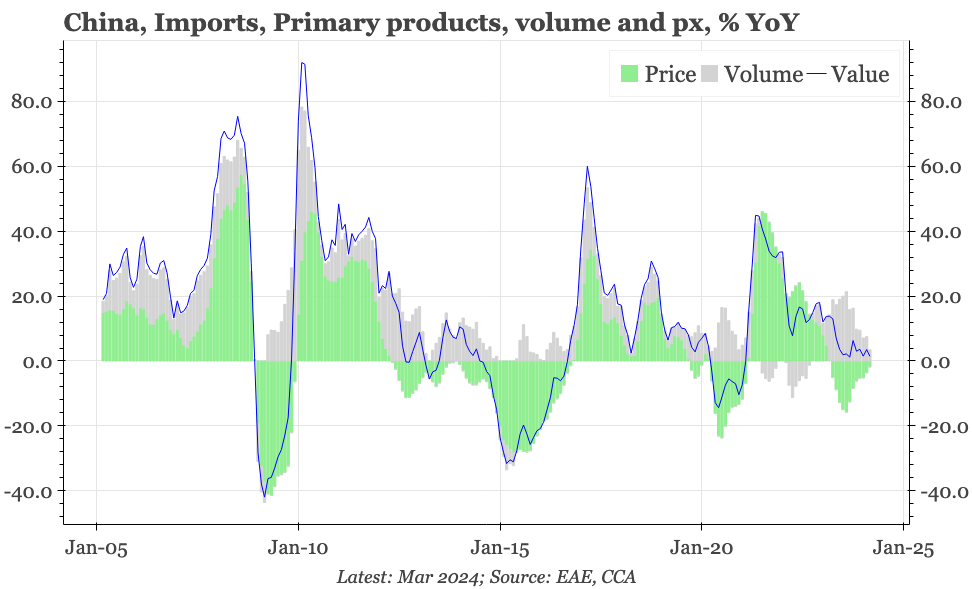

Given the sharp fall in real estate market activity, it perhaps isn't surprising that imports are also soft. But it isn't so obvious in the data that it is the drop in property construction that is depressing imports. Buying of commodities has actually held up near the record high recorded in 2022, and that isn't even because of prices, which have been falling.

The more obvious source of weakness in imports is in capital goods. Historically, that would have made sense when exports were weak and so there was less demand for imported components. But the export cycle is now improving, and anyway, government data show domestic manufacturing capex demand has been strong. All else equal, that should create greater demand for imports of equipment.

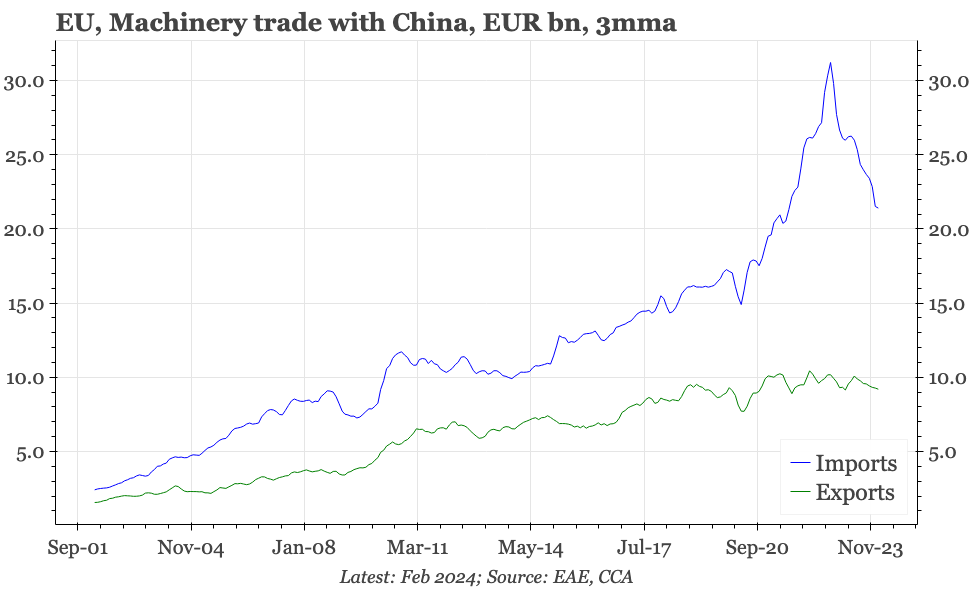

That import demand is nonetheless lacklustre reflects in part import substitution. The only major category of capital goods for which imports are rising is semiconductors, which in turn is the one significant manufacturing sector where China's domestic capabilities obviously lag those of the rest of the world.

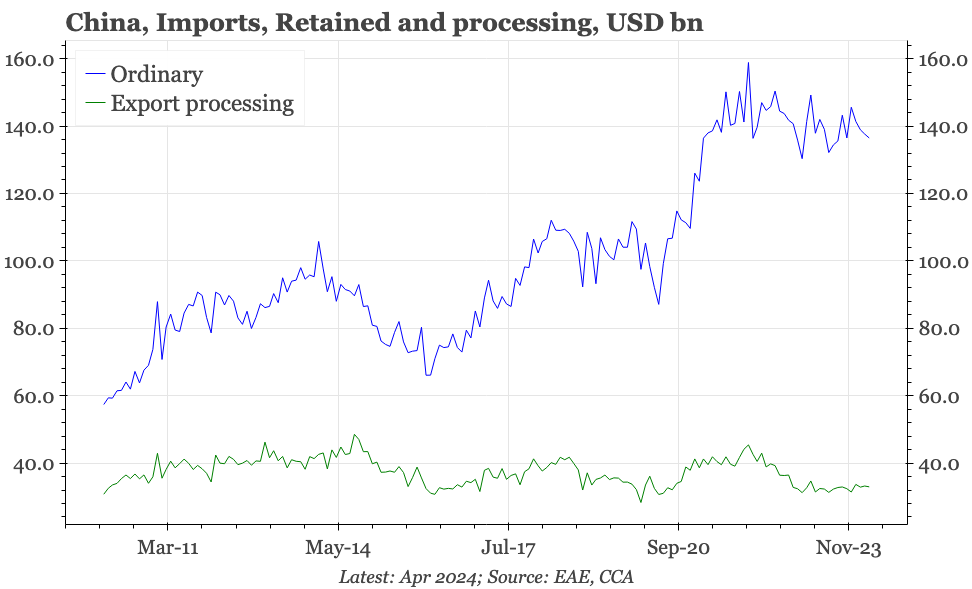

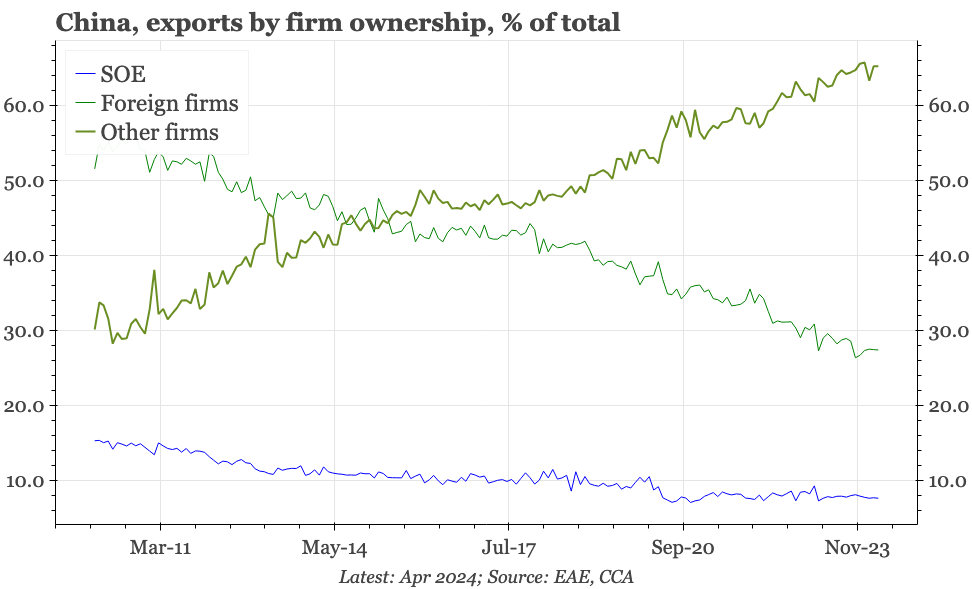

The weakness of imports is likely also being driven by supply-chain restructuring, with China's data showing a clear fall in the share of exports produced by foreign firms. This change breaks the previous inbuilt inclination to import from overseas parent companies and suppliers. To be clear, that isn't a new phenomenon: the foreign share peaked long before Trump was elected. It might also be a trend that is good for China's productivity, with the falling foreign share of exports being filled not by Chinese state firms but rather by private companies.

Balance

It should be no surprise that this pattern of trade – exports rising while imports don't – is showing up in a clear re-widening of the trade surplus. For now, that remains below the monthly high of a most USD90bn in mid-2022, but if there is no pick-up in import demand, then that record will soon be broken.

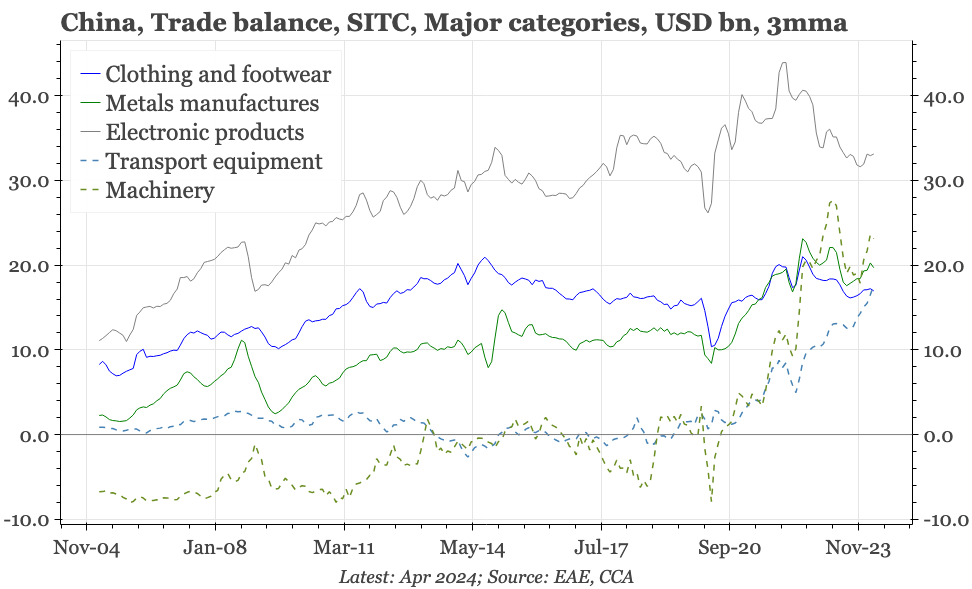

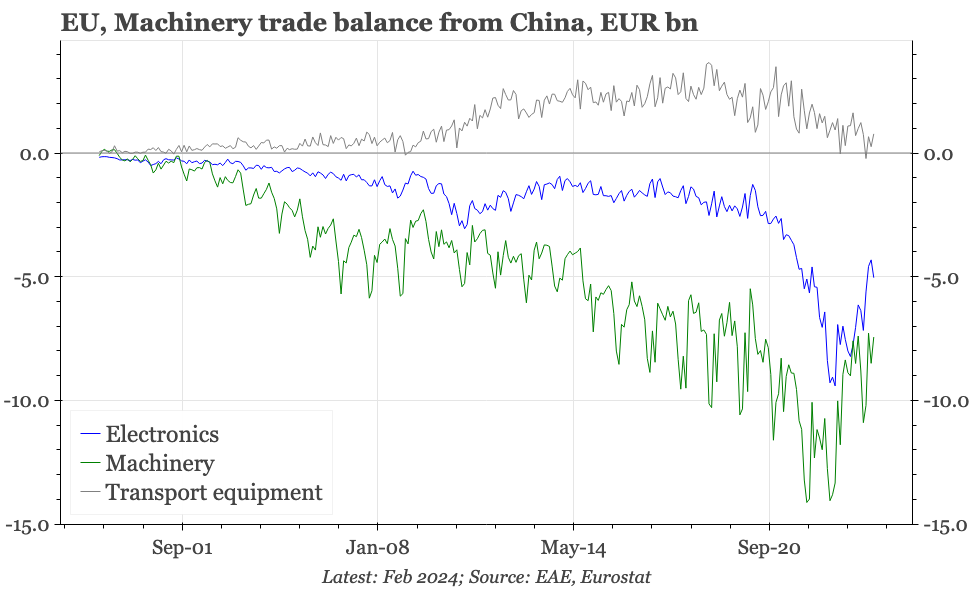

As of now, the surplus is running at around 5% of GDP, and that is unlikely to grow to the double-digit gap that was usual before the global financial crisis. But China these days is a much bigger economy. Moreover, whereas fifteen years ago and most of the surplus came from electronics, metals and clothing, now it has broadened to include machinery and transport equipment. In this way, China is more clearly competing with DM companies, so the protectionism.