China – three post-tariff themes

Yesterday's tariffs are close to a worse case scenario for China, and are a big negative shock when the cycle is already weak. Three things strike me as important in what happens next, both for China's economy, and for its global influence: consumption, imports, and the currency.

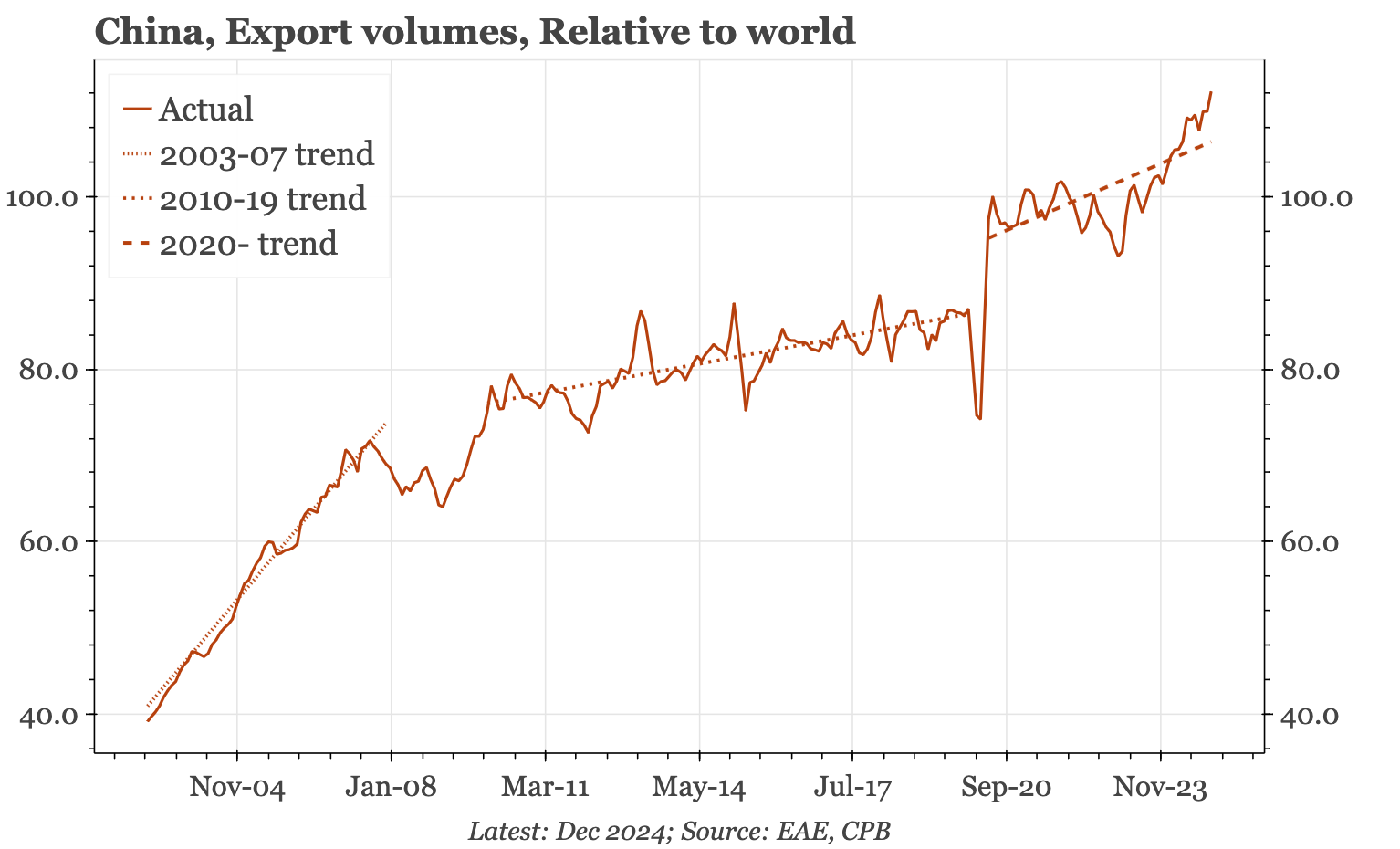

The US tariffs aren’t quite a worse case scenario for China, but they are close. The final blow would be other countries imposing tariffs on China, either to try to get their own US tariffs reduced, or to stop a flood of extra imports as trade is diverted from the US. While China’s economy has shown signs of stabilising in recent months, there has been no pick-up. That's despite surging export volumes. The cycle is weak and poorly placed to withstand this latest shock.

In thinking about this huge shift in both the global economy and geopolitics, three things strike me as important for China. Central to all of those, of course, is what the government will do to offset the hugely negative impact of the tariffs. These economic policies will, in turn, have consequences for China's ability to grow its own soft power to fill the gap as the US seems to throw its own away.

Consumption

I've argued before that China's post-covid slowdown isn't because of weaker household spending: if properly measured, that it is back to the pre-pandemic trend. But that isn't sufficient for overall growth when property market activity has collapsed, a development that has left overall growth weaker, and, by blocking an important avenue for the mobilisation of consumer savings, has also contributed to deflation.

In recent months, government rhetoric around consumption has shifted, but that won't amount to much until it is backed up with fiscal resources to boost welfare spending. It isn't impossible that this will be forthcoming. Many observers have argued that the reason such policies haven't appeared yet is because of Beijing's premonition that extra stimulus would be needed when Trump started to unleash his agenda. I haven't been convinced about that. However, now will be the test of this belief, and it is important that the domestic backdrop has been local economists trying to come up with politically palatable ways for China to support consumption.

Imports

Just as remarkable as the strength of China's exports in recent months has been the weakness of imports. In the run-up to the pandemic, it was common to see commentary arguing China was in line to become the biggest importer in the world (and, in the process, run a current account deficit). But since 2021 that trend rise in imports has come to a sudden stop.

That sharp reversal reflects the same industrial strengths that are boosting China's exports, and will thus be difficult to reverse. But it is also clearly the result of weak domestic demand. Unlike the US, China in recent years has been reducing tariff barriers and signing up to more free trade deals. Observers have already noted how some of the other Trump policies– like the shutting of USAid – have the potential to be a boon to China's own soft power. If Beijing can now find an effective way to boost domestic demand, then the US tariffs might have a silver lining for China too.

Currency

Investors commonly think CNY depreciation is a negative development for China, and PBC efforts this year to prop up the currency suggest the government thinks the same way. I am not so convinced, but in any case, if the tariffs continue to prompt selling of USD assets, China could run into another problem: too much currency strength.

That the CNY could be a beneficiary of an exodus from the USD isn't so far-fetched: if external balances rather than interest rate differentials become the theme in fx markets, then there would be plenty of perceived support for China's currency. But when there is already domestic deflation, this wouldn't be a helpful development for China's cycle. There is a precedent for this: the rapid appreciation of the JPY in the early 1990s that deepened Japan's deflationary. This risk, obviously, makes an effective stimulus of domestic demand even more important.