China – what if property is for speculation (part 2)?

My base case - that the economy won't turnaround without fiscal – isn't especially differentiated. But the reports of stronger real estate sales in the holiday highlight a risk case: that the equity rally mobilises household savings and boosts price expectations, lifting the economy without fiscal.

Readers will be forgiven for thinking that I keep asking questions, when it is answers that are much more important. So, to be clear, my base case if that the events of the last week do not mark a turning point for the economy. The reason is there hasn't been a breakthrough in either fiscal or property policy. Such shifts might yet occur, but today's NDRC press conference doesn't give me confidence that they will.

That all said, stressing the importance of fiscal is hardly an uncommon approach. And while I still think that to turn the economy around any policy package does need to include significant new public spending, developments over the holiday have got me thinking more about one of the risk cases: that the stockmarket frenzy mobilises household savings, thereby lifting economic activity and money velocity, and so also boosting inflation and nominal growth.

In this, it isn't the rise in share prices that has caught my eye. That is important, but in itself will reflect the PBC's financing for the equity market rather than necessarily indicating a broader change in risk appetite. Instead, it is the reports of much stronger property sales over the holiday period. These reports stand out for at least two reasons: a turnaround in property would show a wider recovery in price expectations, and would also matter more directly for the economy.

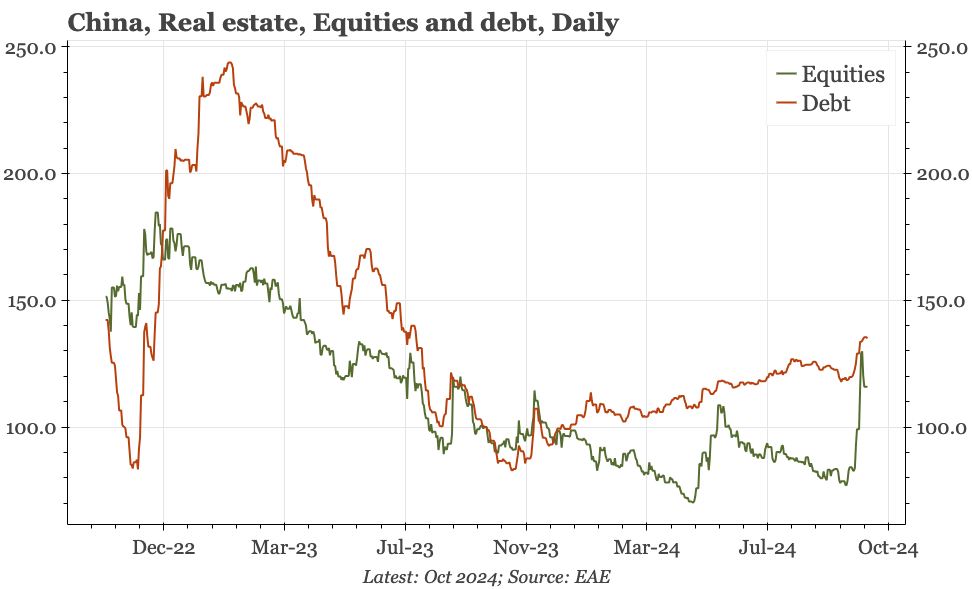

The reports are local, anecdotal and tentative, and the fallback in listed property debt today doesn't encourage the idea that a fundamental shift is occurring. But that there is any turn in real estate sales is still notable, suggesting that the speculative motive – the famed animal spirits, if you like – might not be as dead as I had been imagining. If that catches hold and property sales start to recover, it would open the possibility to a broader economic recovery occurring, even if fiscal follow-through remains under-whelming.

More than a year ago I wrote a piece asking 'What if "property is for speculation" after all?'. The idea was that short of saying "flipping property is patriotic", the government had done just everything else it could do to persuade buyers back into the market: even by mid-2023, most of the local-level macro prudential measures had been abandoned, mortgage rates were at record lows, and hukou restrictions were fast disappearing. And yet, real estate activity was dropping. As far as I could see, the only thing left in the toolbox was for Xi Jinping to go on CCTV and announce he was changing in mind, that property wasn't for living, but was still for speculation after all.

I concluded at the time that actively U-turning on Xi's signature property guideline was unimaginable. The reasoning was partly practical. China's top leaders seem even less likely than politicians in the rest of the world to admit a mistake. It also felt that the government in general had invested too much political capital in its property control measures to throw them all out of the window. The stimulus measures announced over the last couple of weeks seem consistent with that assumption, given they didn't include anything substantive to improve financing conditions for property developers. That's even though it was the imposition of the three red lines on the supply side, rather than anything to discourage demand, that really kicked off the property market collapse.

Apart from these practical considerations, my reasoning a year ago was also that even such a change wouldn't actually work:

Xi's words obviously carry quite the sway these days. But the record of the last few years would seem to offer ample proof that the Xi administration really has no tolerance for property. So, even if the impossible did happen and Xi's rhetoric shifted, why would anyone believe he meant it?

I highlight this because of the huge change in risk appetite seen during the last couple of weeks. That change has been seen most clearly in equities, and in a sense, that isn't surprising. While there hasn't been much change in property policy the last couple of weeks, the PBC's equity financing scheme did mark a big departure from the government's previous way of doing things. Even if the overall economic environment doesn't shift, there is a specific reason equities can rise.

However, there have also been signs that this recovery in risk appetite is spreading into property, with bottom-up reports over the holiday of real estate agents and projects seeing much stronger foot-traffic and sales. One property agency reportedly said that "new home transactions at its outlets in Shenzhen city surged 979% on year" during the holiday.

To be sure, the evidence is anecdotal, and the signs of change tentative. Real estate sales are so depressed that even really spectacular increases aren't in themselves sufficient to signal that there really is recovery. In a sign that the lift is far from secure, the decent bounce in listed property debt seen through yesterday in Hong Kong has today lost momentum today.

Still, that there has been any rise in real estate buying still feels noteworthy. While the PBC's pre-holiday package did include more support for property buyers, the changes were incremental, and officials added nothing new either to support developers or to address excess inventories. That seemed light, given that the collapse in activity since 2021 seemed to have broken something structural, in particular the previously widely shared assumption that property prices could only ever rise. It was in this context that I'd thought something different, like the proclamation that "speculation is good", was needed.

The government hasn't done that, but the pick-up in property sales hints that the equity market support might have had the same impact. Again, the evidence for such a turnaround is very tentative, and my base case would be that it doesn't continue. But if I am wrong and the stockmarket-focused measures of the last couple of weeks have been sufficient to achieve the Politburo's pledge of "stopping the fall in the property market", it would suggest that price expectations haven't been as thoroughly killed as I'd assumed. And given the importance of property in the economy, a recovery in real estate sales would open the way for a lift in overall nominal growth, even if the government doesn't follow through with fiscal.