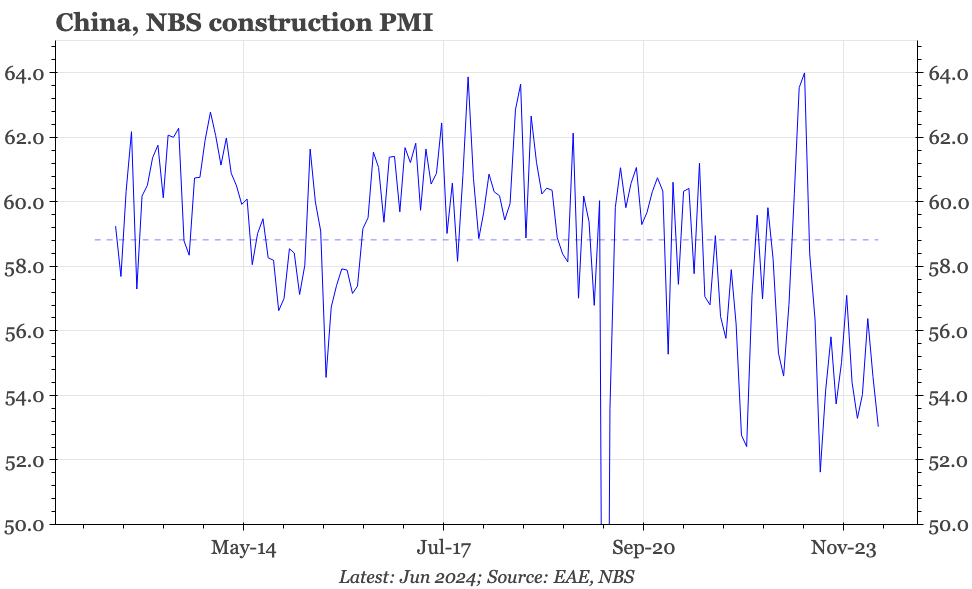

China – construction PMI drops again

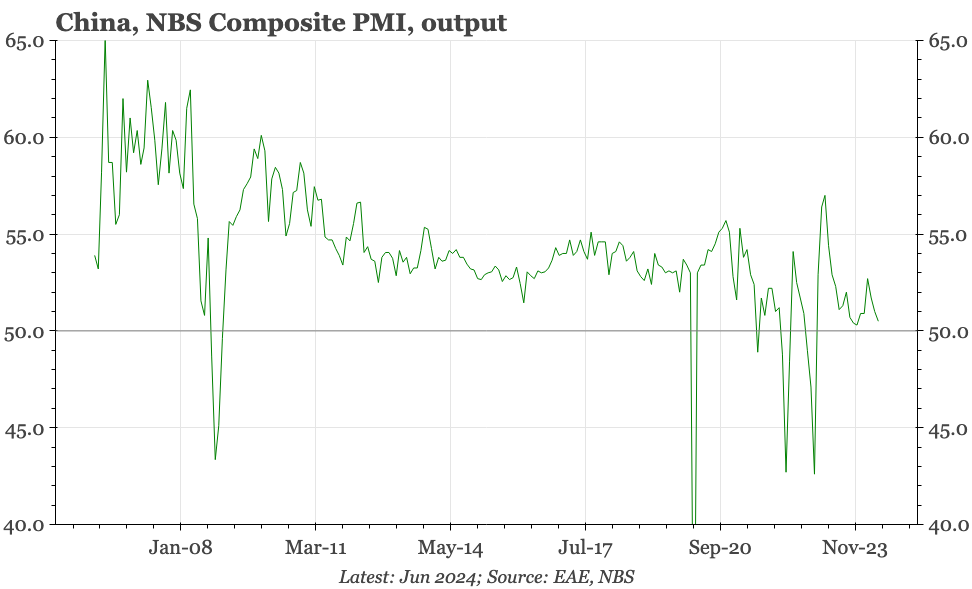

The official PMIs for June show China's cycle remains weak, weighed down by construction. There is unlikely to be a recovery until the property cycle stabilises.

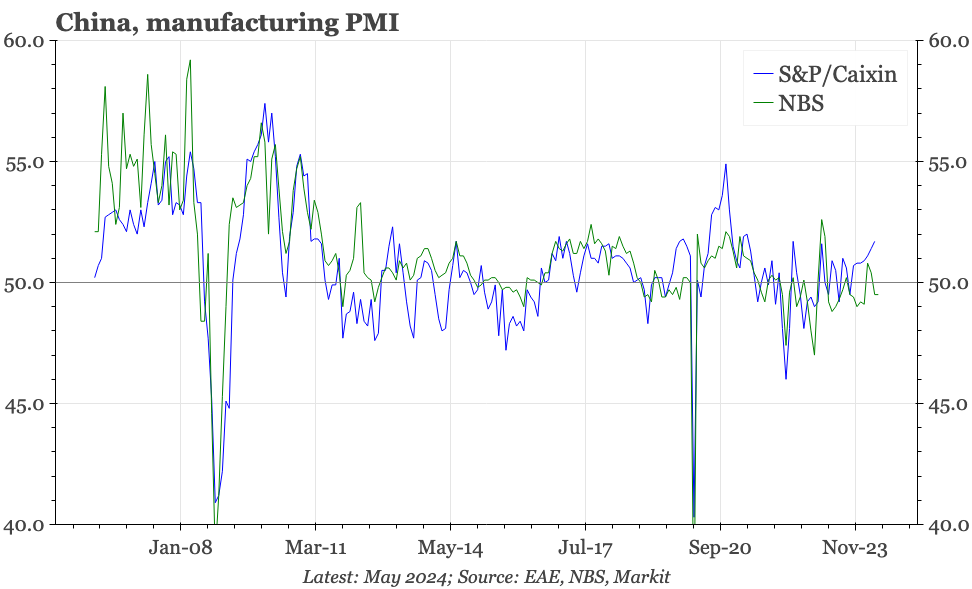

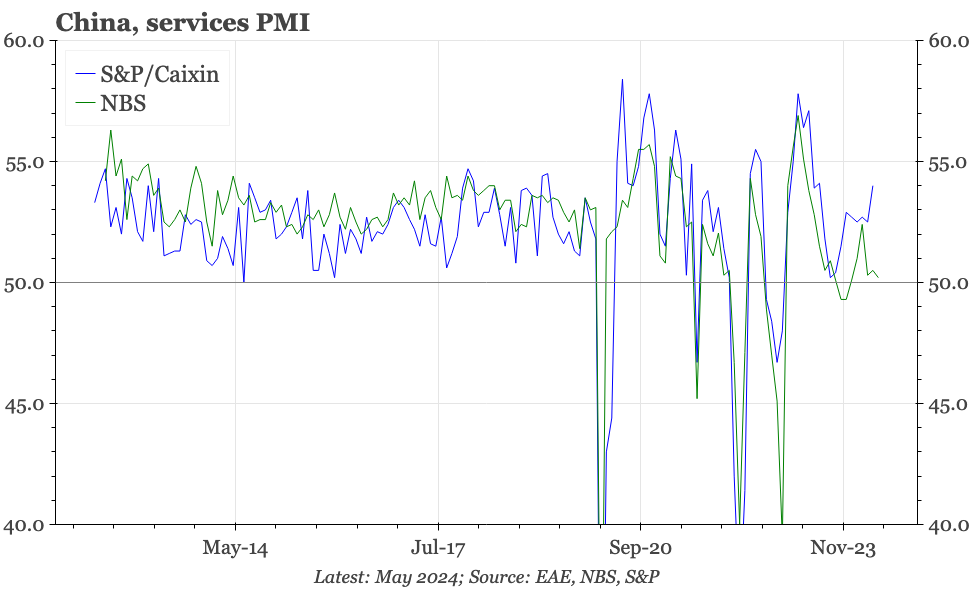

The official PMIs were either unchanged or weaker in June, and so continue to point to a cycle that is at least soft, and perhaps slowing further. The manufacturing PMI in June was 49.5, the same as May, but still below 50. The construction PMI fell to 52.3, the lowest in almost a year, and well below the long-term average for the series of 54. The services PMI dropped from 50.5 to 50.2.

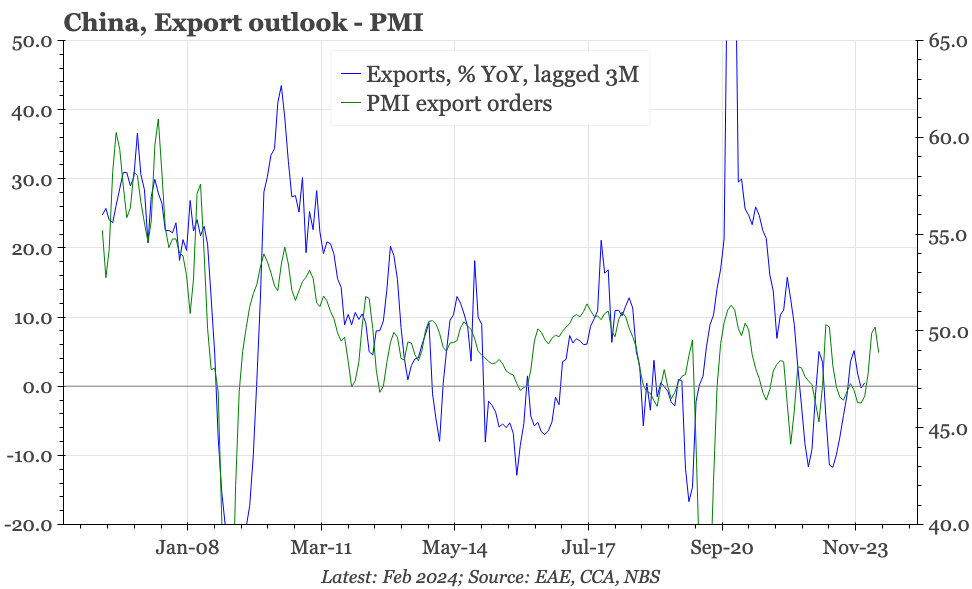

It is often thought that the official manufacturing PMI is more weighted to developments in the state sector than the S&P Global/Caixin version. But the only element of the PMI that has moved in recent months is export orders, which was stronger in March and April, but dropped in May to 48.3, a level that was unchanged in June. These ups and downs in exports mirror the moves in the headline PMI. That is surprising if the official PMI is more focused on developments in the state sector, because private and foreign firms account for 90% of China's exports.

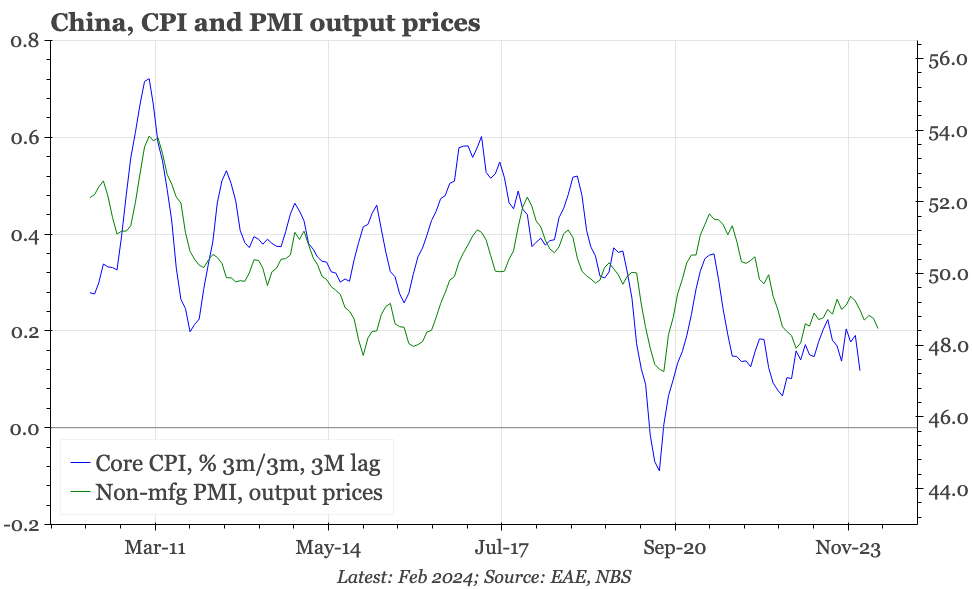

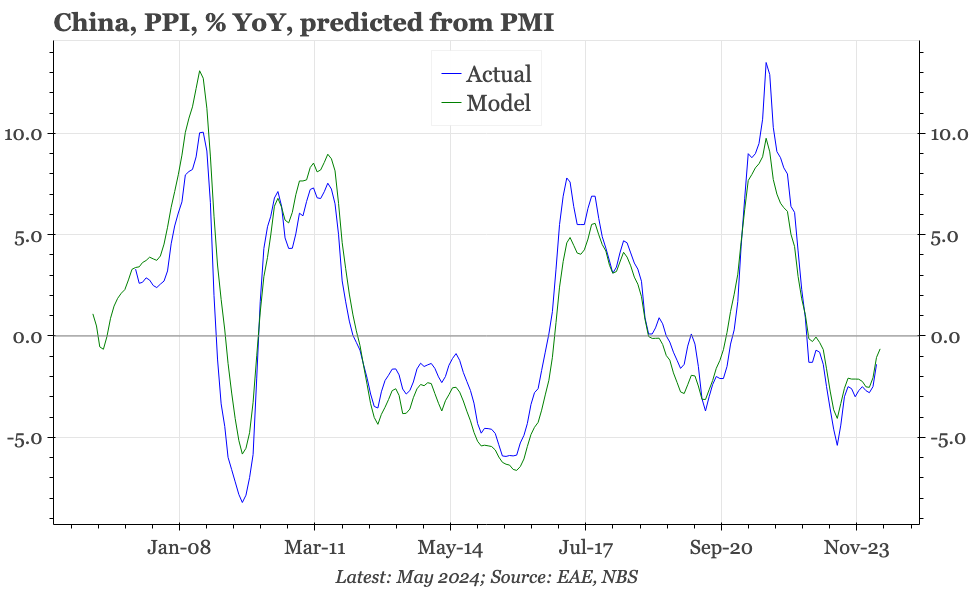

The only modestly bullish sign in the PMI is that the recovery in input prices since April, a development also seen in other price indicators, continues to point to a firming of headline PPI. However, this isn't a game changer for nominal growth. Input prices have stabilised, but in MoM terms aren't rising; indeed, input prices in today's PMI fell back to only a little above 50. The likely further move up in PPI on a YoY basis is more because of base effect.

That the overall manufacturing cycle remains soft isn't unexpected given the weakness in construction. The construction PMI is noisy from month to month, but in only four other months has it been weaker than it was in June. That is clearly capturing the problems in the real estate sector, and is an illustration that without stabilisation and recovery of the property market, the overall economy isn't likely to start looking a lot stronger.

China's cycle is then clearly weak. But there is a counterpoint to the weakness shown in the official PMIs: the strength of the Caixin PMIs. That is true in both services and manufacturing. We still haven't come across a convincing explanation for the gap. However, it probably does at least show that some sectors of the economy are continuing to do quite well. That relative strength isn't enough to offset property weakness and lift overall growth, but as long as the diversity in macro indicators persists, it will remain likely that the overall economy is muddling through rather than slowing sharply.