China – property weakness still key

The PBC's Q1 depositor surveys show that it is less consumption sentiment per se that is weak than consumer price and property expectations. In this context, the news that the Politburo is studying ways to reduce property inventories is potentially significant for the macrocycle this year.

Q1 PBC sentiment surveys

When almost nine months passed without the PBC publishing its quarterly corporate, business and banker surveys, it looked like we'd lost a useful way of monitoring the economy. But the PBC suddenly published the missing surveys for both the third and fourth quarters of 2023 at the end of March, and has now followed up earlier this week by releasing the surveys for Q124. Who says China economics only brings only bad news these days?

Looking through the surveys, the big takeaway for me is how much they fit with the concept of the "new normal". This idea was introduced by Xi Jinping in May 2014 as a way of conveying that while China's long period of (very) rapid growth was ending, an economy expanding at a more moderate rate wasn't a change that was either abnormal or to be feared.

The PBC's surveys, in a way, suggest that in the ten years since, this new normal is precisely what has happened. Across the consumer, corporate and banking sectors, sentiment is running at a much lower level than it was before 2014. But, while there is clearly a cycle – and unlike the PMIs, the PBC surveys suggest China is once again on the slowing part of the cycle – the underlying level of confidence isn't continuing to drop further.

Weak inflation expectations

Perhaps inevitably, the details of the surveys aren't entirely consistent with that broad takeaway. In the corporate sector, profitability has been soft since 2022, though companies report that revenue growth is currently quite strong. Banks indicate loan demand in manufacturing being well up from the lows of 2015.

The bigger challenge to the idea of the new normal is in developments in the household sector. For example, while household sentiment about future employment is rather stable, confidence about the current state of the jobs market continues to drop. In terms of incomes, it is current sentiment that looks more stable. The structural decline in confidence in the future, by contrast, looks to be continuing to slow.

At least as far as incomes are concerned, this continued deterioration is consistent with changes in the overall rate of nominal GDP growth. With wages accounting for around 50% of GDP, consumers can't expect higher incomes as long as the overall rate of nominal growth continues to slow. And the depositor survey doesn't suggest this macro trend is about to reverse, because inflation expectations are continuing to drop. That fall is true for overall prices, but is particularly pronounced for real estate, with property price expectations dropping in Q1 to yet another record low.

Strong saving preference

So, at the margin at least, consumer sentiment is soft. For now, that doesn't seem to be dragging down consumer spending. The PBC survey reported that around a quarter of respondents said they planned to increase consumption over the next three months. That isn't low when viewed against the history of the survey. If that sounds at odds with the weakness of retail sales, that's partly because of the ongoing shift away from spending in goods towards services, a trend that is also visible in the survey results.

However, while the survey suggests consumption might be holding up better than some of the more commonly followed indicators might suggest, the softness of consumer sentiment does still matter for the economy. This is because there clearly is bearishness towards property, and that is continuing to rob the economy of what was an important engine of growth.

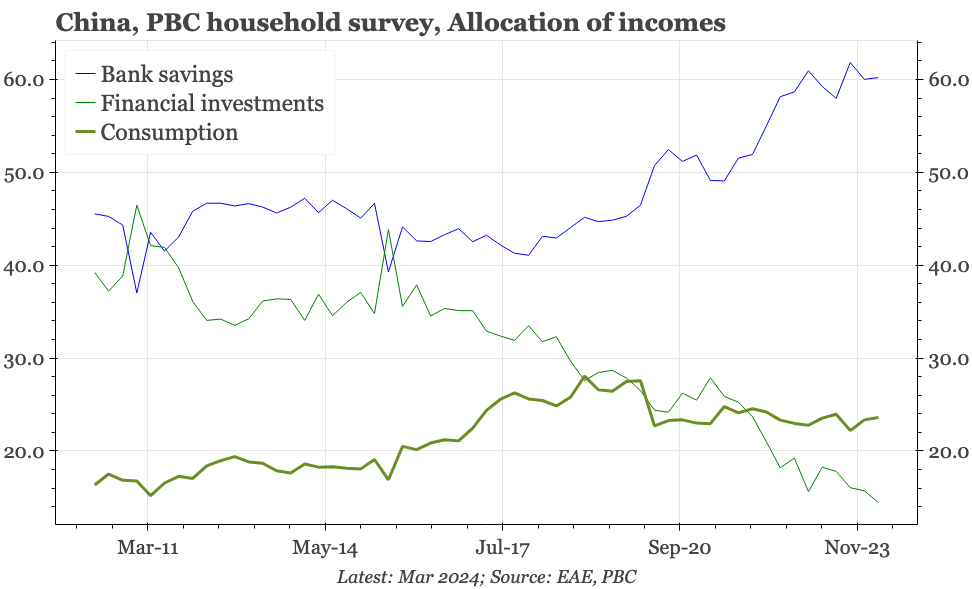

That's obviously true in terms of construction. But the collapse of the property market has also greatly reduced the attractiveness of what was previously a big destination for household savings. Indeed, while consumption sentiment is holding up, households are proving much less willing to use their money in other ways, be that buying property or making other riskier investments. The resultant flow of money into the safety of bank deposits shown in the PBC's survey in turn contributes to the weakness of narrow money growth, which further depresses overall prices.

Buying up property inventories=consumer stimulus

Xi's "new normal" remarks in 2014 didn't signify that the government was going to stand around and watch the economy slow further and further. Indeed, his remarks came close to marking the bottom of the cycle then, with officials in the following months launching ground-breaking initiatives –shanty town redevelopment funding and supply-side reforms – that greatly improved sentiment and pushed up the cycle.

With consumer inflation expectations continuing to fall, we continue to think the economy needs a new initiative this time around. It would be nice to see the direct household stimulus that is favoured by many observers, but there is no sign that is in the offing. In any case, the depositor survey suggests that there may be another way to stem the fall in nominal growth. That's because it isn't consumption per se that is the big drag. Rather, the more obvious weakness is with falling expectations around prices in general and property, and the related flow of money into the safety of bank deposits.

Of course, stabilising property is a goal that officials have had for months, and the depositor survey shows very clearly that all the mortgage rate cuts and other measures that have been unveiled have yet to have an impact. In this regard, the statement from the Politburo this week that it was considering measures to "absorb real estate inventories" could be very important for the macro cycle this year. Direct government purchases of excess property, particularly if used to then re-house and offer enhanced welfare to migrant workers in urban areas, offers a more direct way of ending the fall in property price expectations as well as boosting consumption.