China – June monetary data

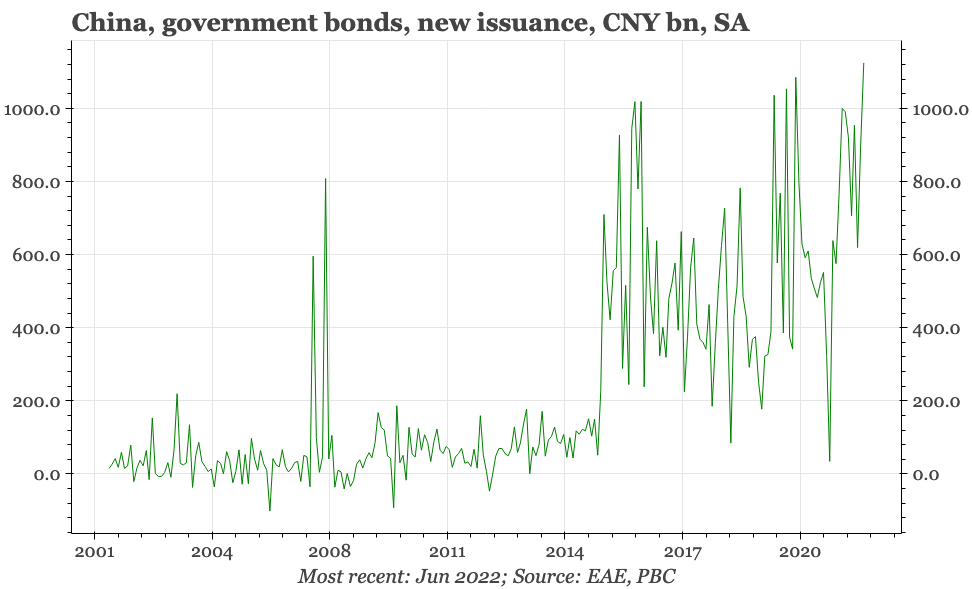

Credit data were strong in June, and big enough to help short-term market sentiment. But the details were weaker, with the rebound being driven by government bond issuance.

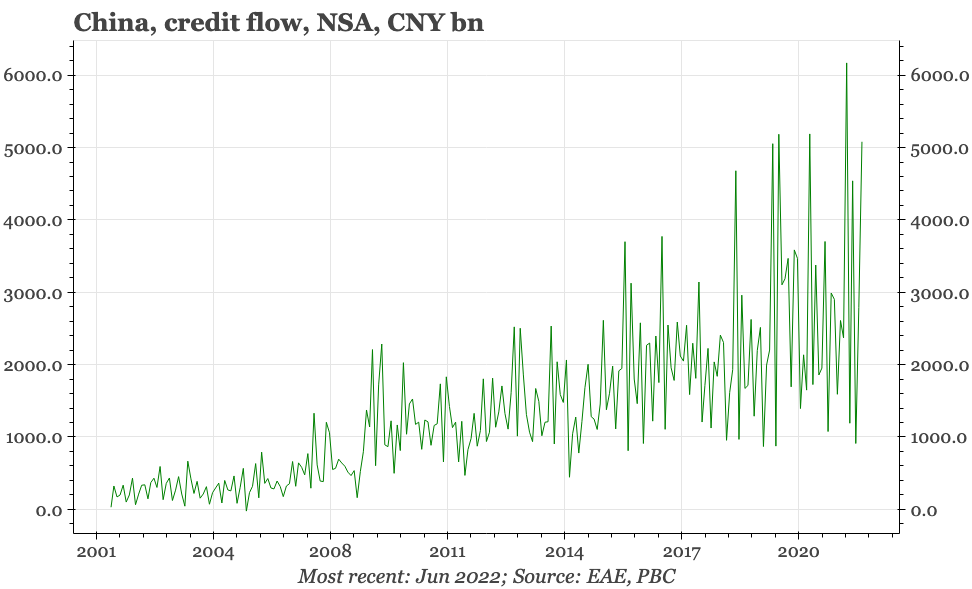

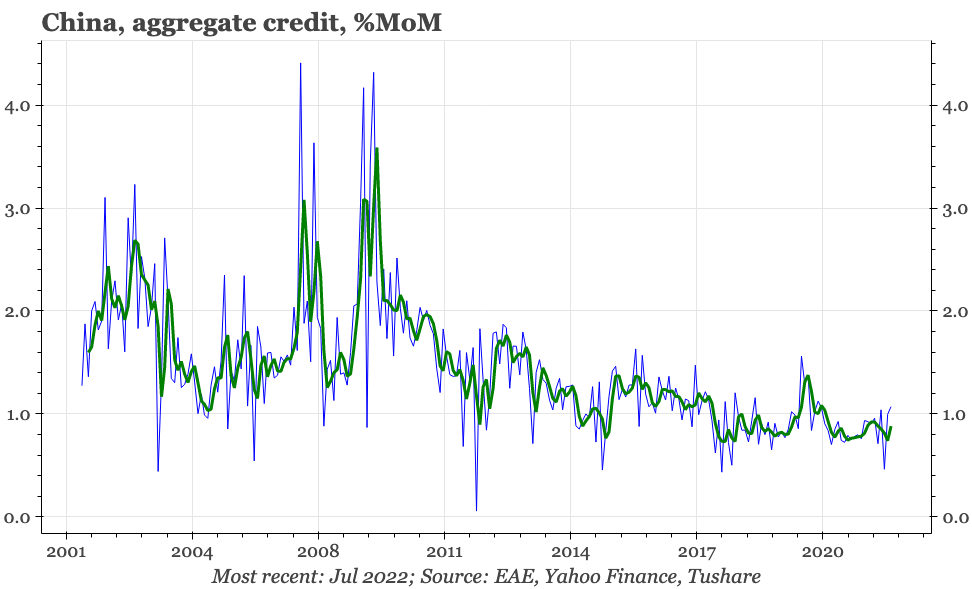

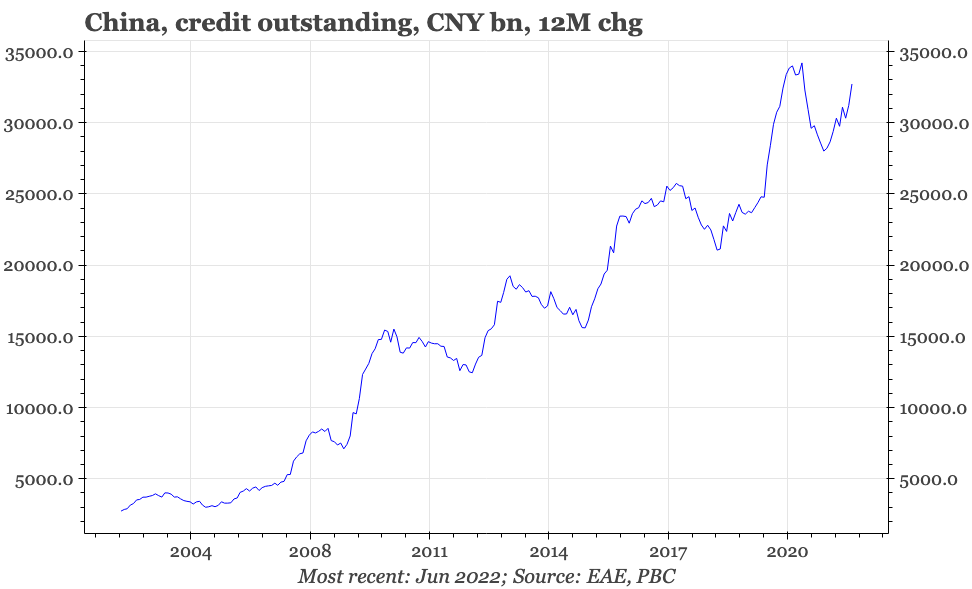

Headline credit data in June were strong. New issuance in the month amounted to a bit over CNY5trn. That was the fourth highest in any month (the seasonal pattern for lending mean issuance in Q1 is always larger than in the rest of the year), and the highest ever for June. After adjusting for seasonality, credit grew around 1.1% MoM in June, which is the strongest since early 2020.

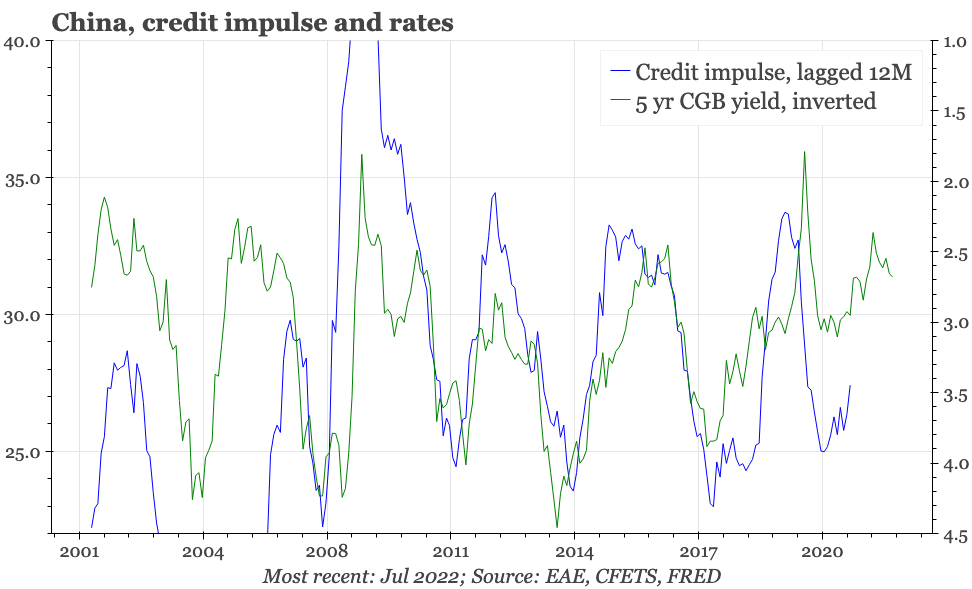

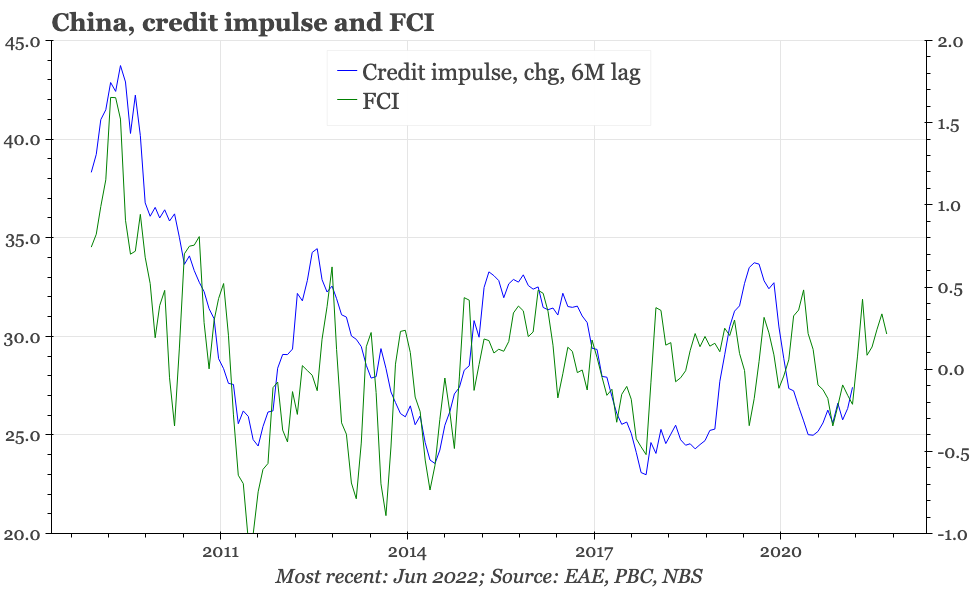

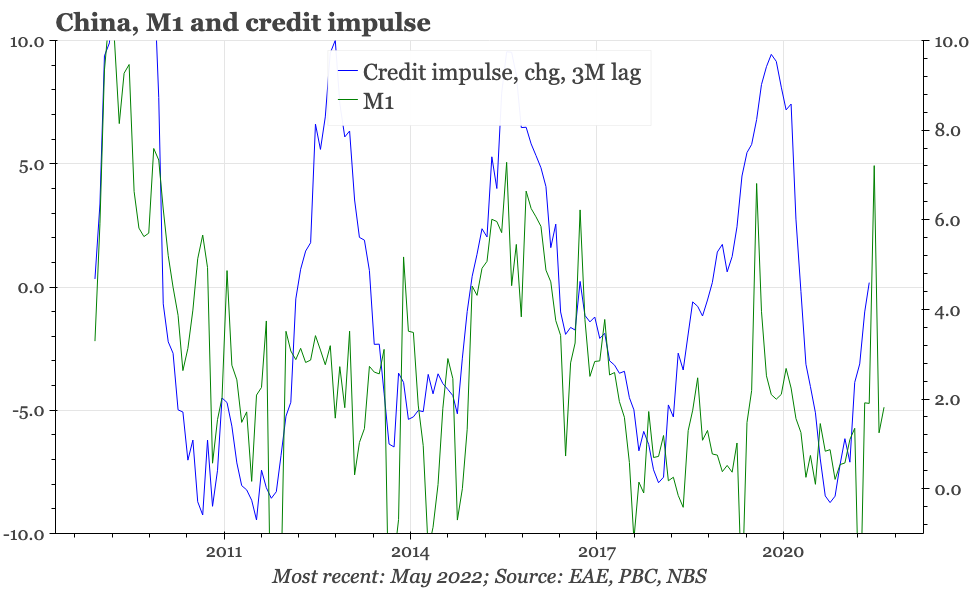

Given this, it is possible to argue that the usual elements of an upcycle in credit and thus the overall economy are once again falling into place. The credit impulse is rebounding, in line with the low level of interest rates and loose FCI, and both indicators point to more upside ahead.

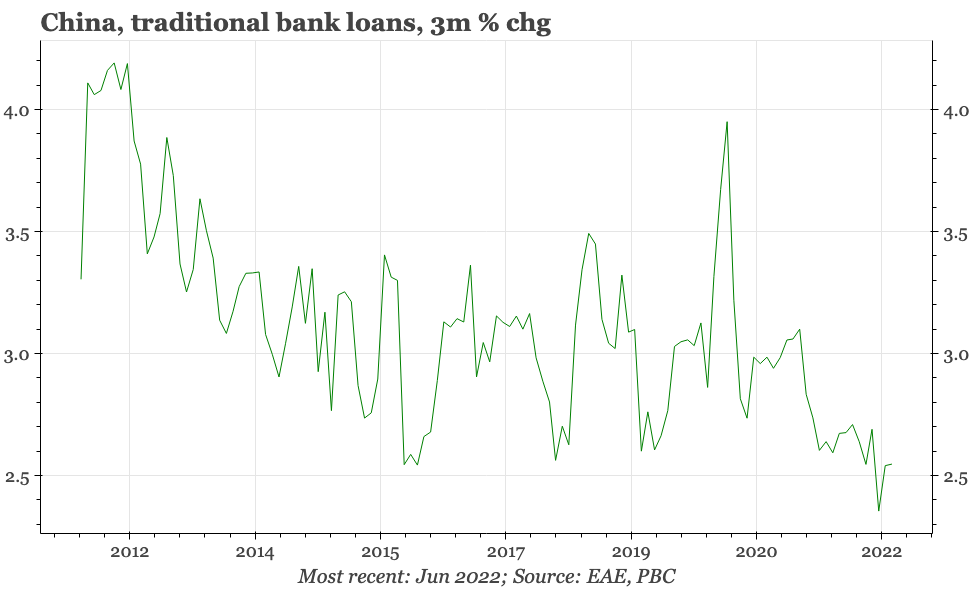

Given that, these data will probably help risk sentiment towards China in the very short-term. But the details of today's release suggest reasons to remain cautious about how much upside is likely. It is positive that traditional lending did rise strongly in June, and that bank acceptances, often used by banks to window dress otherwise weak lending data, remained modest. But the big driver of June credit was the CNY1.6trn in government bond issuance. That reflected the central authorities' push to have local governments utilise all of their full-year quota for special bond issuance by the end of June. Now that they've done that, government bond issuance will likely slow again in July and August.

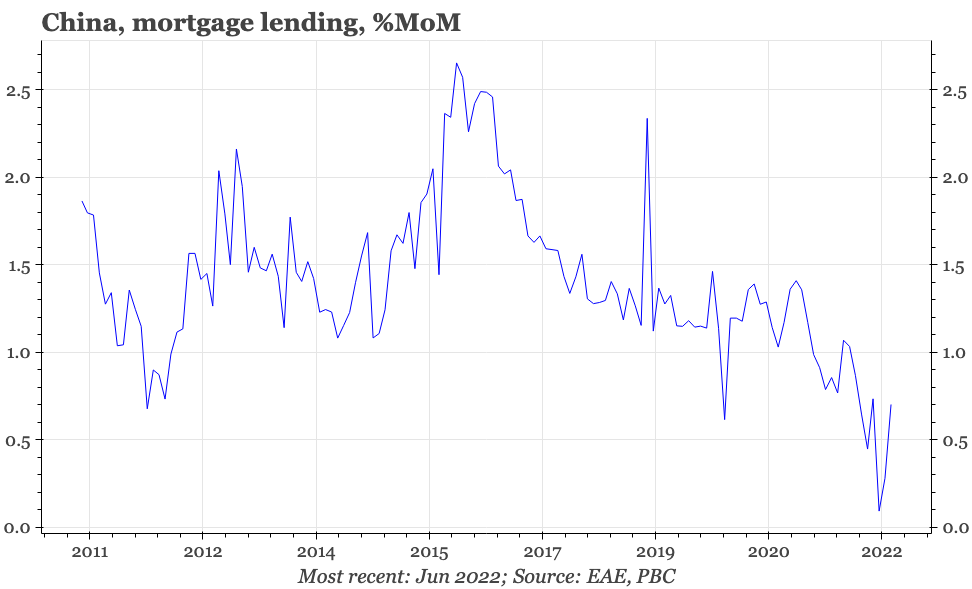

It was positive that mortgage issuance looks to have improved in June, consistent with other data showing an improvement in end-user demand in the real estate market in the last few weeks. But mortgage credit growth in June was only high relative to the last couple of months, and doesn't suggest sufficient a rebound strong enough to turn property construction around.