China - June inflation

June's data still don't show much inflation in China. And, outside of food prices, there's not much sign of that being about to change.

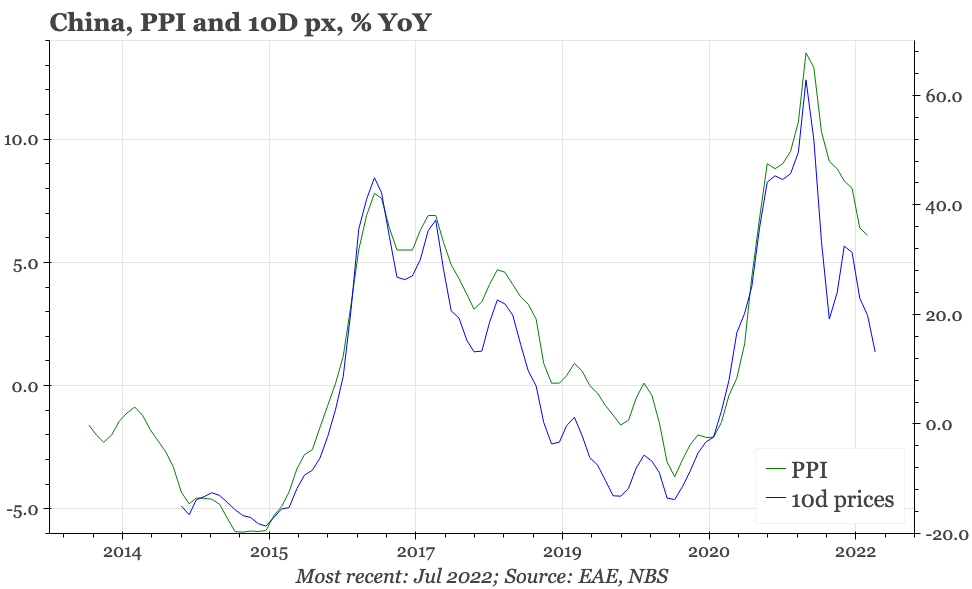

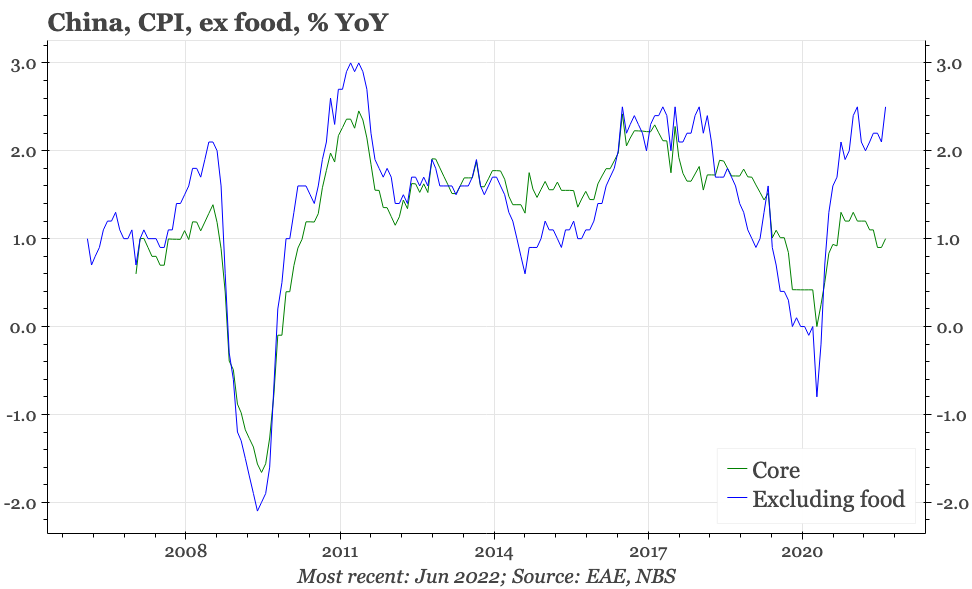

There's still very little sign of inflation in China. In June, PPI fell to 6.1% YoY, the lowest in 15 months. CPI picked up, but at 2.5% YoY remains modest. Core CPI inflation was only 1% YoY In June, with the rise in overall CPI driven by energy prices and higher food prices inflation. Add in the weakness of asset prices, and the overall inflation picture is very soft indeed.

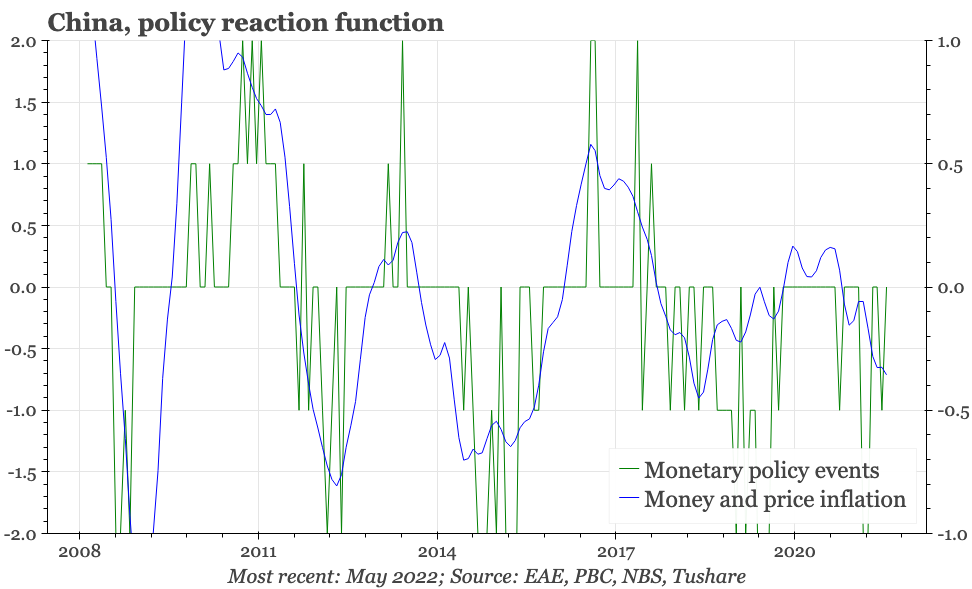

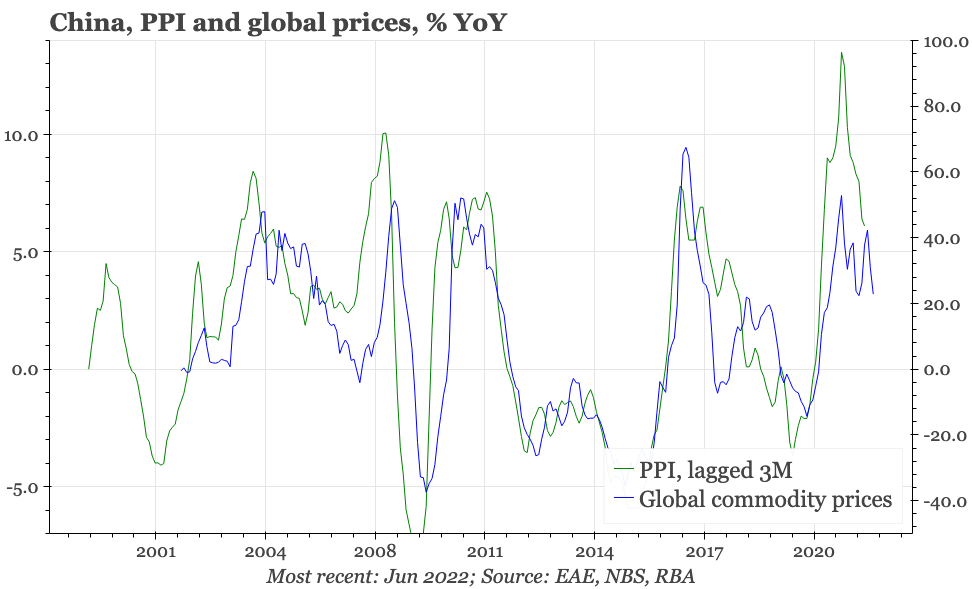

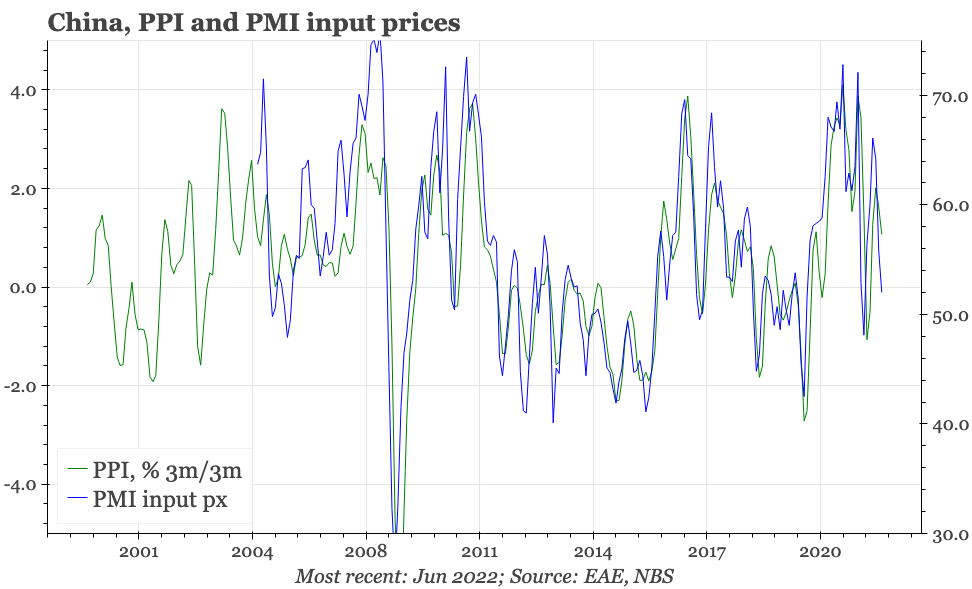

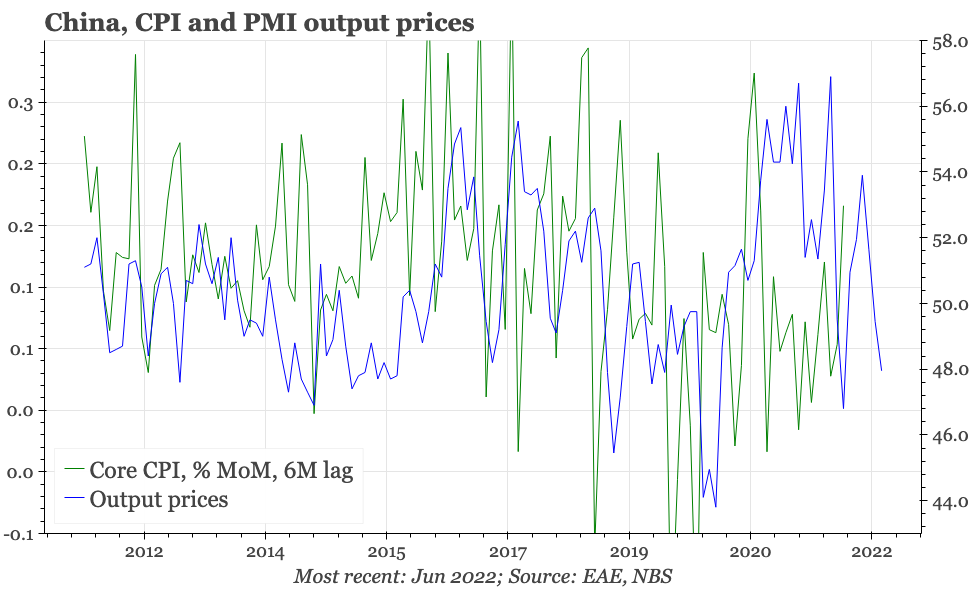

Given this, the obvious risk is that this is the trough, and inflation is about to go a lot higher. If the economy really gets going, that that becomes more possible, but the recovery needs to regain a lot more momentum yet for that to happen. For the moment, all the PPI leading indicators are pointing down. PMI output prices, which offers a rough guide to the direction of core CPI, doesn't suggest any big turn is in the works. And monetary indicators suggest, if anything, that the current very weak trend in overall inflation is going to be sustained though the end of this year.

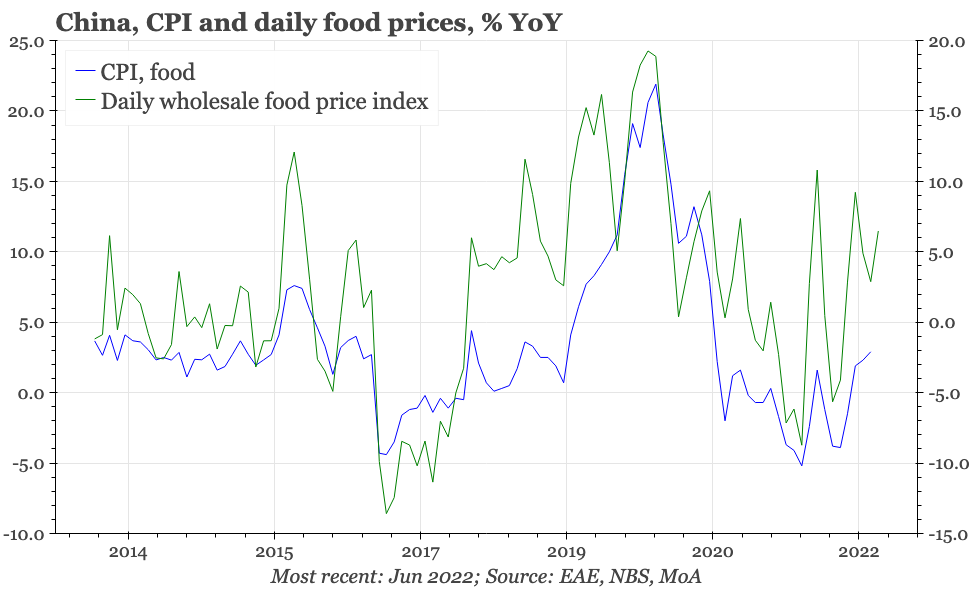

This doesn't cover food prices. The rise last month in the YoY rate was because of comparison with the food price deflation that began in June 2021; food prices actually fell MoM last month. This low base effect will likely mean YoY food price inflation will accelerate in 2H22, and it might get some more meaningful MoM momentum if the pork price cycle kicks in too. That is something to be watching, but CPI would have to rise a long way for it alone to impact PBC policy settings.