China – slower in March

The consensus on China has improved in recent weeks, but there's nothing in the Q1 activity release to reinforce that shift.

Q1 GDP and March activity data

Overall, the trends of the last few months are persisting: weakness in property and prices, but relative strength in manufacturing production and investment outside of real estate. In addition, although not for the first time, data for overall household spending in Q1 suggest consumption is stronger than indicated by the monthly retail sales numbers.

After becoming overly pessimistic earlier in the year, economist consensus on China has improved in the last few weeks. However, I don't think there's anything in today's data to reinforce that shift. If anything, the March numbers for IP and retail sales were weaker than January-February.

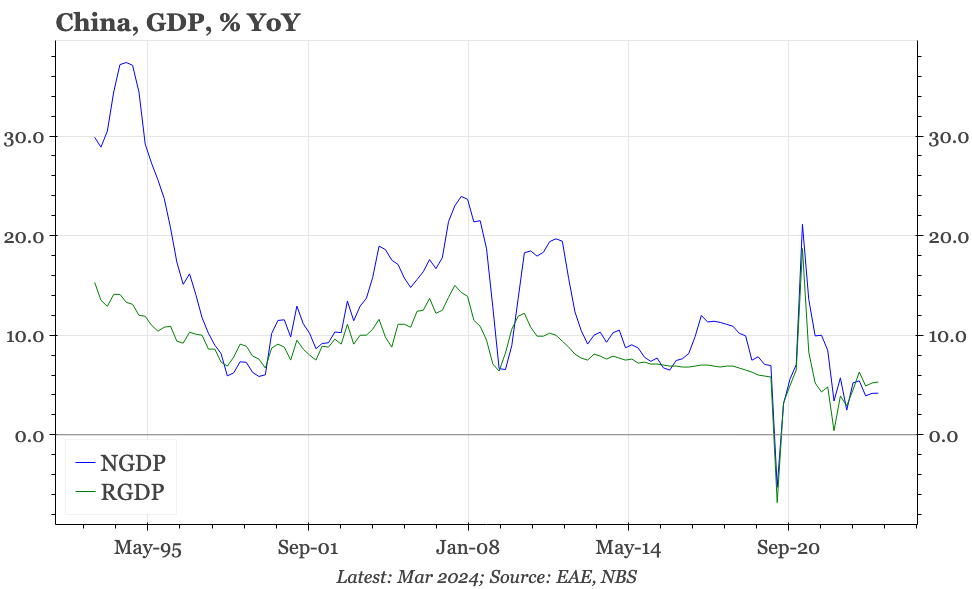

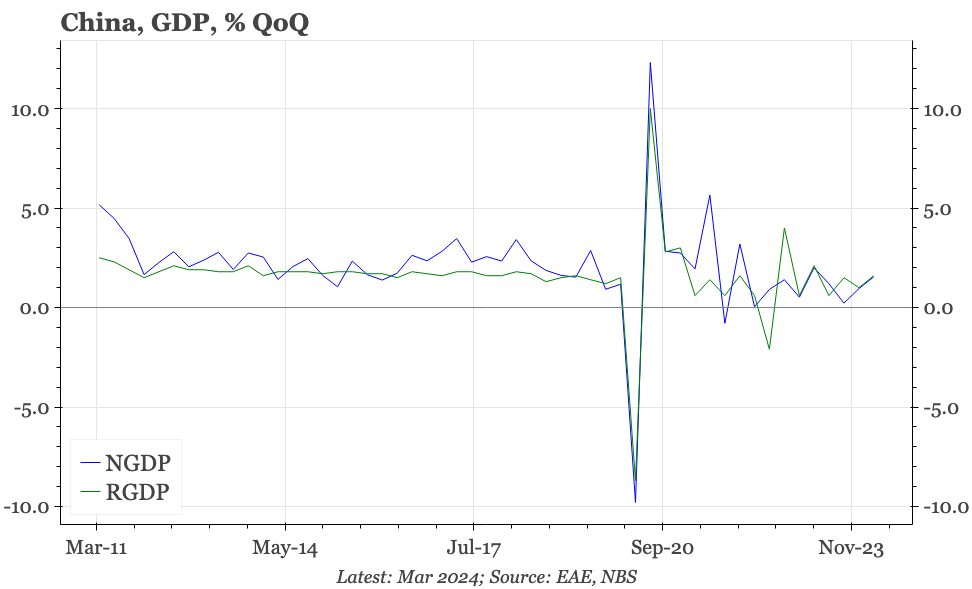

GDP

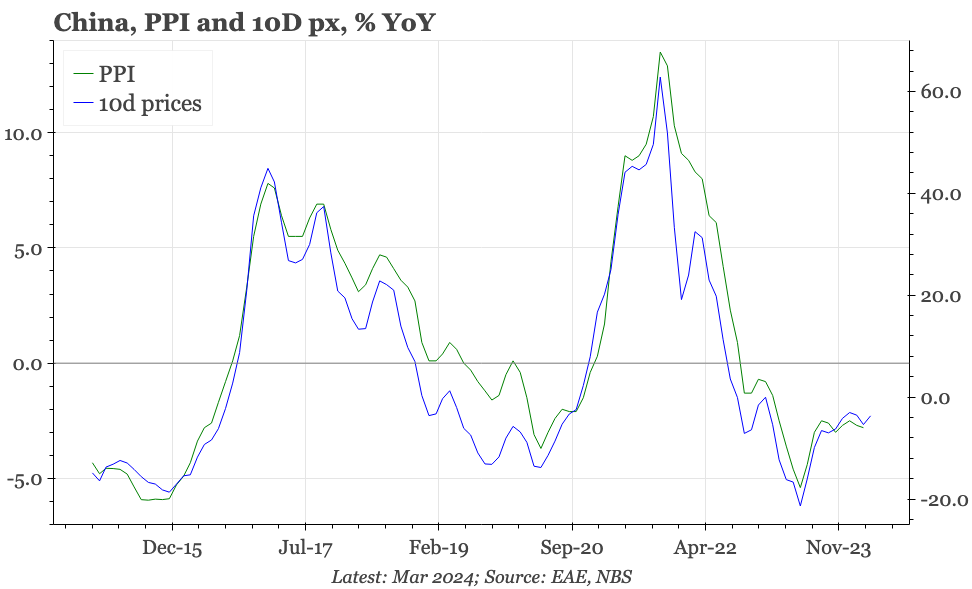

Officially, GDP grew 5.3% YoY in Q1, well above consensus expectations of 4.6%. QoQ also beat, rising 1.6%, which was even stronger given that in today's release last year's growth profile was also revised up. However, today's data also confirmed the message already suggested by the earlier-released CPI and PPI data that the GDP deflator remained negative in Q1. As a result, in nominal terms, the economy grew just by just 4.2% YoY in the first three months.

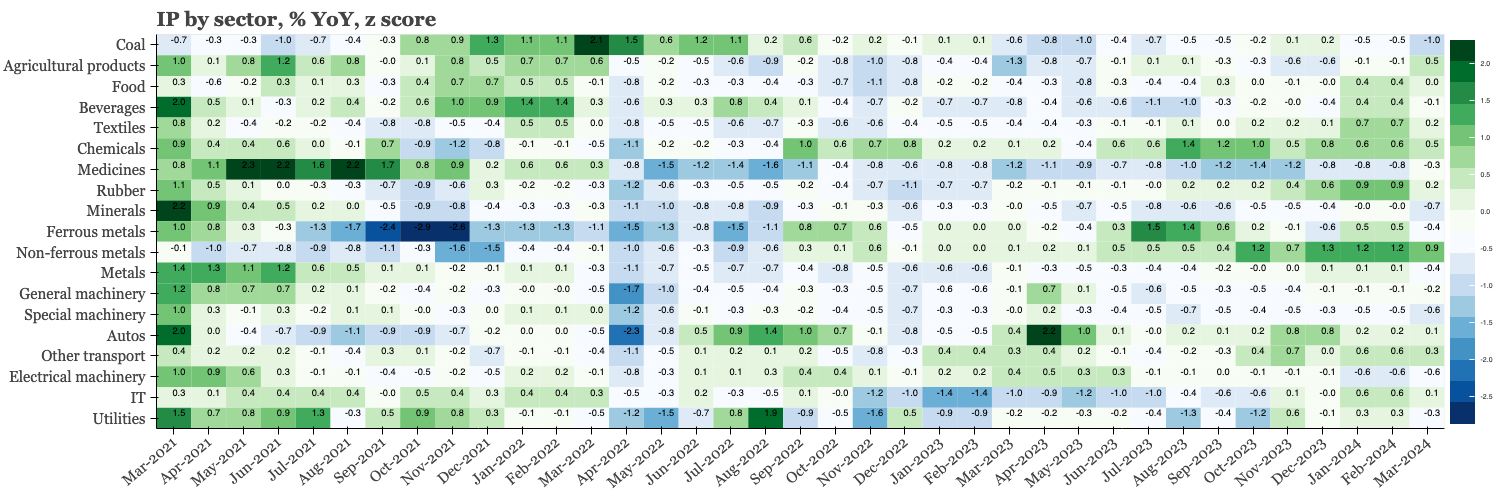

IP

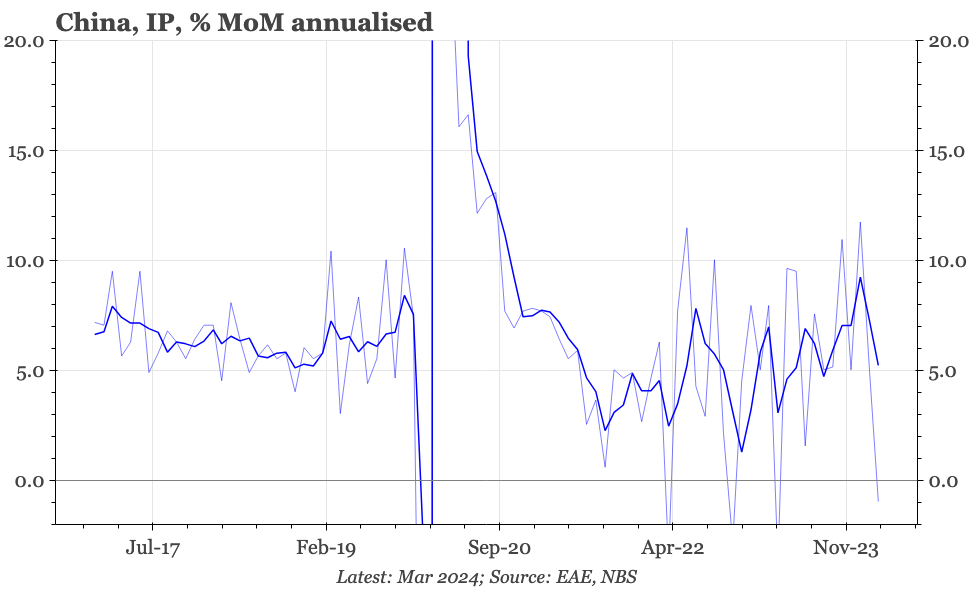

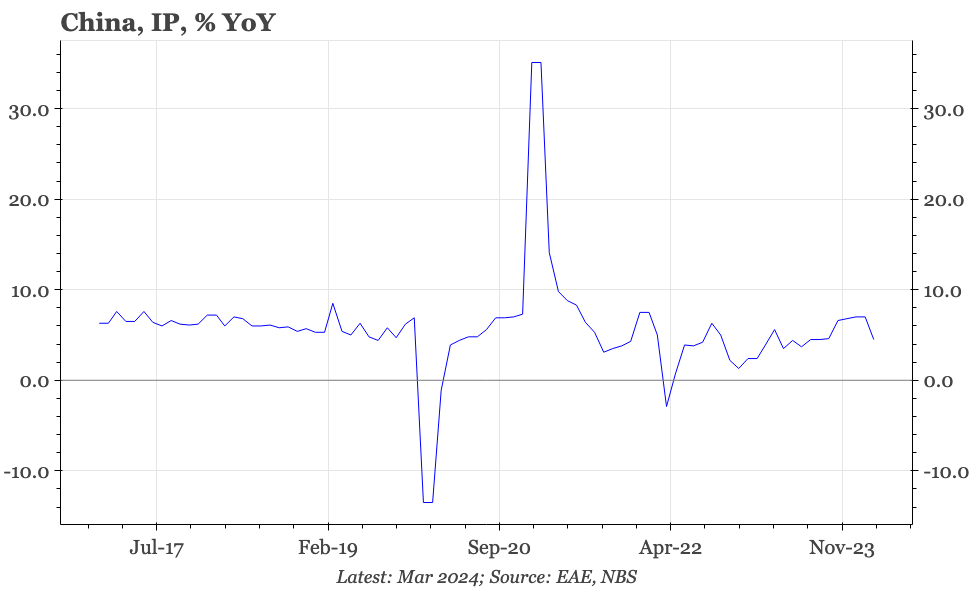

The official data suggest momentum was strongest earlier in the quarter, and faded during March. For the first time in almost a year, IP actually fell MoM in March. That does come after a notable spurt in growth since Q323, but even so, a sequential decline doesn't suggest that a real upcycle in the macro economy is starting.

Consumption

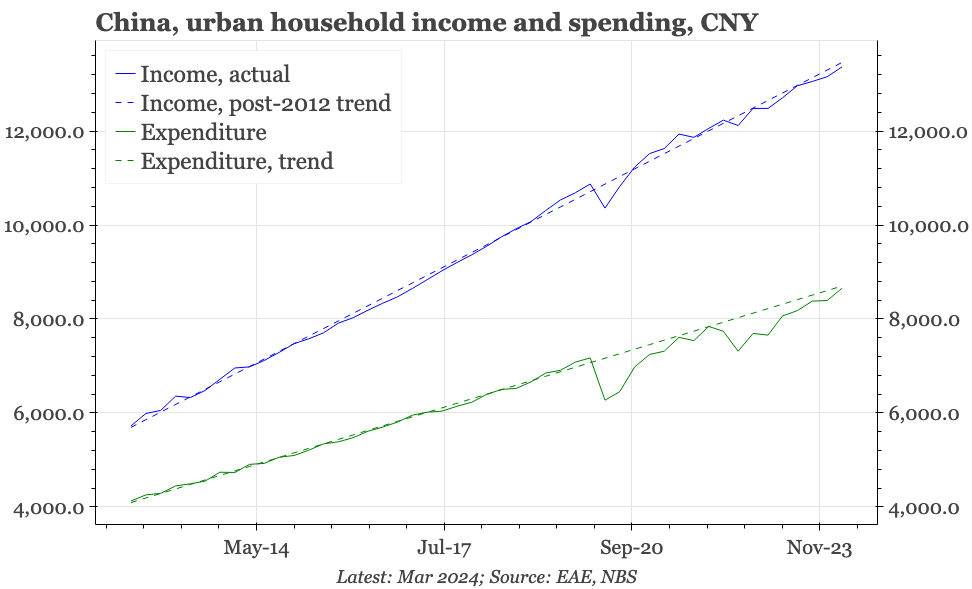

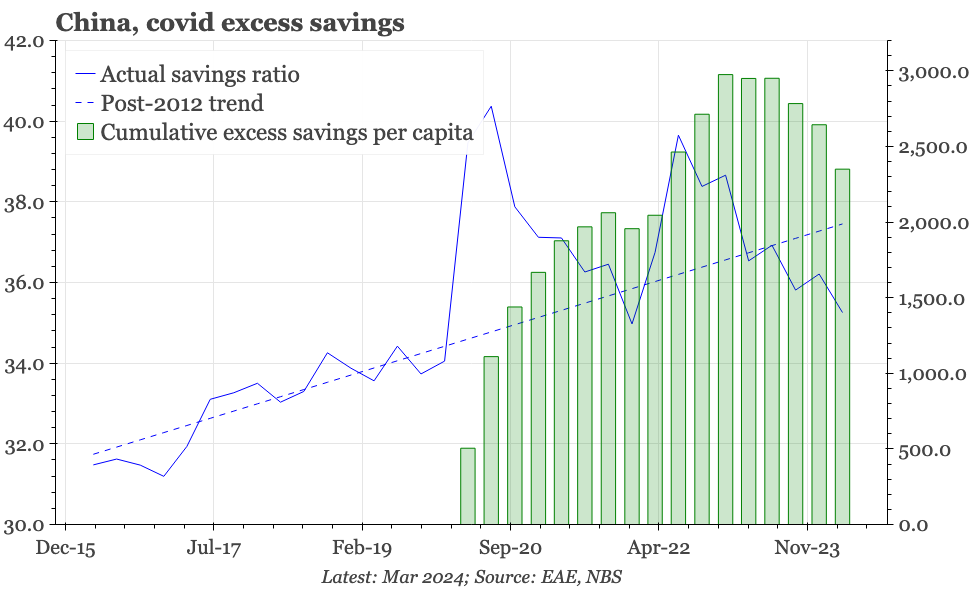

Retail sales growth also slowed in March to 3.1% YoY, below consensus expectations of 4.6%. However, in sequential terms, retail sales were actually a bit stronger last month. In addition, quarterly data on household consumption, which includes services as well as goods, was better. Consumers seem to be dipping into savings built up since covid, but income growth is also stronger.

Property

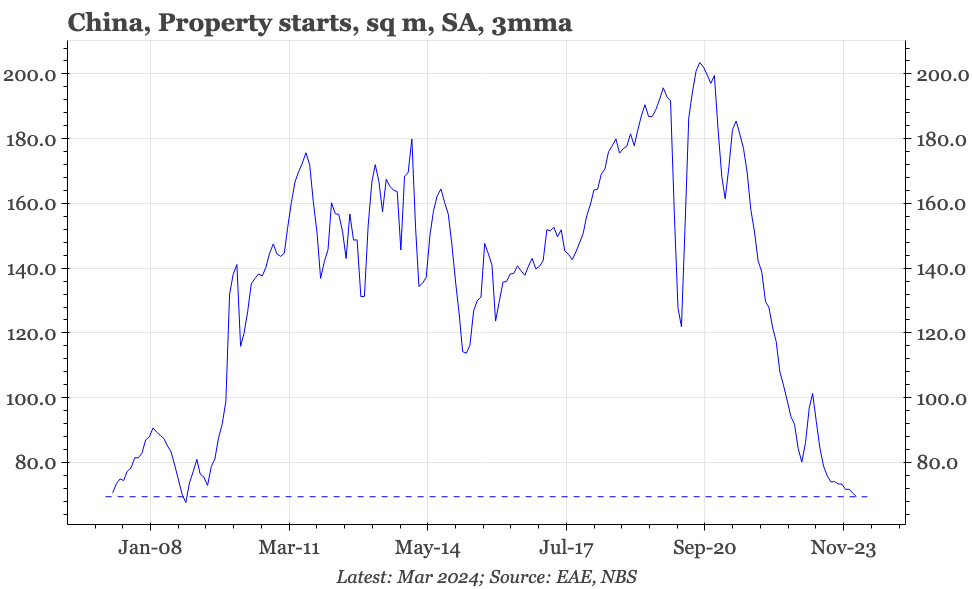

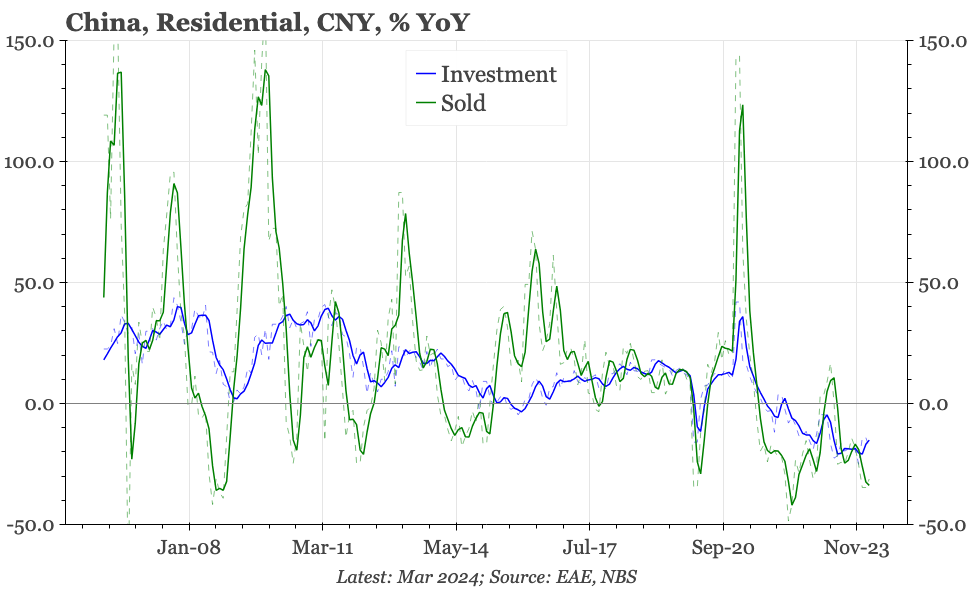

Consumers are clearly not dipping into their savings to buy housing. The deep, deep slump in property shows no sign of bottoming out, let alone reversing. Property sales fell again in March, and are now a remarkable 65% below the peak of 2020, and barely above the previous low reached in late 2008. Property sales have ticked up this year, but only marginally, and not by enough to suggest any risk that construction is about to accelerate.

Industrial prices

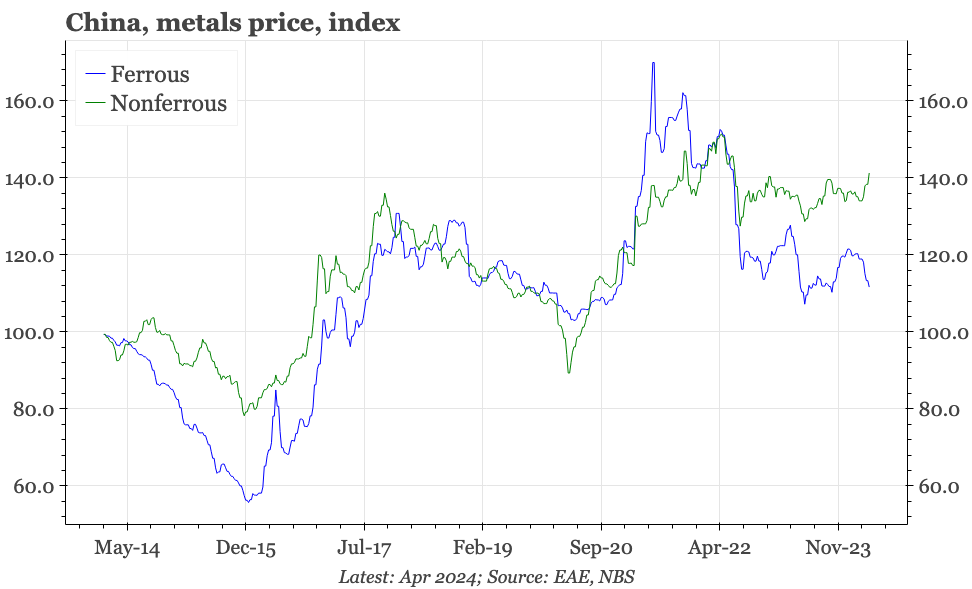

This collapse is feeding into weaker prices for ferrous metals and building materials, clearly visible in other data released today for upstream industrial prices though the first ten days of April. However, the same dataset show industrial prices overall not changing much, in part because non-ferrous prices have been rising.

Investment

While there are supply-side and global factors contributing to this gap, a local driver is the differentiated performance between property-related sectors and the rest of industry. According to the NBS, investment in property fell -9.5% YoY in Q1, while in other sectors it rose +9.3%. Overall private sector investment barely rose in the first three months, but excluding real estate and growth was 7.7% YoY. The picture is similar for industrial production. By ownership, private sector IP grew 5.4% YoY in Q1, slightly outpacing the 5.2% growth of the state sector. As has become usual, the NBS today again highlighted growth in new industries, production of charging stations, 3D printers and electronic components rose 41.7%, 40.6%, 39.5% respectively in Q1.

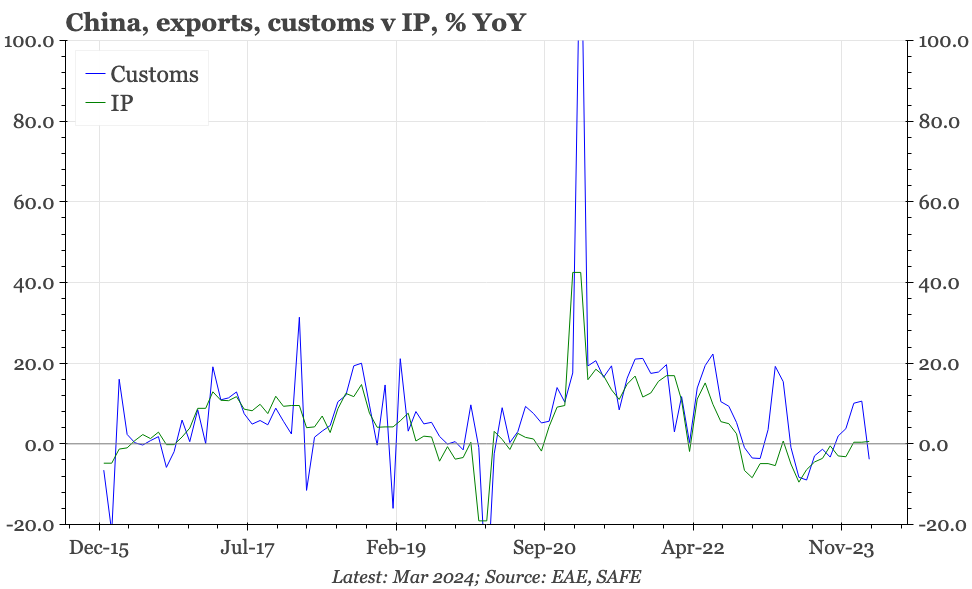

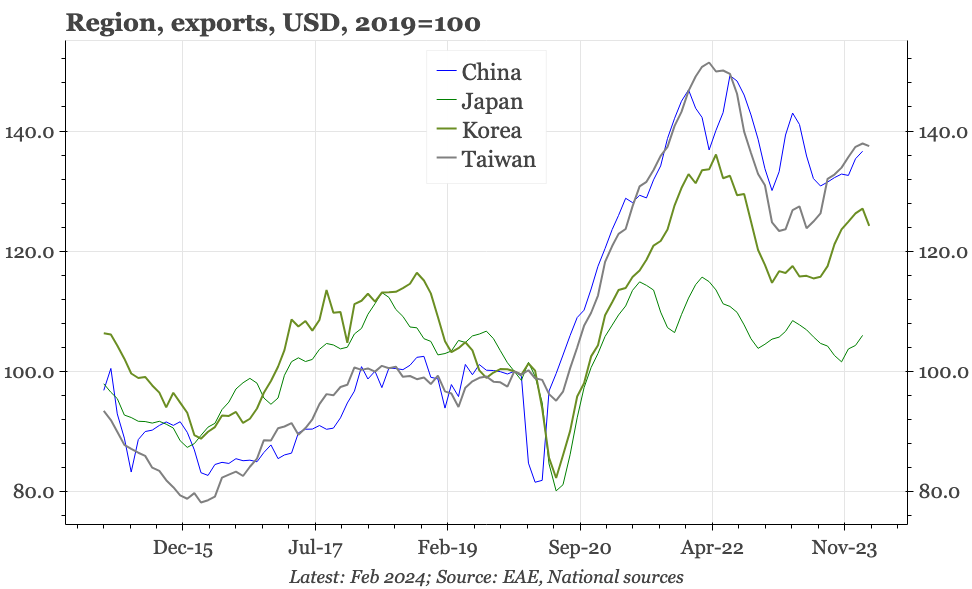

Exports

That is encouraging. However, the slowdown in IP growth in March does look quite broad-based. Moreover, while we've been fairly confident that external demand would be supporting growth in some of China's new industries this year, the export delivery data published as part of the IP release actually look quite soft.