China – the consumption challenge

As a long-time fan, I was very pleased to have a piece in the latest China Leadership Monitor. It argues that while cyclically, spending hasn't been so bad, that isn't enough given the property bust. Even so, and despite interesting proposals from onshore economists, policy support is still lacking.

This is a longer piece than I usually post here, but to get you started, here is the abstract. If you want more charts, there is a slide pack I sent a few weeks ago, and as usual, they can also all be viewed from my website where the data is also available.

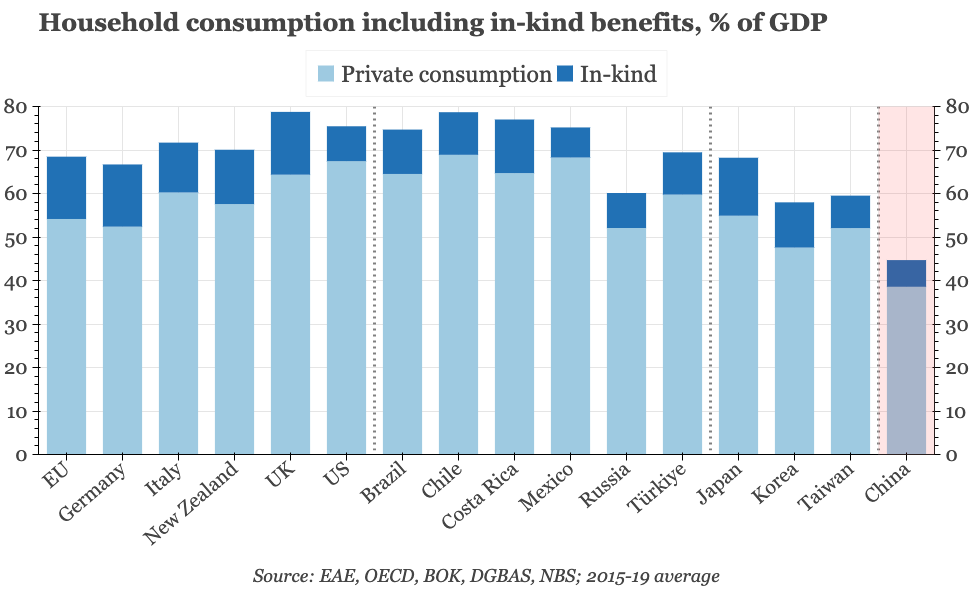

With consumer confidence collapsing and retail sales barely growing, it has become common to think that consumption in China is suffering from a cyclical crisis that is intensifying the economic difficulties caused by the property slump. The reality is different, however, with consumption in China regaining its pre-Covid trend, a recovery that is rare among the major economies. This bounce back has been made possible by the normalization of the spike in savings seen during the pandemic. With the savings rate now back to the 2019 level, a further rise in consumption is dependent on growth in household income, but that is slowing. The recent burst of cyclical stimulus, by boosting demand for labor and thus stabilizing wages, should provide some respite, but given the bust in the real estate market, what is especially needed are structural policies that raise the non-wage component of household incomes and permanently reduce the savings ratio. Such policies have yet to be seen, even though there are proposals by onshore economists that have the potential to help households while avoiding the sort of welfarism that Xi Jinping has so publicly criticized.

China’s Consumption Challenge | China Leadership Monitor

With consumer confidence collapsing and retail sales barely growing, it has become common to think that consumption in China is suffering from a cyclical crisis that is intensifying the economic difficulties caused by the property slump. The reality is different, however, with consumption in China regaining its pre-Covid trend, a recovery that is rare among the major economies. This bounce back has been made possible by the normalization of the spike in savings seen during the pandemic. With the

China – the consumption challenge

A chart pack arguing that consumption hasn’t been as weak as is often imagined, but that downside risks are growing as wage and property income falls. Policy solutions need to overcome the weakness of non-wage incomes, the strength of savings, and the pro-investment official mindset.