China - August PMI

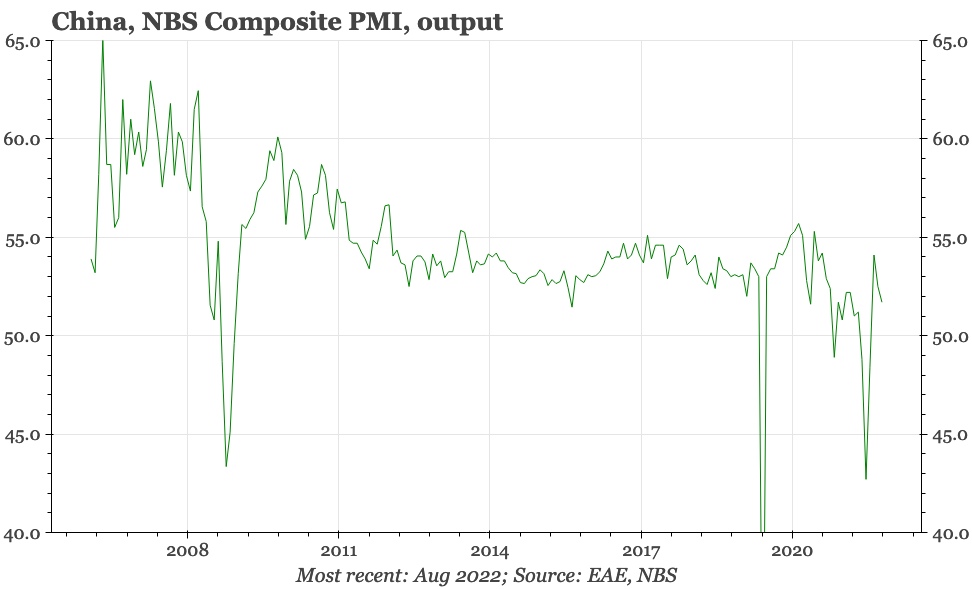

The August official PMIs suggest no change in the economy. Growth remains weak, and doesn't look likely to turn up any time soon. Price indicators continue to suggest deflation is a bigger risk in China than inflation.

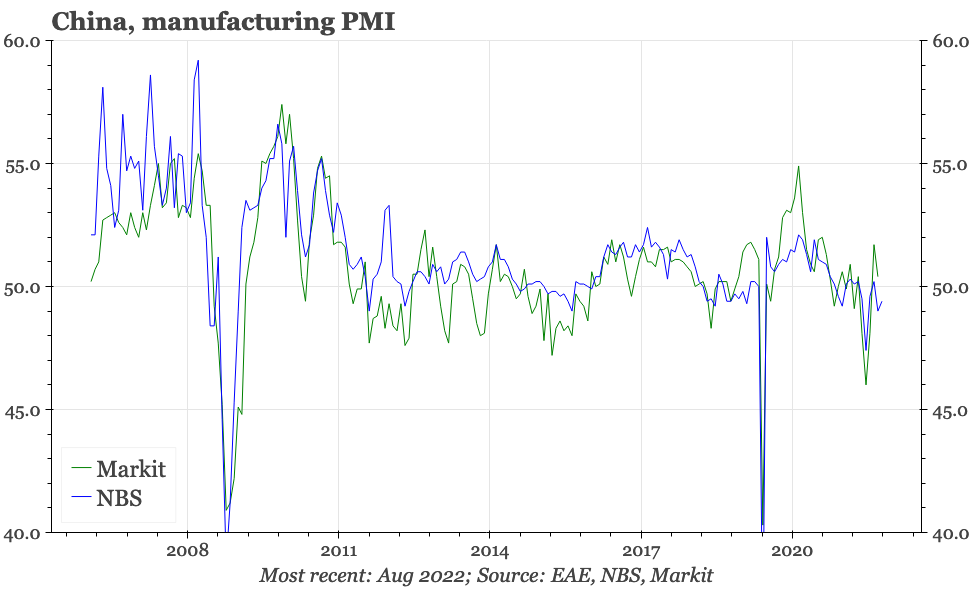

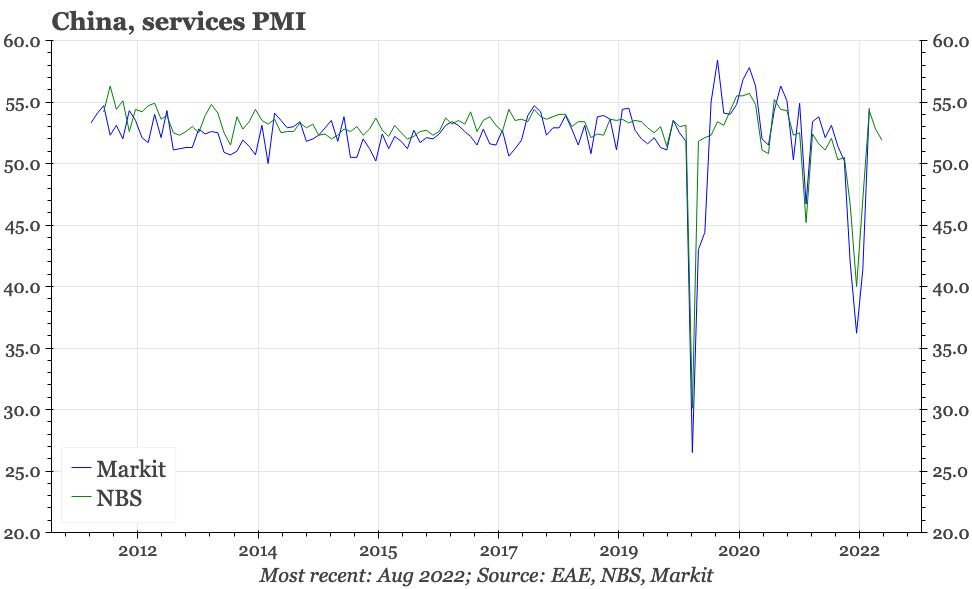

The headline manufacturing PMI in August lifted a bit from July, but remained below 50. The non-manufacturing PMI fell back after last month's bounce, and so overall, the Composite PMI weakened from July.

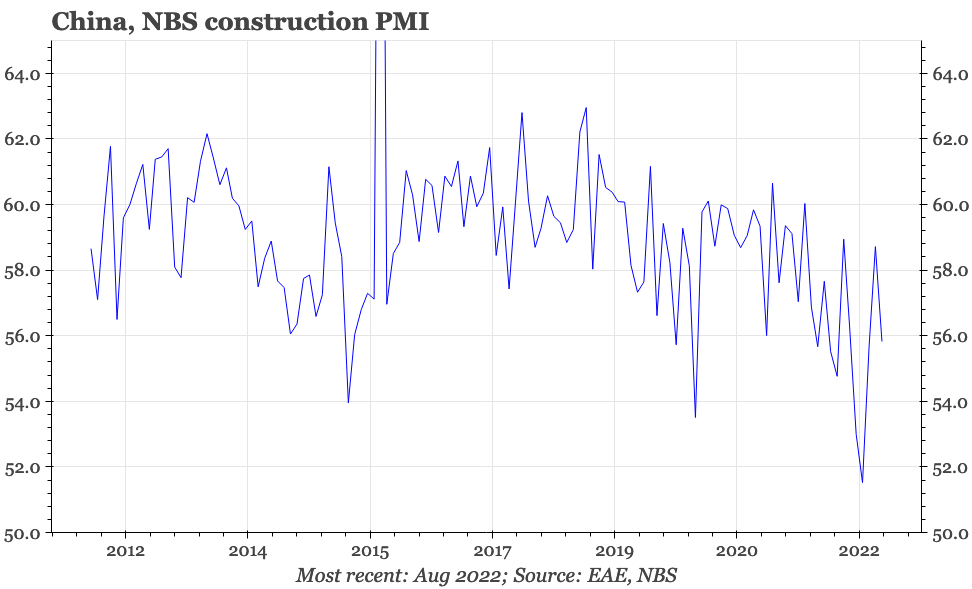

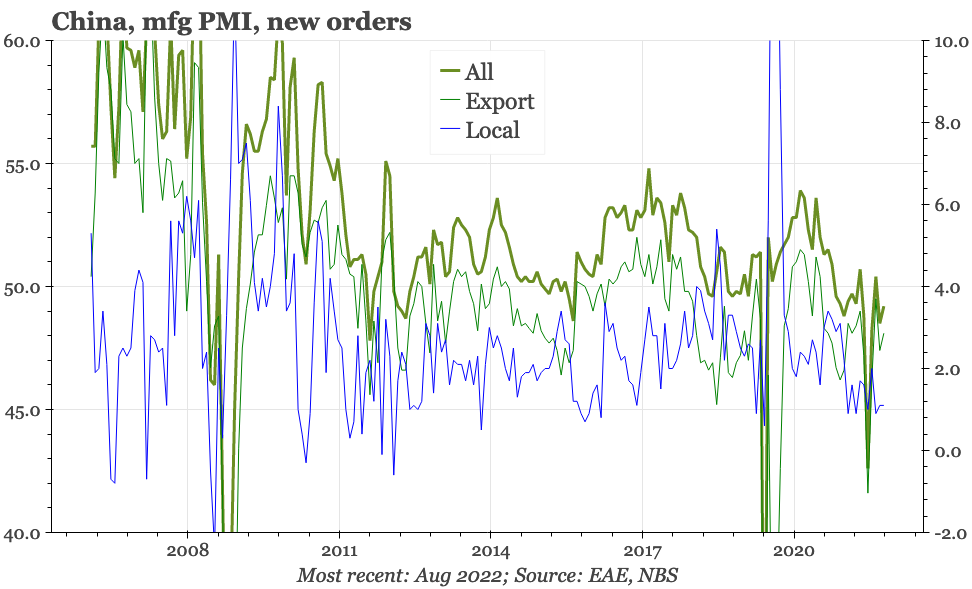

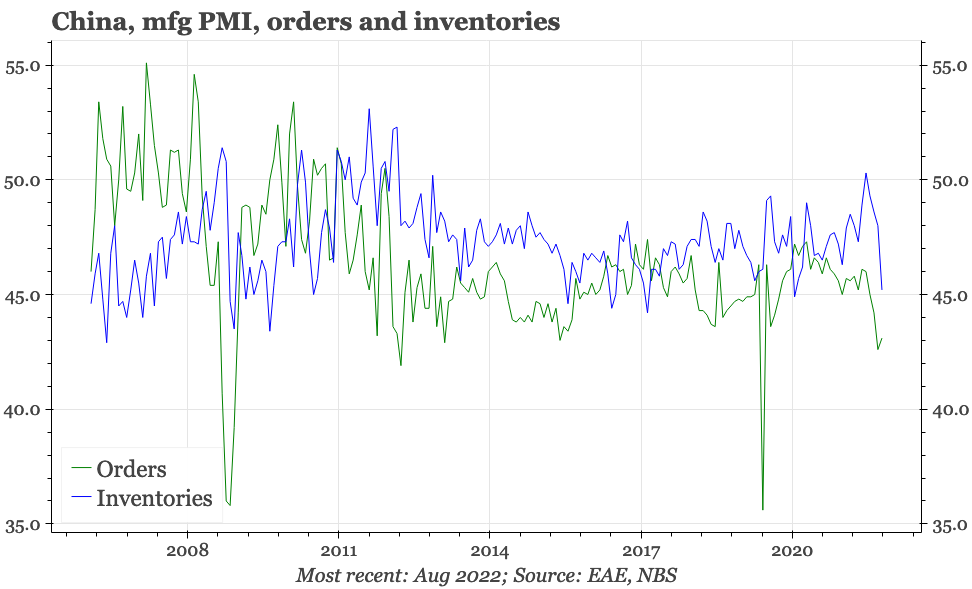

The details continue to look soft. Last month's improvement in the construction PMI wasn't sustained, and with domestic orders in the manufacturing PMI remaining sluggish, there's nothing to suggest any sort of significant lift in the economy is in the works. The one more optimistic development in the survey was the fall in inventories, which might cushion some of the downside in the short term.

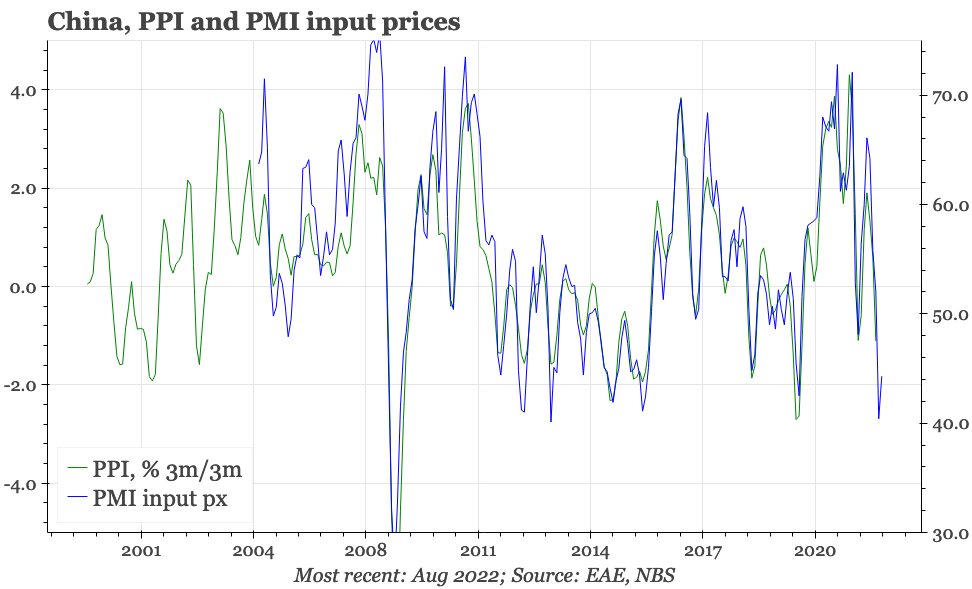

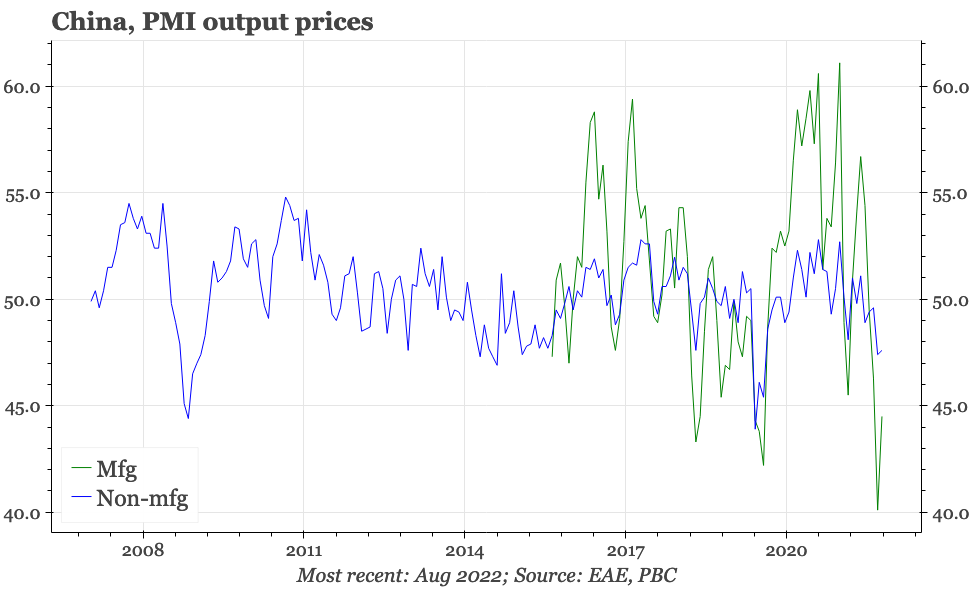

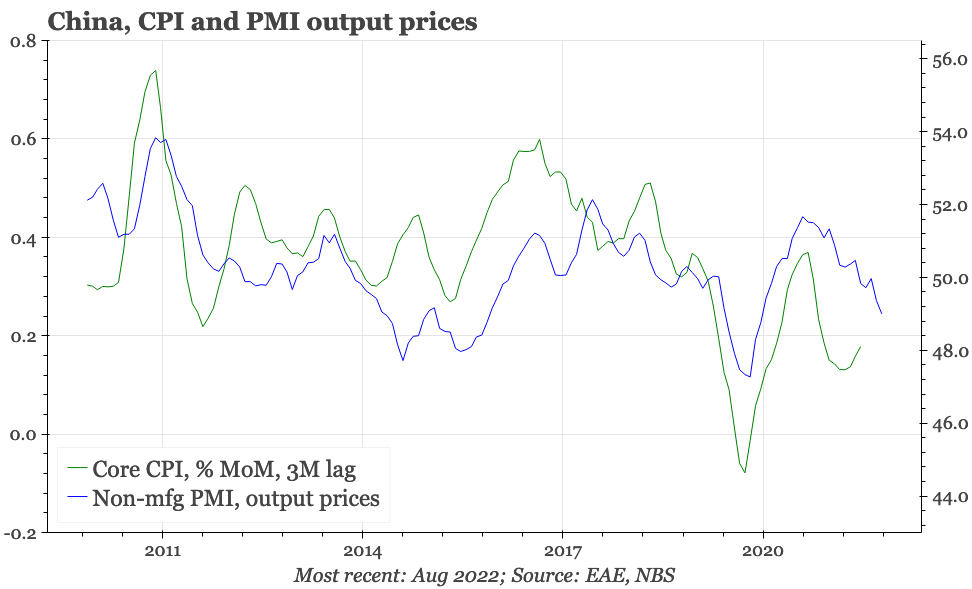

Prices paid remained below 50, and suggest PPI inflation drops further again in August to 3.1% YoY, from 4.2% YoY in July. Output prices in both the manufacturing and non-manufacturing PMIs were also below 50, and point to core CPI remaining very low. There would have to be a very dramatic rise in food prices for China to have an inflation shock in the next 6M. The bigger risk remains deflation in the underlying price level.