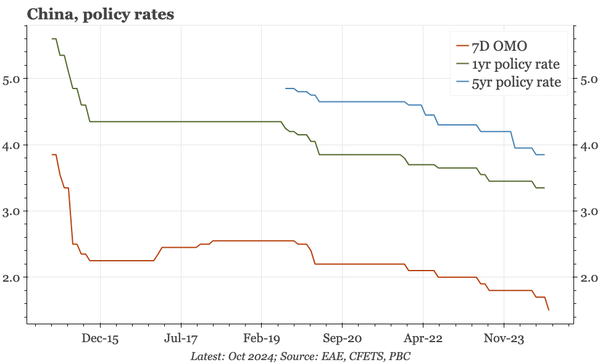

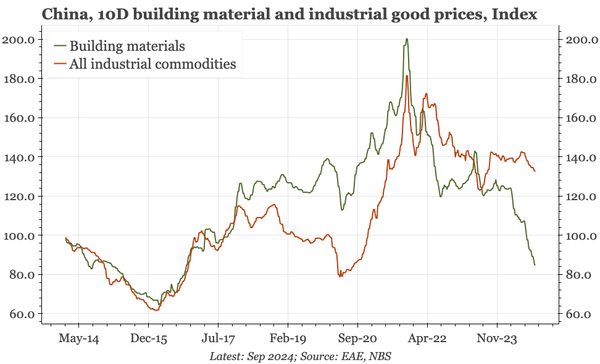

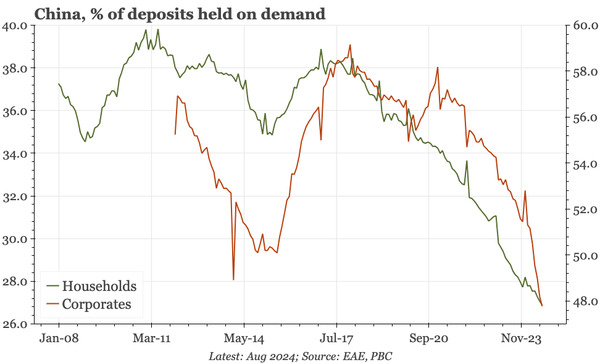

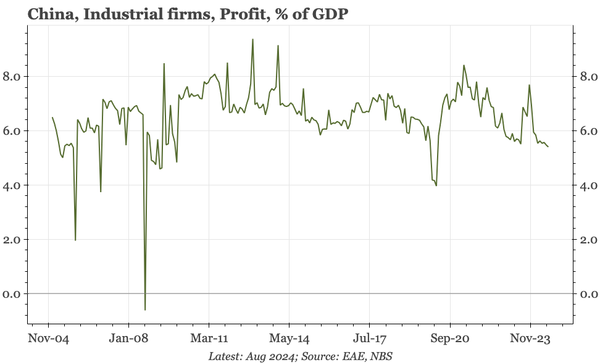

China: profit share as low as 2009

The 17% YoY fall in profits in August is exaggerated by comparison with the spike 12M previously. But the details are sluggish. Corporate revenues haven't yet regained the level of November 2023, and except for early 2023, the profit share of GDP is lower than any time since 2009.