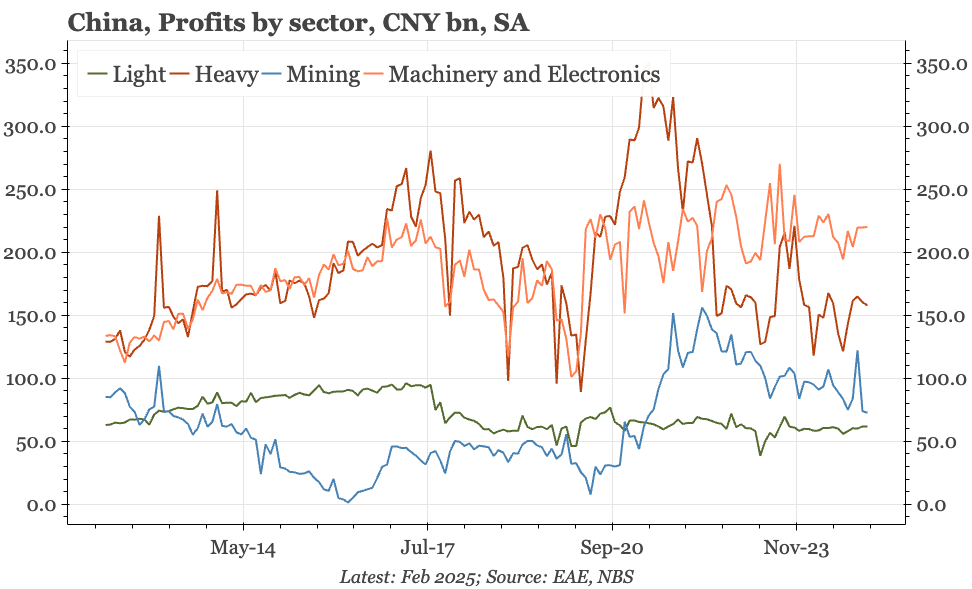

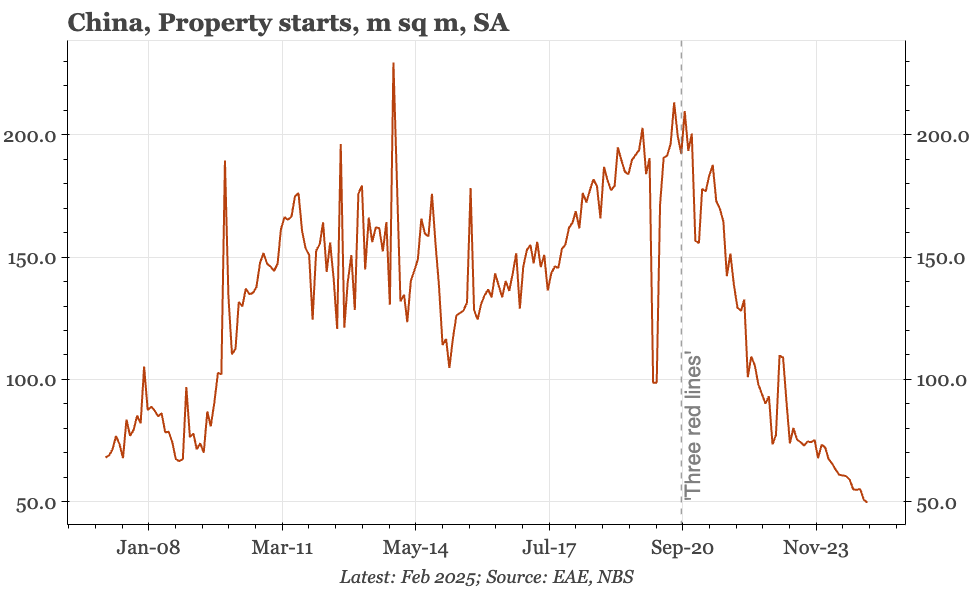

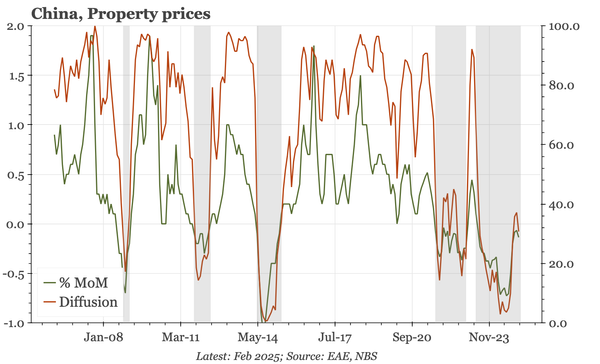

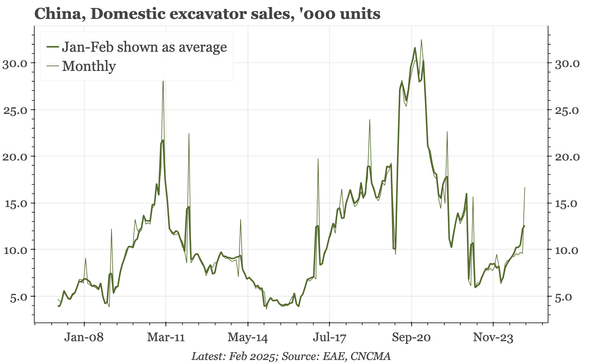

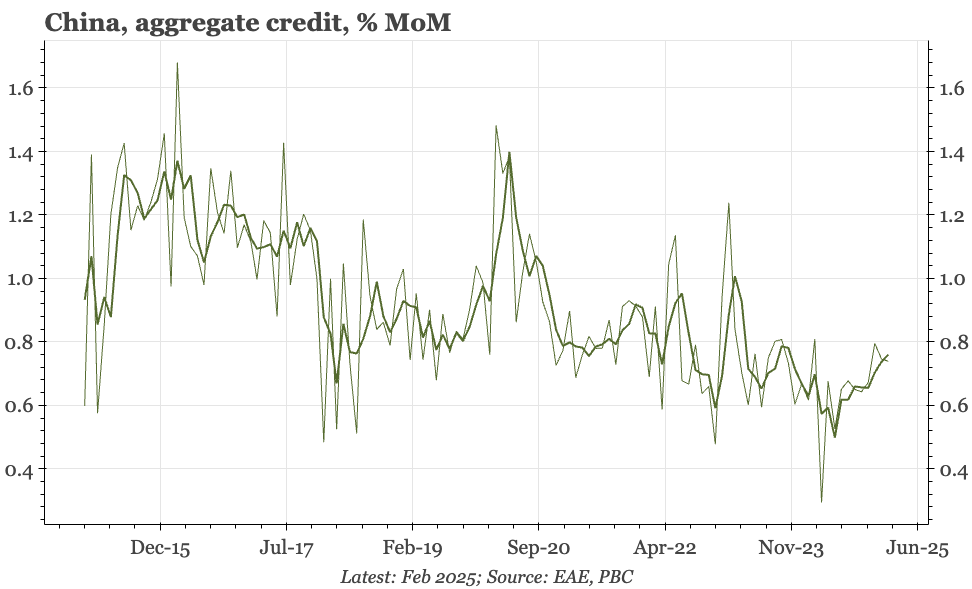

China – muddling through at risk from tariffs

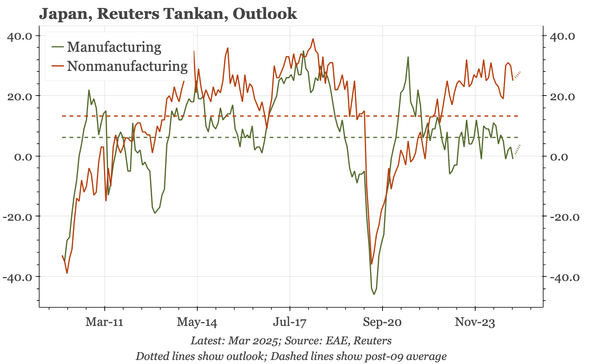

The PMIs suggest the economy, once again, is muddling through. The better momentum after the policy announcements that started from September has faded, but isn't reversing. However, that probably isn't enough, given the new shock from tariffs that is about to hit.