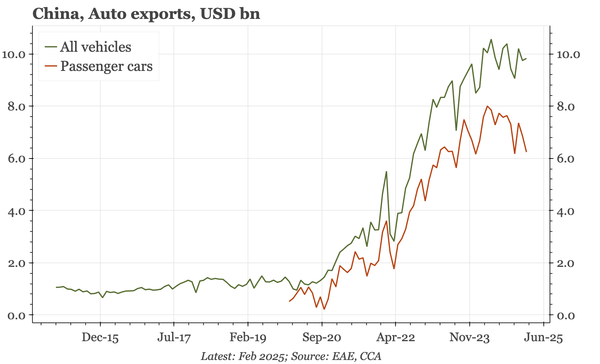

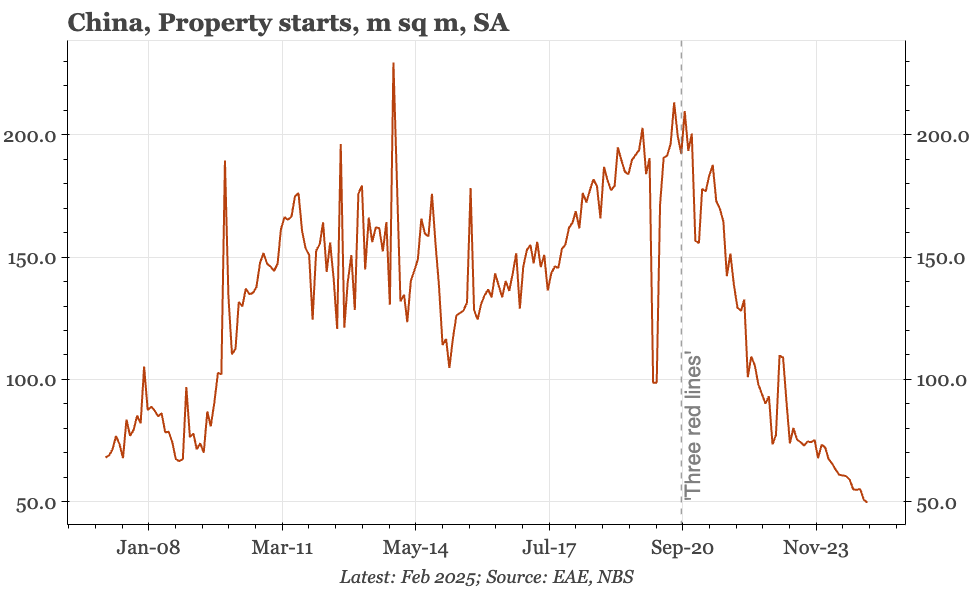

China – three post-tariff themes

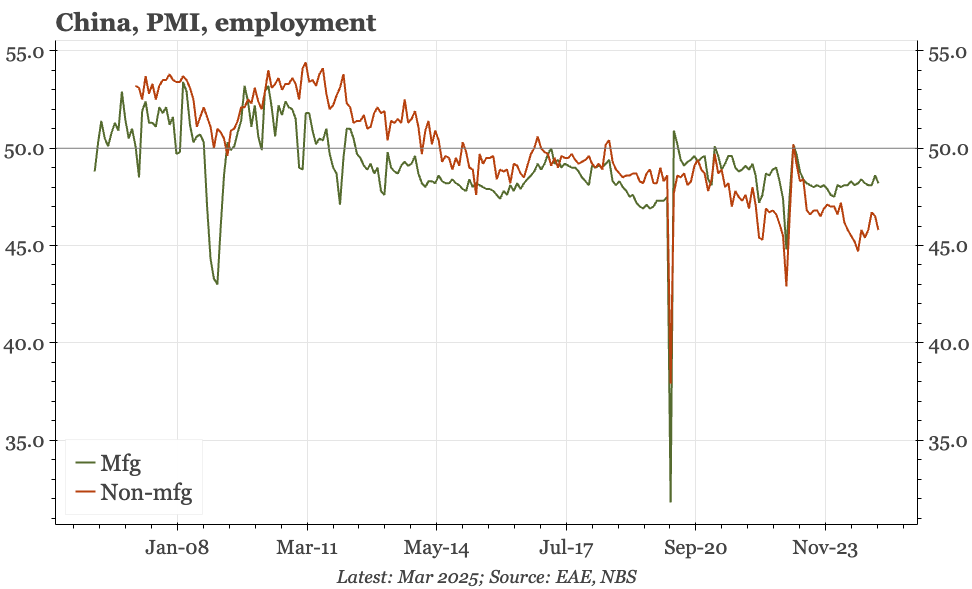

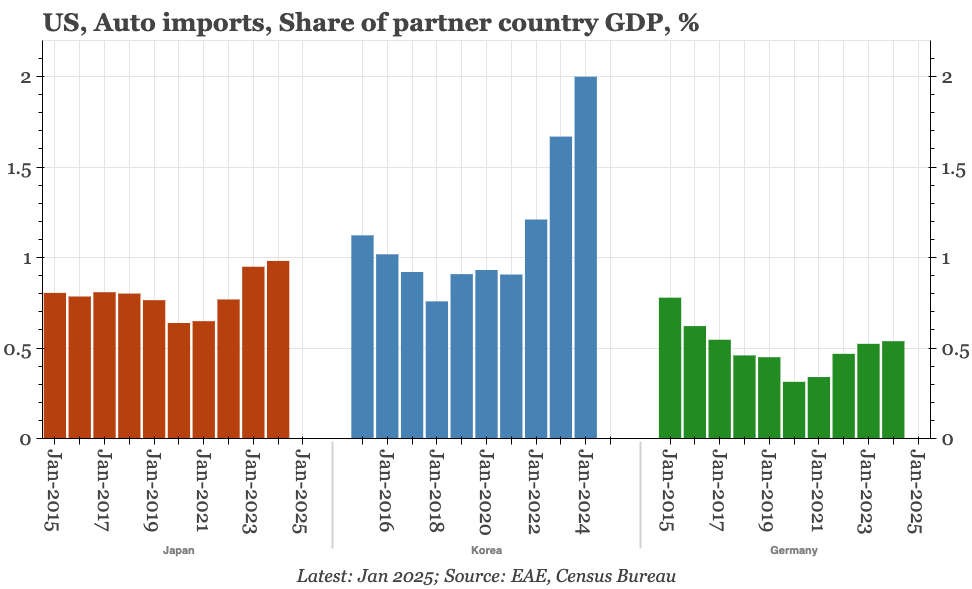

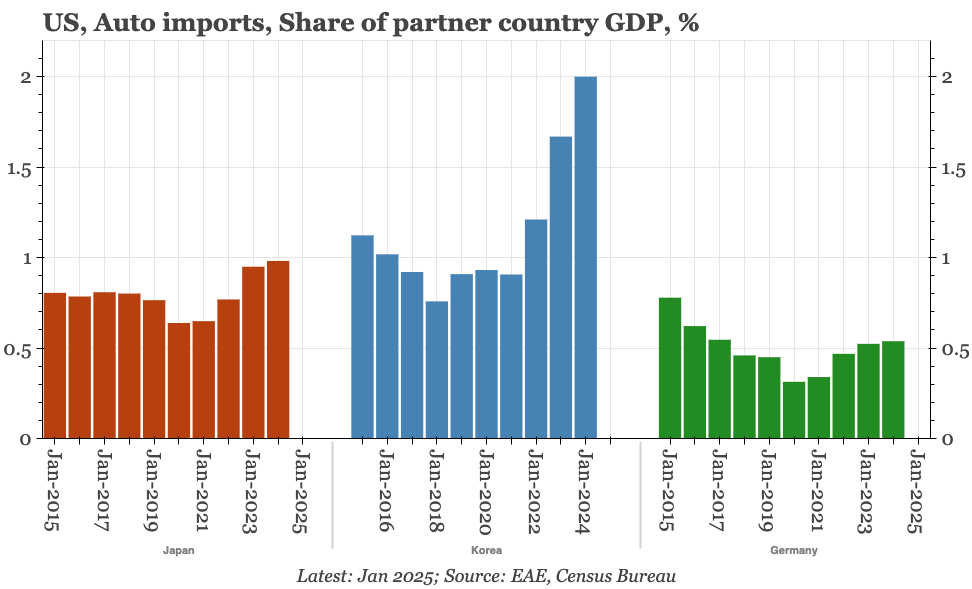

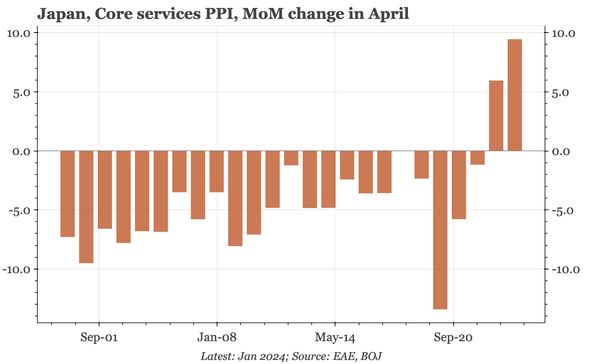

Yesterday's tariffs are close to a worse case scenario for China, and are a big negative shock when the cycle is already weak. Three things strike me as important in what happens next, both for China's economy, and for its global influence: consumption, imports, and the currency.