Paul Cavey

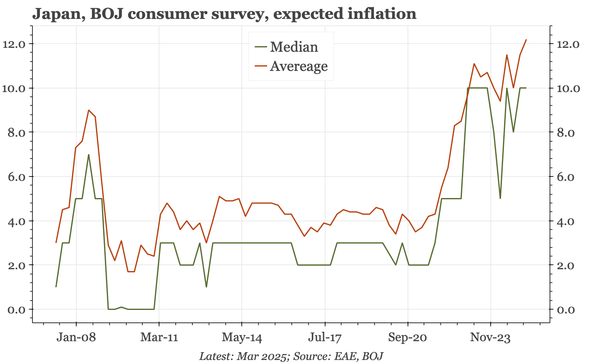

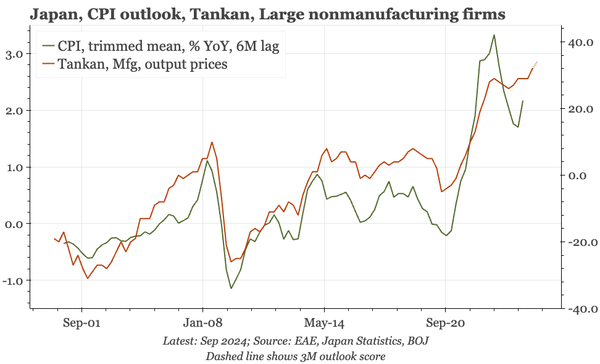

Japan – inflation expectations still strong in Q1

In today's BOJ quarterly consumer survey, inflation expectations remained strong, just as they had in the corporate Tankan last week. Given tariffs, this is not nearly as significant for the BOJ as it would have been, but it is better to be facing Trump's shock with inflation rather than deflation.

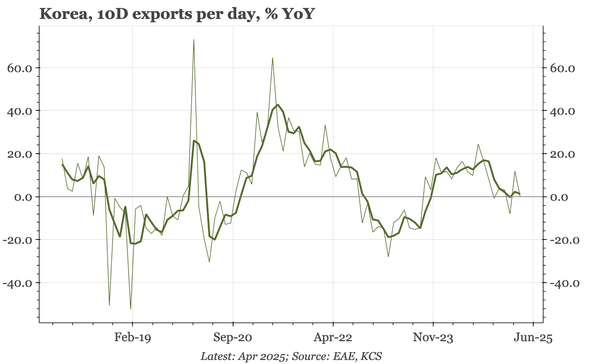

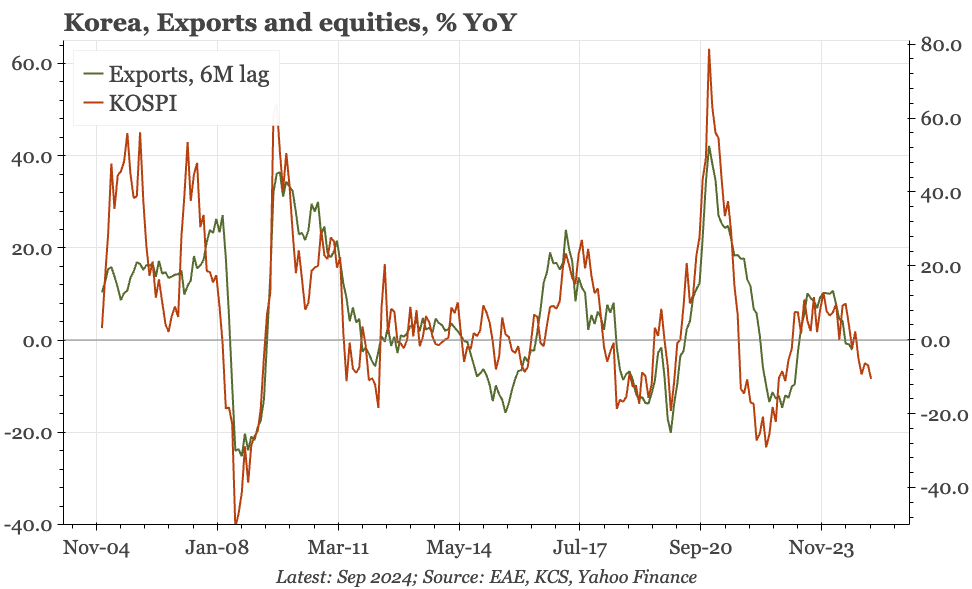

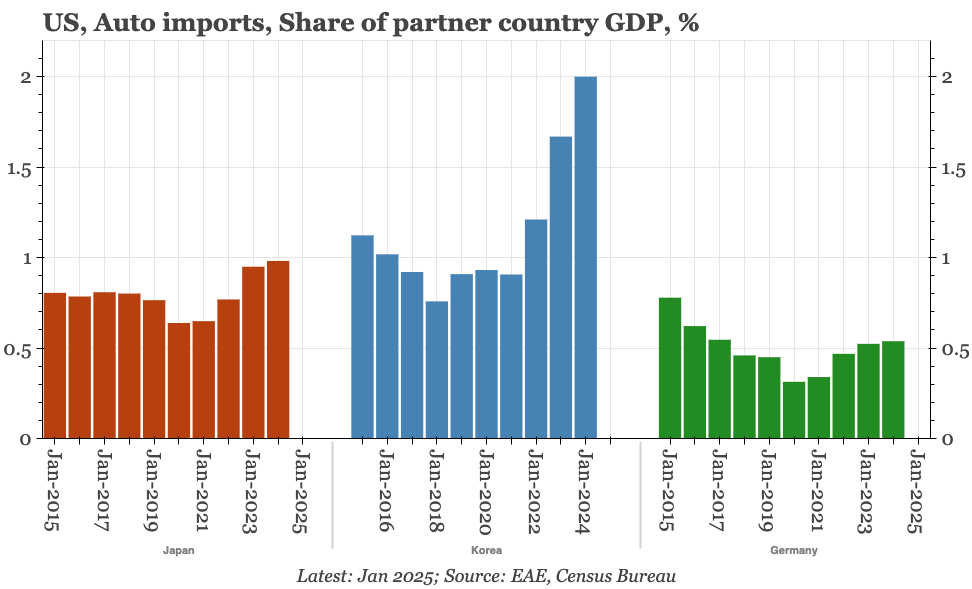

Korea – April exports flat 0% even before tariffs

Exports in April didn't grow. The sluggishness of sales this year contrasts strongly with the surge in shipments from Taiwan. This isn't a great position from which to be drawn into a trade war, which for Korea is still very much alive: Trump's tariff reprieve doesn't extend to his auto tariffs.

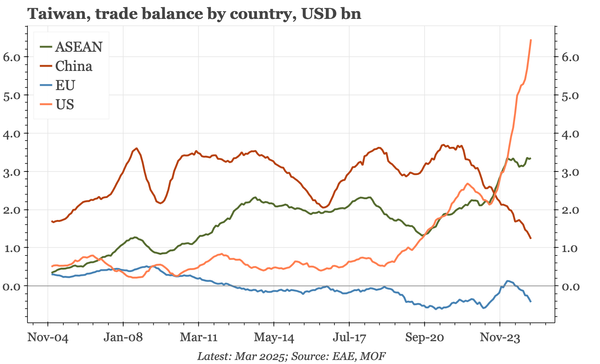

Taiwan – trade surplus with US still rising

The slight moderation in March wasn't big enough to change the vertical trend rise in Taiwan's trade surplus with the US. Maybe the tariffs will cause a bigger change. At the least they will cause a slowdown in exports, which remained strong last month, led by another record month for TSMC.

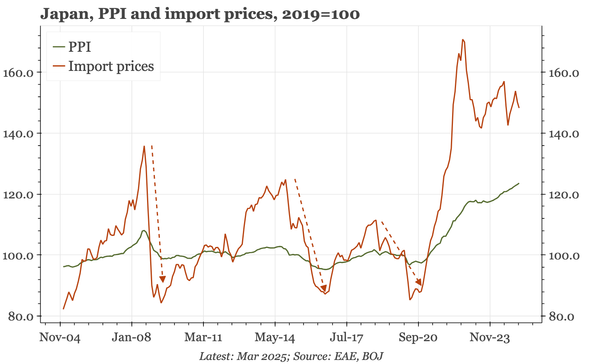

Japan – inflation risk from PPI and consumer expectations

The gap between PPI and import prices shows pent-up inflationary pressure, a dynamic that is also showing up in a renewed rise in consumer inflation expectations. These trends probably have further to run, unless there is a global recession or JPY appreciation that causes import prices to fall.

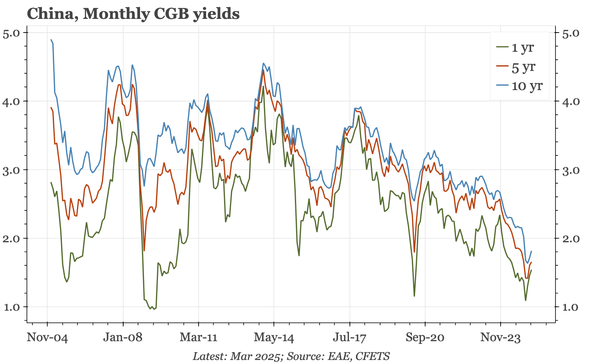

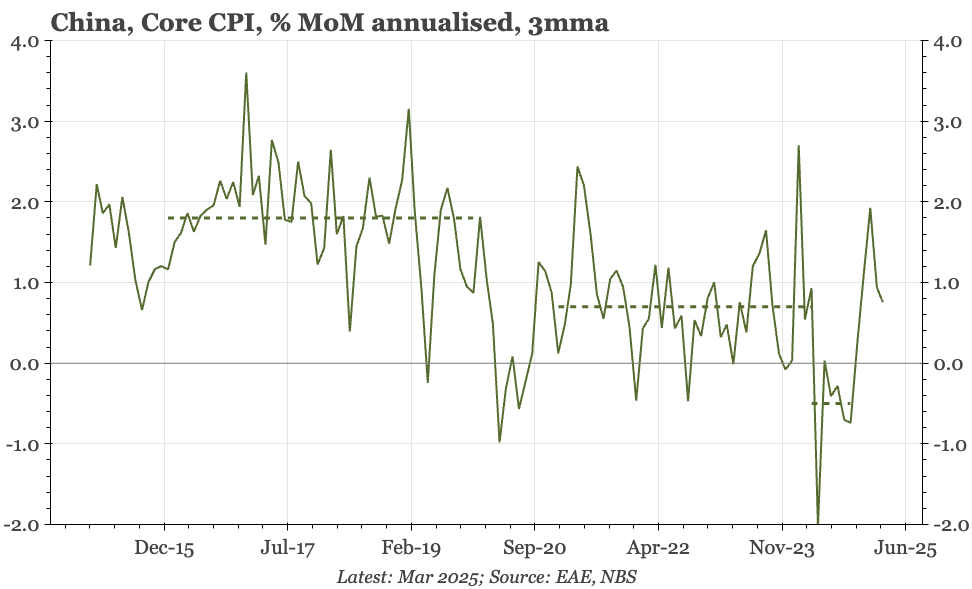

China – stronger inflation not enough

The rise in core from Q424 sustained in Q125. But that isn't enough to suggest a turnaround in the GDP deflator, and Trump's tariffs mean that downside risks to inflation have grown again. Policy rates are likely to be cut, but that won't be enough to offset this latest shock.

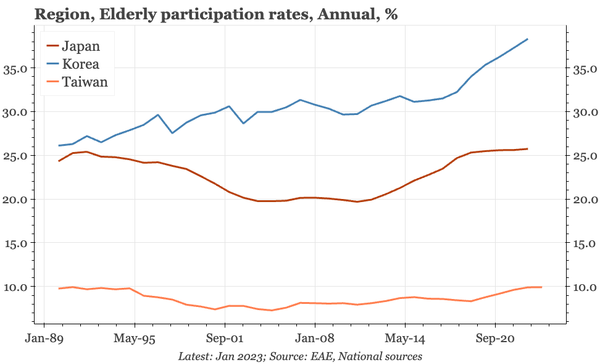

Region – does low UE mean labour market tightness?

20 slides analysing structural labour market issues: the puzzle of low unemployment but weak wage growth; supply side changes that have deflected demographics; demand side strength as China offshoring ends; and the implications of the renewed trade war.

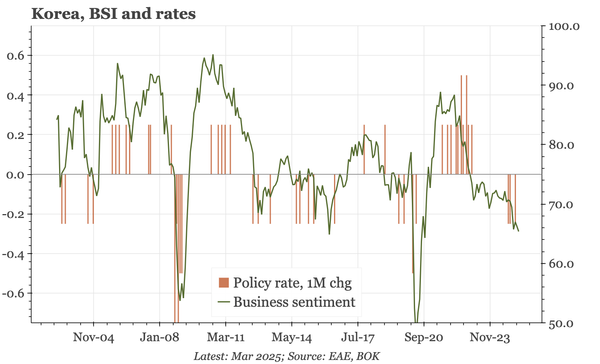

Korea – employment sluggish even before the trade war

Unemployment in Korea remains low, but it is clear that the cycle low has been seen. Private sector business sentiment has been pointing to falling employment, and that even before the export recession that is highly likely in the next few months.

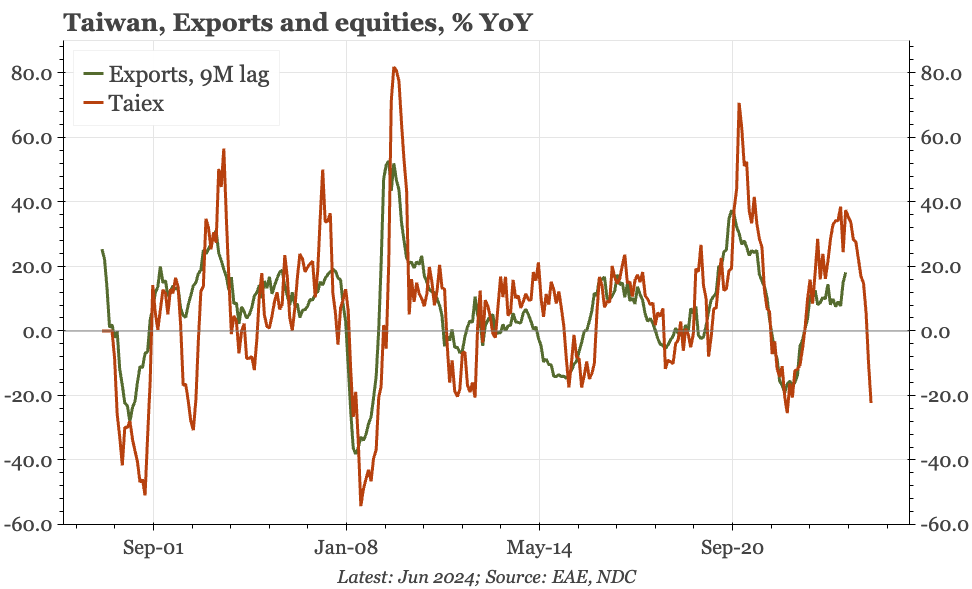

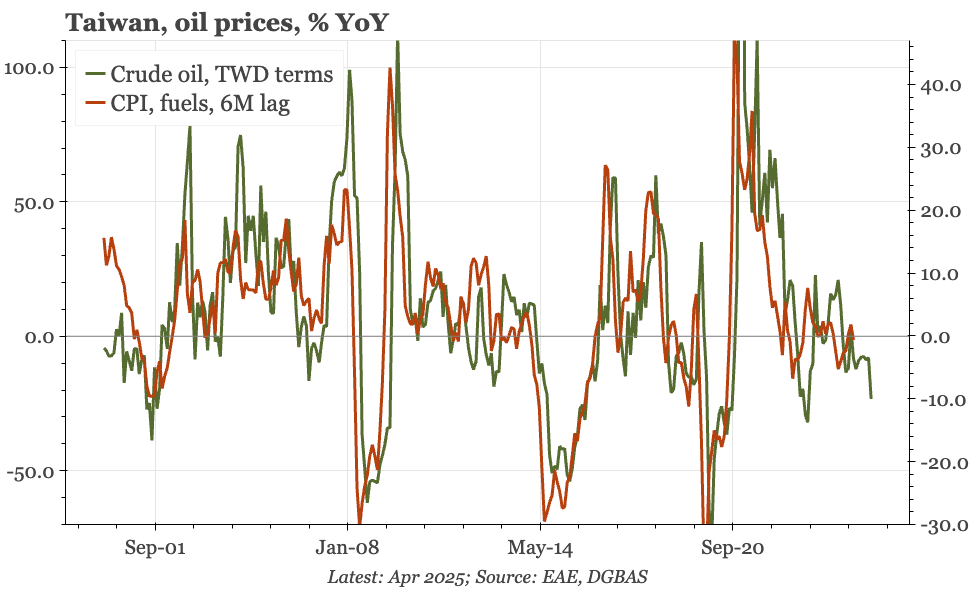

Taiwan – inflation receding, but growth is too

Core inflation eased in March, and is now down to a bit over 1%. The fall in oil prices should mean downside risk for headline from here too. That's important because of the likely recession that's now ahead. Equities are suggesting exports fall 10% in the coming months.

China – five consumption myths

The first of two videos on consumption. This one looks at recent trends, arguing spending has been stronger than often realised. It still isn't high enough, especially given the huge shock from Trump's tariffs. So the second discusses policies that would boost consumption further.

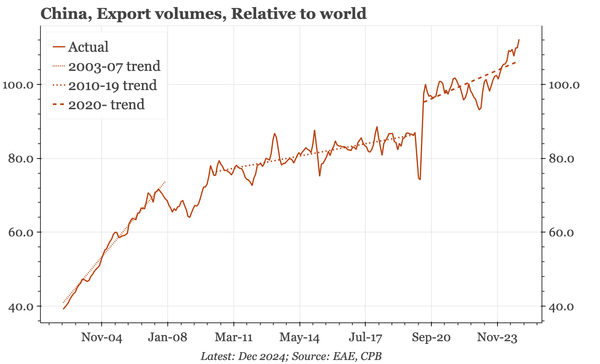

China – three post-tariff themes

Yesterday's tariffs are close to a worse case scenario for China, and are a big negative shock when the cycle is already weak. Three things strike me as important in what happens next, both for China's economy, and for its global influence: consumption, imports, and the currency.

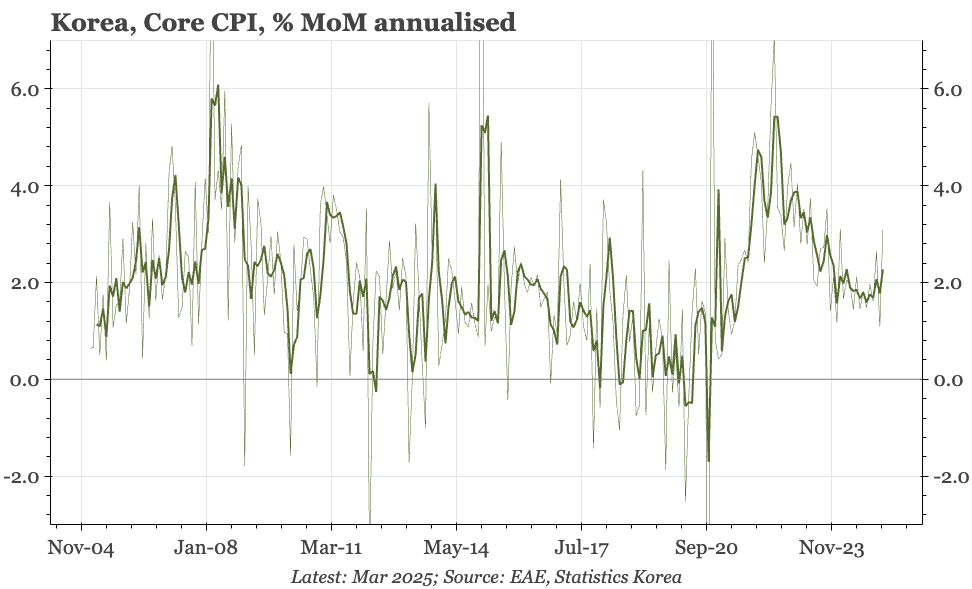

Korea – core inflation up again

With public services prices rising in March, the upwards drift in private services prices of recent months is now showing in core inflation. It still isn't high, but with business surveys suggesting some pressure on goods prices too, inflation is becoming more of a constraint on BOK action.

Region – weak activity, but firm pricing in Korea and Japan

The picture painted by the PMIs isn't uniform, either for the region, or for particular economies. Overall, however, for activity there are more signs of weakness than strength. But inflation looks firm in Korea, and continues to have even stronger momentum in Japan.

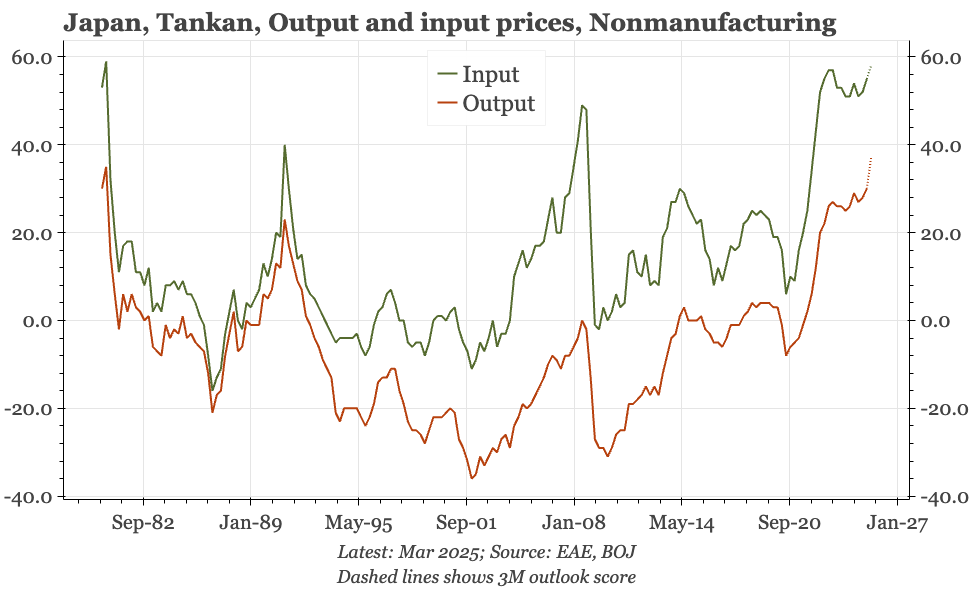

Japan – Tankan keeps May alive

The Tankan showed another rise in price pressures, particularly in non-manufacturing, the sector where labour market conditions are also the tightest and sentiment the strongest. The details of Trump's plans could change things, but domestic dynamics keep the BOJ on track to hike again.

China – muddling through at risk from tariffs

The PMIs suggest the economy, once again, is muddling through. The better momentum after the policy announcements that started from September has faded, but isn't reversing. However, that probably isn't enough, given the new shock from tariffs that is about to hit.

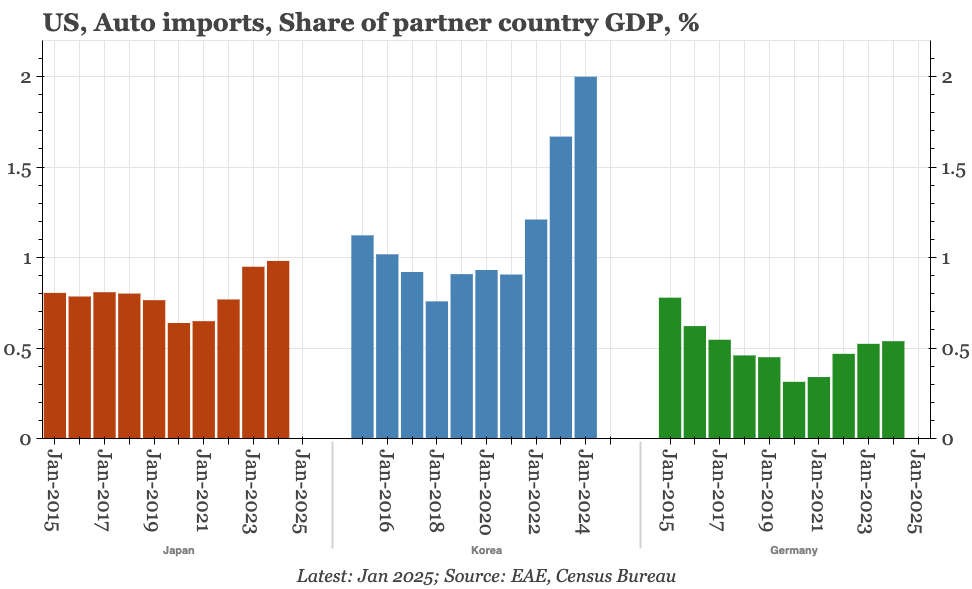

Korea – and now the hit from auto tariffs

Pulled by the policies of previous US administrations and pushed by rising China competition in EM, Korea has focused more on the US market. As a result, US tariffs will hurt more than they would have a few years ago, and with domestic demand weak, there's not much else to support the local economy.

Japan – more talk of upside risks to inflation

As would be expected, the summary of the March MPC meeting shows more concern about US policy. But this isn't a repeat of summer 2024 when the BOJ got cold feet on new rate hikes. Inflation data remain solid, and the meeting talked about upside risks for prices, driven by domestic factors.

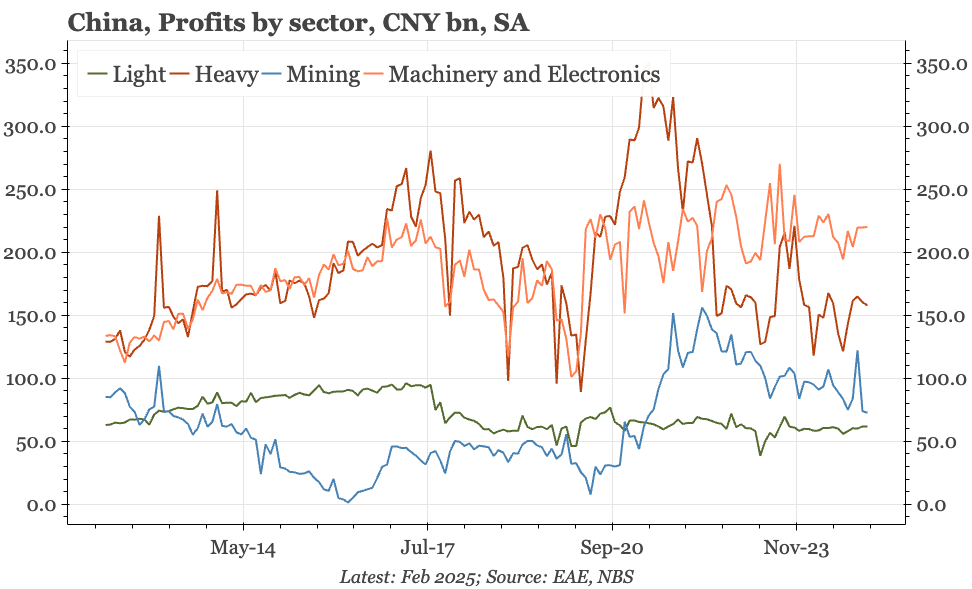

China – profits subdued, especially in heavy industry

Profits rebounded YoY in Jan-Feb, but in level terms remain subdued. That overall picture, however, masks big sectoral differences. Aggregate profits in heavy industry have fallen, and are no higher than in 2013. Earnings in machinery and electronics are more stable.

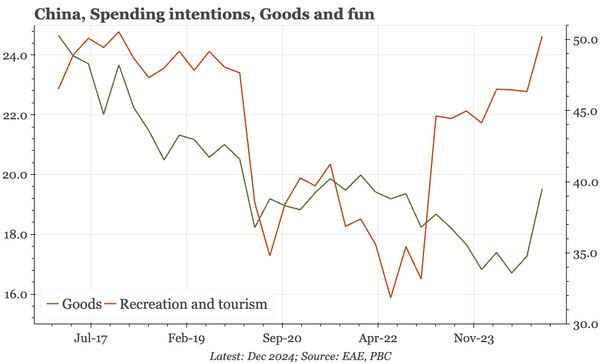

China – still difficult to get excited

The PBC sentiment surveys suggest again an economy that is muddling through. One reason is that consumer spending hasn't fallen, with the big shifts instead being a further move away from consumption on goods to spending on services, and more saving in bank deposits rather than investments.

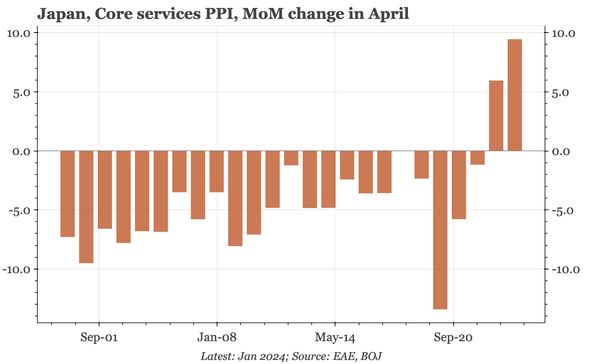

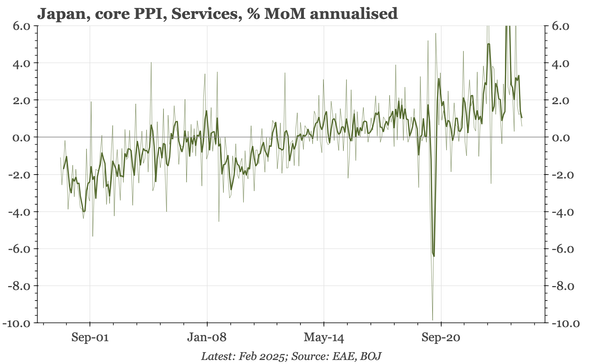

Japan – Services PPI inflation slower, at least until FY25

Sequential momentum in services PPI has eased in recent moths. However, the data have been volatile since covid, and in 2023 and 2024 there was a big re-acceleration at the beginning of the new fiscal year. Given continued wage growth, a rebound seems likely in April 2025 too.

Korea – sentiment drops again

Business confidence remains extremely weak, and consumer confidence isn't a whole lot better. That being the case, the BOK is going to want to cut further, but inflation readings in the sentiment surveys aren't giving the all-clear for an aggressive loosening.