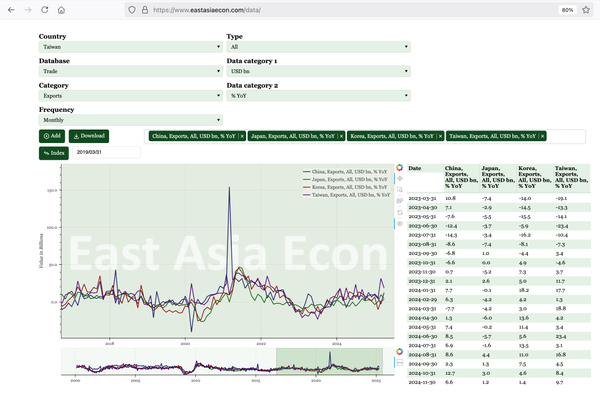

China – US exports down, but ROW up

The expected fall in exports to the US did happen in April, but that was offset by stronger shipments to ROW. I wouldn't expect that to continue, but it is worth noting that today's data showed an increase in imports of components, which would usually indicate stronger exports in the next 3M.