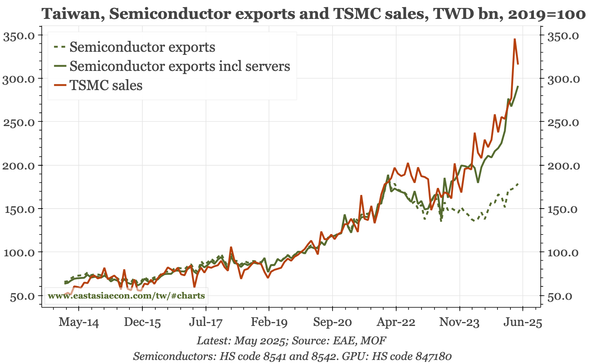

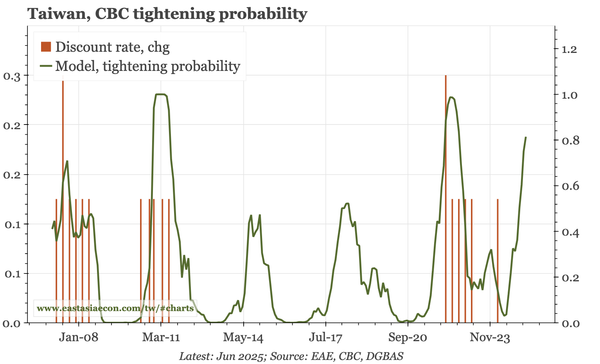

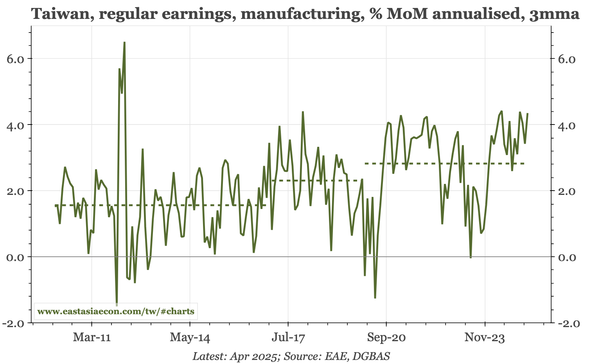

Taiwan – wage growth remains strong

Relative to history, Taiwan's wage growth remains strong. As would be expected, that's being led by manufacturing, though services wages have been firm too. For now, the downside for rates remains a structural appreciation of the TWD, not a problem with the cycle.