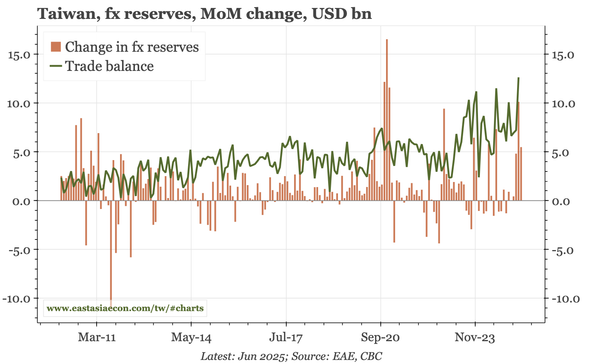

Taiwan – madly strong exports, TWD reducing inflation

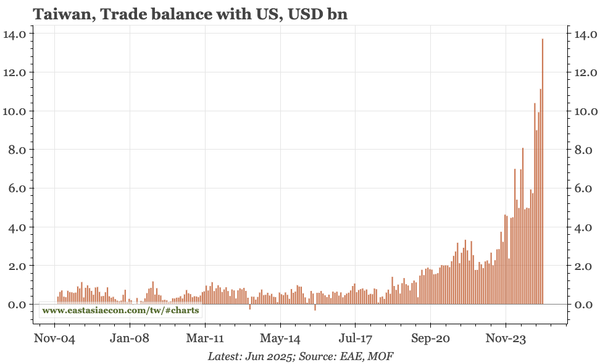

Overall exports, and the trade surplus with the US, continued to surge in June. That Taiwan nonetheless wasn't the recipient of a Trump letter may be because of the sharp rise in the TWD. Other data today show that helping to push down inflation, opening up space for interest rate cuts.