Paul Cavey

Korea – June export surge fades in July

The pop in exports in June faded in the first part of July. That was perhaps because the pop in the DRAM price eased as well: semi exports have risen again in July, but at a slower pace, and exports of other products still aren't doing much. In terms of countries, there's also no big change.

Taiwan – cycle lifting wages and productivity

Wage growth slowed in May in manufacturing, but the trend is still up, and in recent months it has been firm in services too. That CPI is slowing is partly due to the TWD, and partly productivity. In separate news, TSMC's sales were softer in June, but financial markets don't seem concerned.

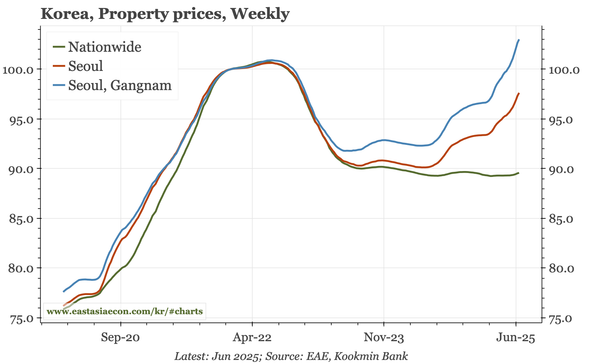

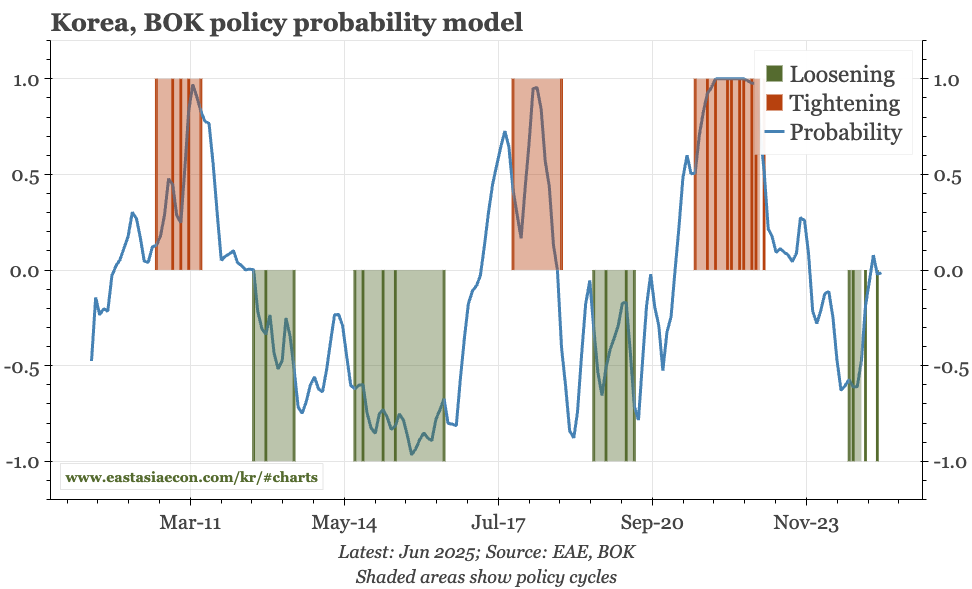

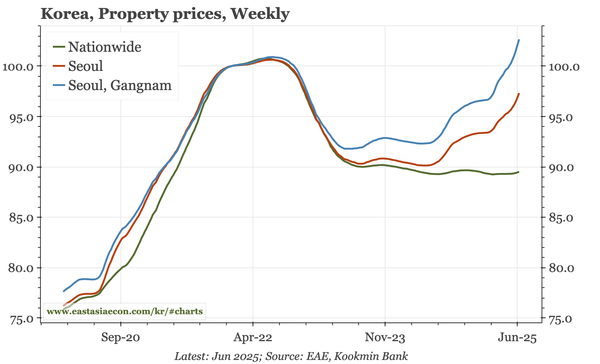

Korea – BOK still more worried about growth

Given the rise in house prices, that the BOK didn't cut rates today wasn't a surprise. However, the bank sounded much more confident than I'd expected that the rebound in house prices would be temporary. So, this really is just a pause, and the bank made no change in its "rate cut stance"

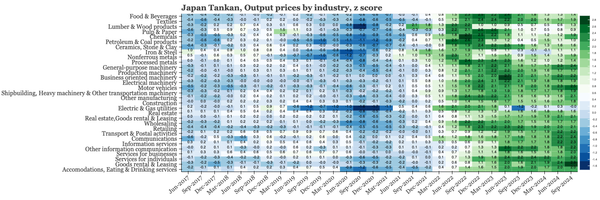

Japan – goods prices starting to reverse

Data today show more feed through into PPI from the easing of import prices. Weekly rice prices have also dropped again. These trends lower goods price inflation, but will boost household spending power. At the same time, the sharp fall in auto export prices shows the negative impact of tariffs.

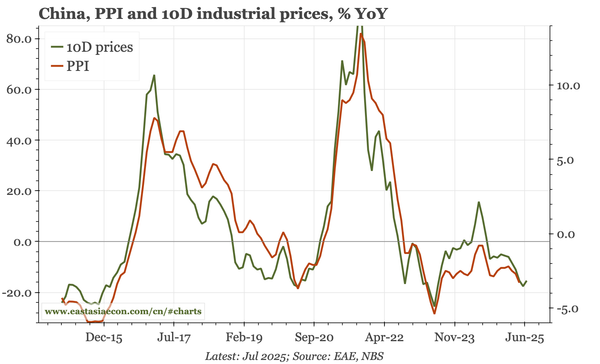

China – deepening deflation

I am away from my desk, so for now, just a few charts on the CPI/PPI release. Deflation is deepening, which for PPI is broad-based. Core CPI is more stable, but that's partly due to a rise in "other" prices. Headline CPI is lower on food prices, which have started dropping again.

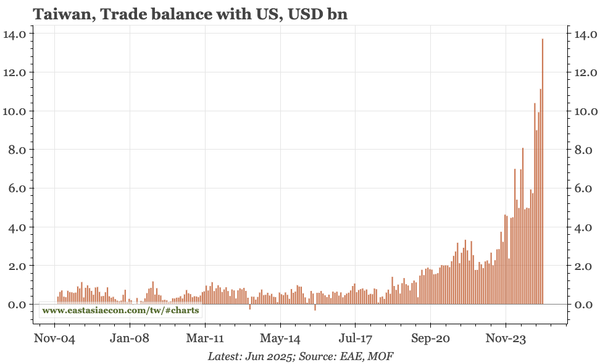

Taiwan – madly strong exports, TWD reducing inflation

Overall exports, and the trade surplus with the US, continued to surge in June. That Taiwan nonetheless wasn't the recipient of a Trump letter may be because of the sharp rise in the TWD. Other data today show that helping to push down inflation, opening up space for interest rate cuts.

Japan – one shock eases, but the other intensifies

Japan in 2025 has suffered two negative shocks: tariffs, and a rebound in CPI that's eroded real incomes. June surveys, such as today's EW, show the household mood starting to improve as the price shock wanes. But that won't matter if Trump proceeds with the yet higher tariffs he's now threatening.

Japan – still the real wage squeeze

Nominal wage growth remains firm, but real wages to continue to fall. That in turn is weighing on consumption, which other data today show remained sluggish in May. The cycle in 2H will likely depend on goods prices, because that will determine the strength of real wage growth and consumer spending.

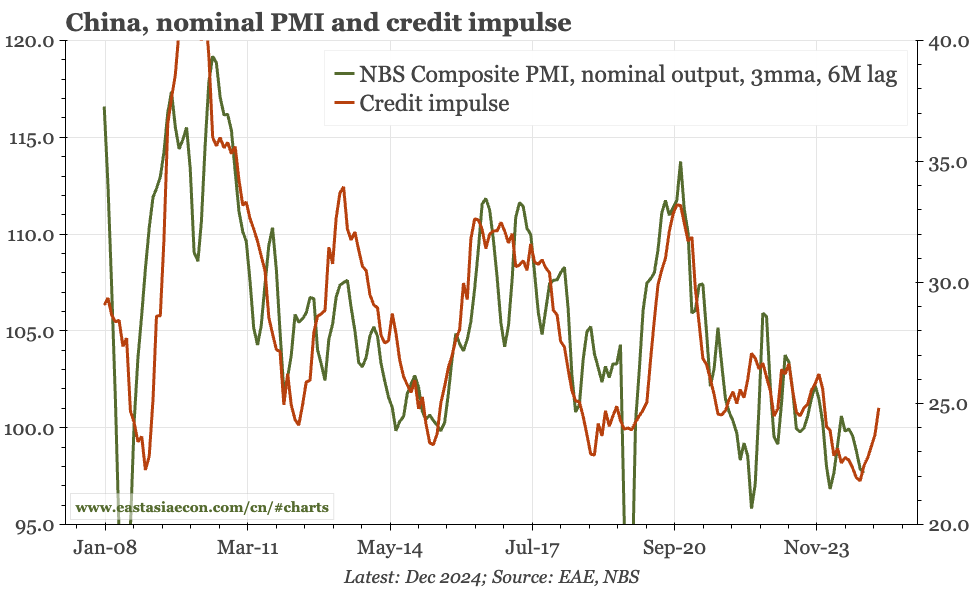

China – PPI deflation likely worsened further in June

10-day industrial prices ticked up a bit at the end of June, helped by energy. But building material and ferrous prices continued to drop, and with the higher base from last year, it still seems likely that next Wednesday's data will show headline PPI deflation worsened again in June.

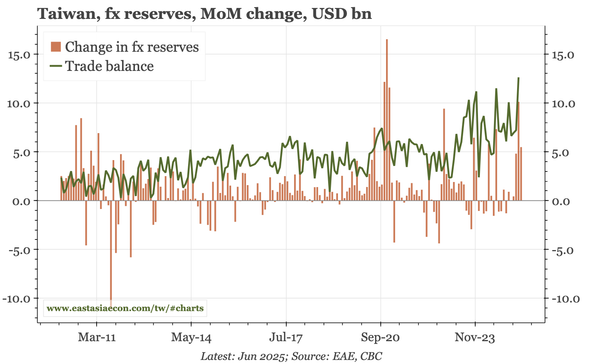

Taiwan – another hefty rise in fx reserves

At USD5.5bn, June's rise in reserves wasn't as big as May's USD10bn. But it is the first time since 2020 that reserves have grown by over USD5bn for two months running. If lifers/corporates are less willing to recycle the rising trade surplus, the CBC has to step in – or the TWD strengthens more.

Japan – BOJ officials still leaning positive

The renewed tariff threat is a dominating issue for Japan. Yesterday's debate among leaders of the political parties didn't reveal any new strategy to head off the risk. But today's services PMI was firm, and in an interesting speech, board member Takata continued to sound cautiously constructive.

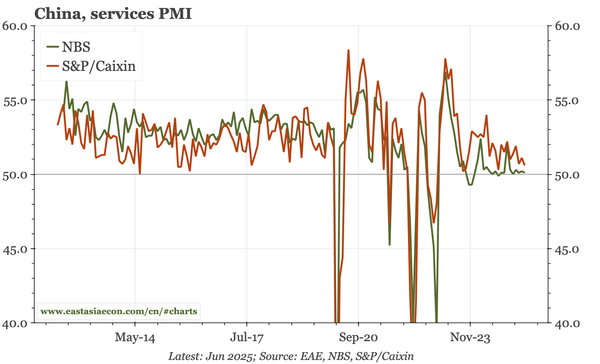

China – still no activity or price momentum

In the Caixin services PMI, like the official version, both data and anecdotes are weak. "Staffing levels were lowered in June...linked to a slowdown in new order growth and concerns over costs", and "intense market competition" led to selling prices being cut at the sharpest pace since April 2022"

Korea – headline CPI ticks up, but should now fade

Leads suggest the mild rise in headline CPI in June should now fade. Core inflation is more stable, in part because services inflation remains on the high side. In next week's meeting, the BOK is unlikely to show much concern about that, with the focus instead being the rebound in property prices.

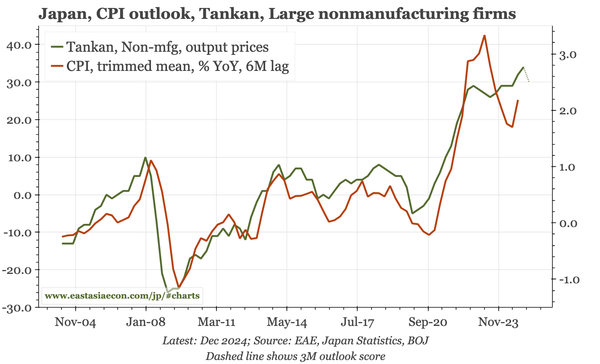

Japan – issues sharpen for the BOJ

In terms of inflation, the details of the Tankan were stronger than yesterday's headlines. Output prices – a good lead for underlying CPI – rose to another new post-1980 high. However, President Trump, as had seemed likely, is now threatening Japan with yet higher tariffs.

Japan – helpful rebound in consumer confidence

In recent months, Japan has encountered two headwinds: higher tariffs which threaten exports, and rebounding inflation which reduces consumer purchasing power. Inflation expectations eased in June, allowing consumer confidence to rebound. That is helpful in offsetting the pain coming from tariffs.

Korea – finally, export perk up

Today's full-month June export statistics show exports finally breaking out of the range of recent months. I wouldn't think that will continue. It is all because of semi, big exporters like Samsung, Kia and Hyundai haven't benefited from the recent Kospi rally, and exporter sentiment remains weak.

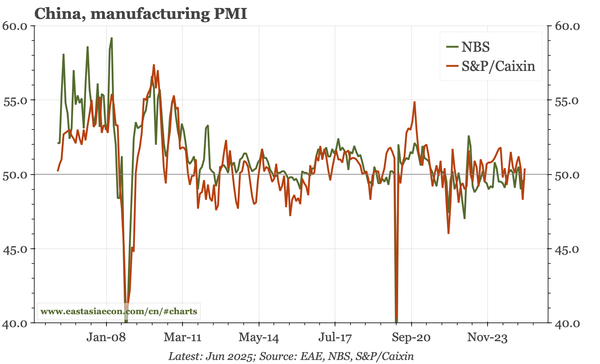

China – still no rebound

The Caixin PMI rose above 50 in June, but only to 50.4. Comments remained cautious. "Firms were generally cautious with hiring on the back of cost control". A "fourth monthly reduction in average input costs" was shared with clients, "resulting in another decline in average selling prices measures"

Japan – another solid Tankan

For reasons I have yet to understand, the BOJ's Tankan is published over two days, so we won't get the full picture until tomorrow. But first impressions from today's summary are quite strong, with business sentiment holding up, and only small deteriorations in prices and employment.

Korea – a change, even if it's not fundamental

Inflation is likely declining, the labour market continues to weaken, and business confidence remains poor. So the fundamentals are weak. But consumer confidence, the DRAM price, Kopsi and house prices have all rebounded. The latter changes the BOK outlook. Further rate cuts will take longer.

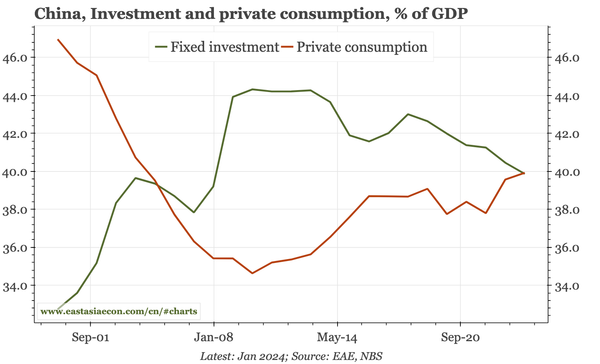

China – structure of GDP shifting, but slowly

Recent data show investment fell in 2024 to under 40% for the first time since 2008. On the flip side, consumption edged up, helped by a stabilisation of the savings ratio and a rise in welfare spending. But none of these changes are happening fast enough to boost the cycle.

China – still looking like a soft floor

At a headline level, the industrial PMIs were better in June, but the details were weak, and there was no improvement in the services PMI. The rise in the credit impulse is taking away some of the downside risk for the cycle, but there aren't indications that the cycle is about to really improve.