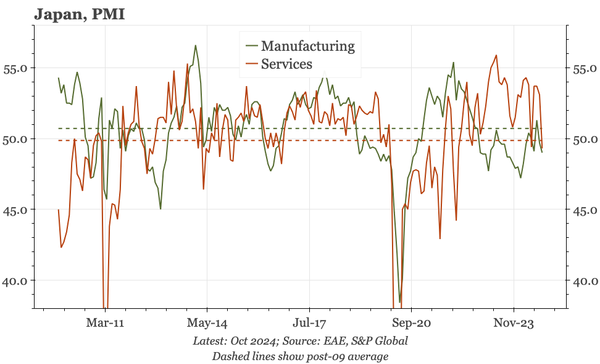

The flash services PMI dropped sharply in October, and with mfg is now below 50. There was a similar drop in June that then reversed, and while the press release doesn't suggest any new factor, the Reuters nonmfg Tankan, which also fell, suggested some noise from unstable weather and a stronger yen.