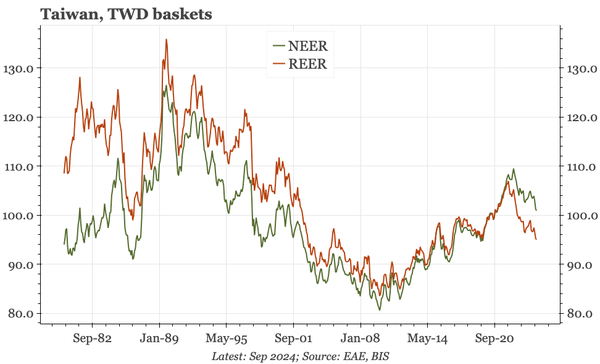

There's a possibility that TSMC's success is pushing Taiwan into unchartered waters, where the CBC needs to sound hawkish, when the external imbalance is as big as it has ever been. If Taiwan's period of zero inflation has passed, there's a good chance TWD undervaluation will be challenged too.