Public Post

Korea – defying demographics

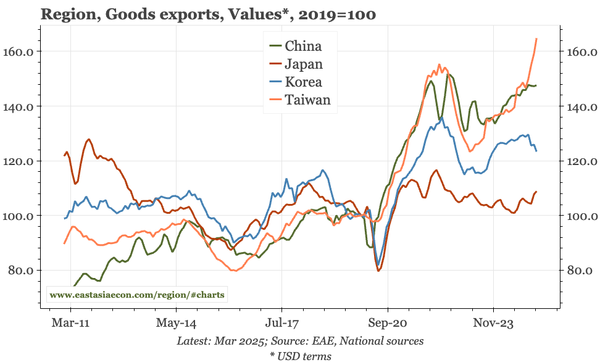

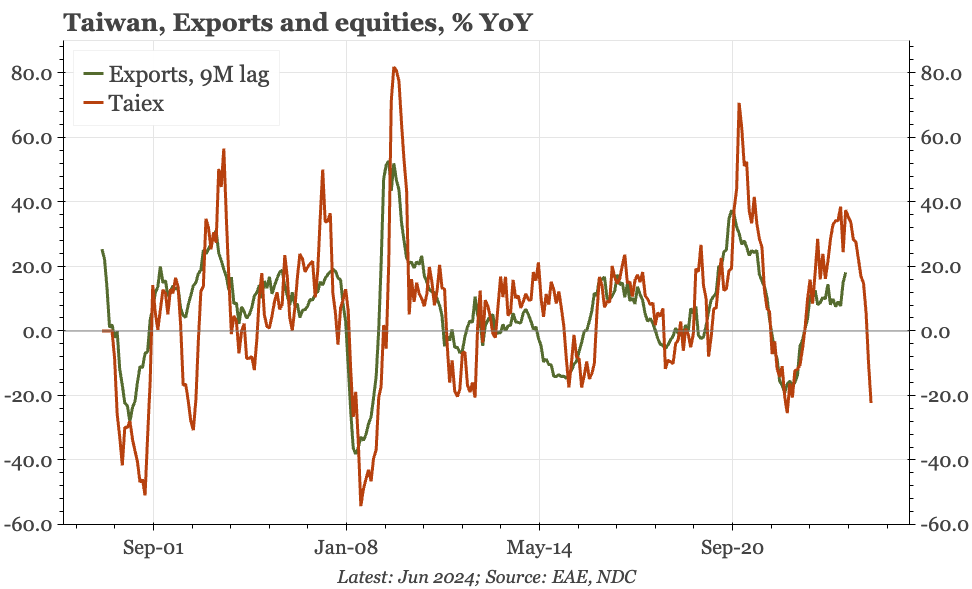

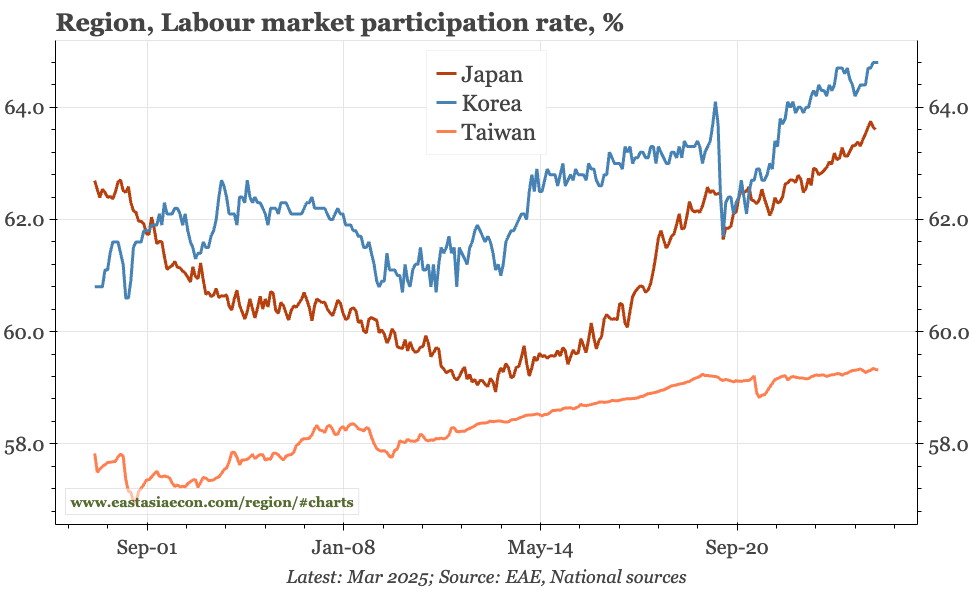

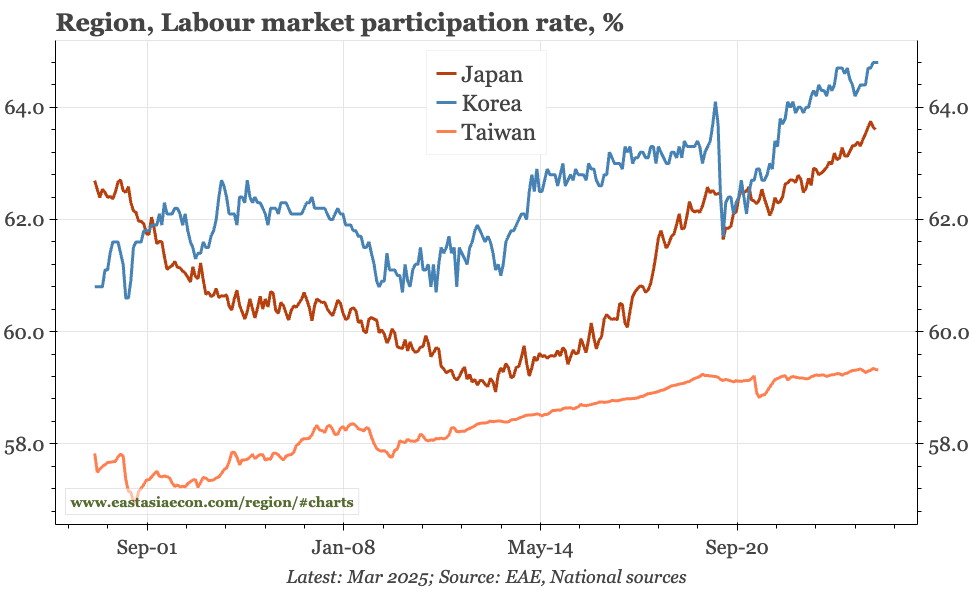

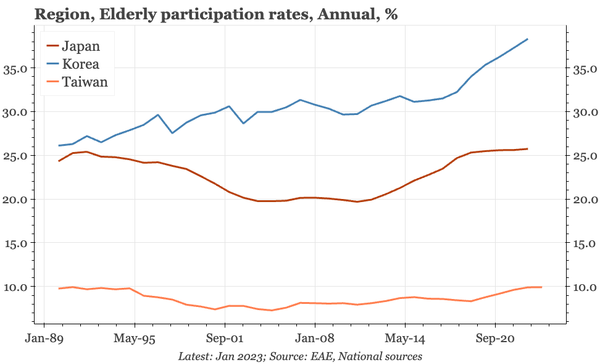

My latest video, discussing how Korea is managing to avoid the labour market decline that would usually be expected as the population ages. This is likely to dampen wages – and potentially inflation – in Korea relative to Taiwan, where the part rate isn't rising in the same way.

Public Post

Region – does low UE mean labour market tightness?

20 slides analysing structural labour market issues: the puzzle of low unemployment but weak wage growth; supply side changes that have deflected demographics; demand side strength as China offshoring ends; and the implications of the renewed trade war.